Market Data

March 25, 2014

Consumer Confidence in March 2014

Written by Peter Wright

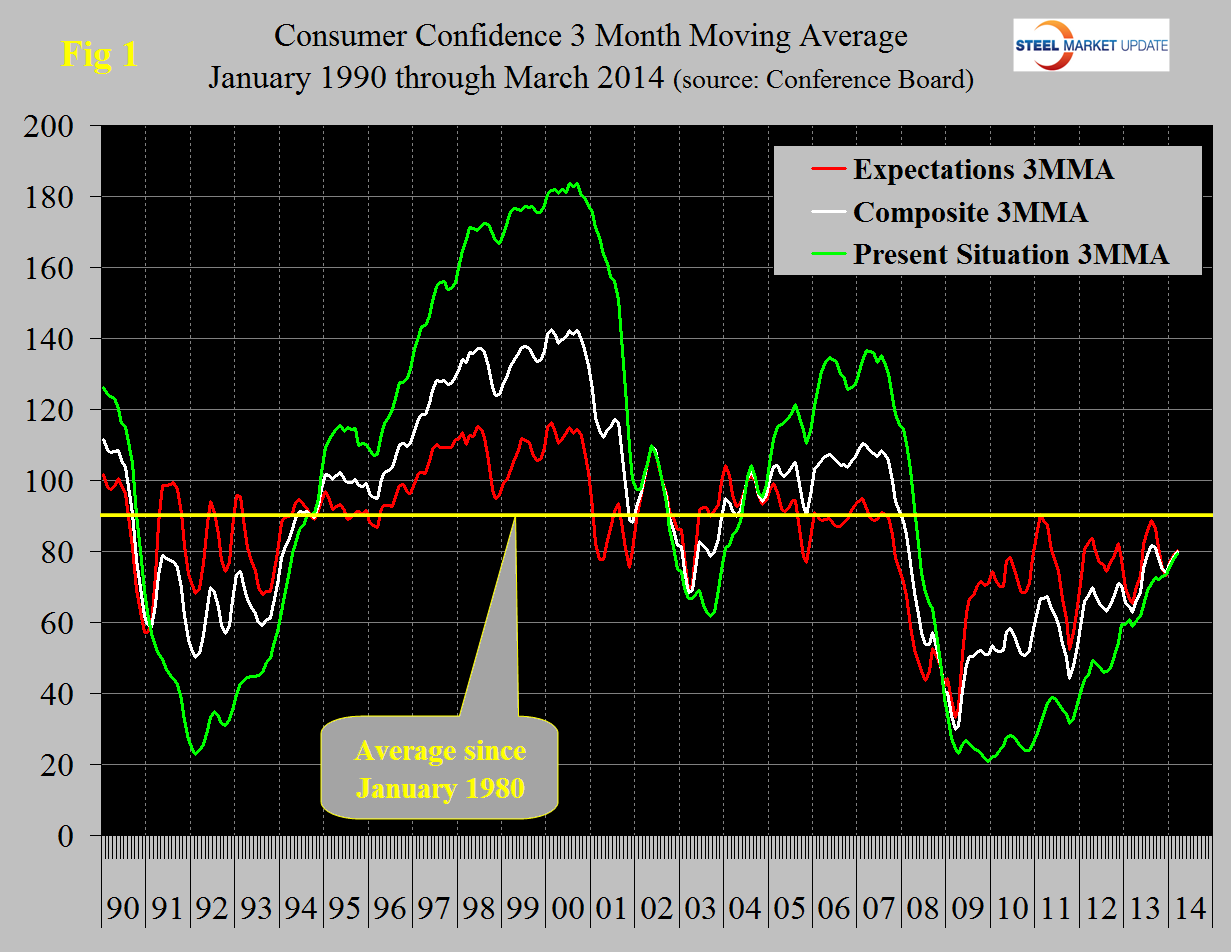

The consumer confidence index increased by 4.0 in March driven by an increase of 7.0 in the expectations component and a decline of 0.6 in the consumer’s view of the present situation. The three month moving average (3MMA) of both the present view and expectations components increased which caused the 3MMA of the composite to rise by 1.6 to 80.0 (Figure 1).

