Distributors/Service Centers

March 23, 2014

SMU Survey Catches Early Changes in Service Center Spot Pricing

Written by John Packard

One of the keys watched by Steel Market Update is service center spot pricing into their customers – especially the manufacturing segment of the industry. We have found if service centers are lowering their spot prices on hot rolled, cold rolled and coated steels, especially after a price increase announcement, it is more difficult for the domestic mills to get flat rolled steel price increases to stick.

With the flat rolled steel price announcement coming on Monday afternoon (March 17th) we believe our survey results will provide a good barometer of what the service centers were doing at the time of the announcements.

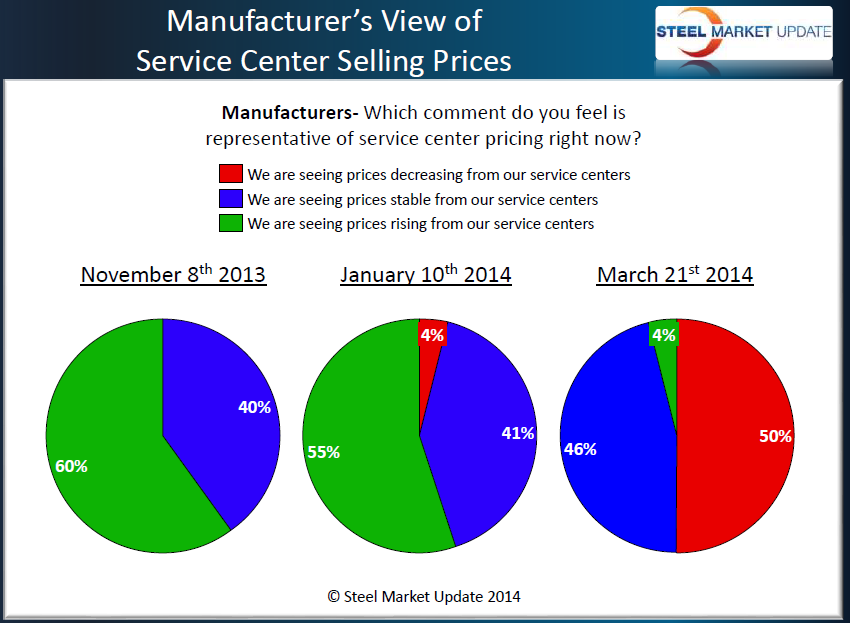

Half of the manufacturing companies responding to our questionnaire reported distributors as moving spot prices lower, 46 percent replied that spot prices remained the same while 4 percent reported prices as moving higher. The percentage of manufacturing companies reporting prices as decreasing dropped from 54 percent in early March to 50 percent now.

In the graphic below we are providing a peak at how the market has changed from early November to this past week.