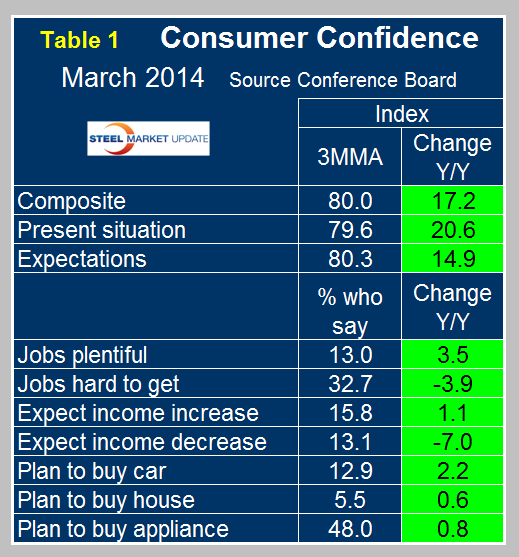

On a year over year basis using a 3MMA, the composite is up by 17.2 led by consumers’ view of the present situation which is up by 20.6 (Table 1). All the subcomponents in Table 1 are green. The consumers view of job opportunities is improving as are income expectations. Intentions for home and auto purchase are up year over year and the recent reported weakness in the housing market is not reflected in the Conference Board report for which the housing component has been more or less flat since August 2012. Table 1 shows a 0.6 percent increase in housing y / y but this is because the result for February last year was an outlier at 3.7 percent.

Moody’s Economy.com reported as follows: “Buyers are more optimistic, leading consumer confidence to rebound more than expected in March. The Conference Board Consumer Confidence Index jumped 4 points to hit 82.3, marking a six-year high. However, details of the report were somewhat uneven with more respondents indicating they see improving business conditions over the next six months, accompanied by little change in the labor market. Moreover, shoppers were slightly less sanguine about their current financial situation, reflecting an increase in the share of respondents who feel that jobs are more difficult to get than they were in February. Several months of unusually harsh winter weather have chilled the job market, but we expect this will change as the weather normalizes. The underlying momentum of the economy still feels positive for the most part, and hiring should resume an average pace of around 200,000 positions per month as the year progresses. This will help bring the jobless rate down to around 6.3% by the end of 2014. Also, the labor market will tighten in the coming years as more retirees exit the labor force. This will add some upward pressure to wages as the supply of workers becomes scarcer, helping to break the vicious cycle of sluggish earnings growth.”

The official statement from the Conference Board read as follows:

The Conference Board Consumer Confidence Index Rebounds in March

The Conference Board Consumer Confidence Index, which had decreased in February, improved in March. The Index now stands at 82.3 (1985=100), up from 78.3 in February. The Present Situation Index edged down to 80.4 from 81.0, while the Expectations Index increased to 83.5 from 76.5.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was March 14.

“Consumer confidence improved in March, as expectations for the short-term outlook bounced back from February’s decline,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “While consumers were moderately more upbeat about future job prospects and the overall economy, they were less optimistic about income growth. The Present Situation index, which had been on an upward trend for the past four months, was relatively unchanged in March. Overall, consumers expect the economy to continue improving and believe it may even pick up a little steam in the months ahead.”

Consumers’ assessment of current conditions was little changed in March. Those claiming business conditions are “good” increased to 22.9 percent from 21.2 percent; however, those claiming business conditions are “bad” also rose, to 23.2 percent from 22.0 percent. Consumers’ appraisal of the labor market was relatively unchanged. Those claiming jobs are “plentiful” decreased marginally to 13.1 percent from 13.4 percent, while those saying jobs are “hard to get” increased slightly to 33.0 percent from 32.4 percent.

Consumers’ expectations, which fell last month, rebounded in March. The percentage of consumers expecting business conditions to improve over the next six months increased to 18.1 percent from 17.3 percent, while those anticipating business conditions to worsen declined to 10.2 percent from 13.6 percent. Consumers’ outlook for the labor market was also moderately more optimistic. Those expecting more jobs in the months ahead edged up to 13.9 percent from 13.7 percent, while those expecting fewer jobs fell to 18.0 percent from 20.9 percent. The proportion of consumers expecting their incomes to grow declined to 14.9 from 15.8 percent, but those anticipating a decline in their incomes also decreased, to 12.1 percent from 13.4 percent.

SMU Comment: Consumer confidence drives consumer spending which is the largest component of GDP. Steel consumption is a function of GDP though the steel component is much more volatile than the headline number. The third estimate of GDP growth and subcomponents for Q4 2013 will be released on Thursday this week and will be analyzed and reported in the Steel Market Update. It will be this time next month before we learn how much effect the harsh winter had on growth in Q1 2014. (Sources: The Conference Board and Economy.com)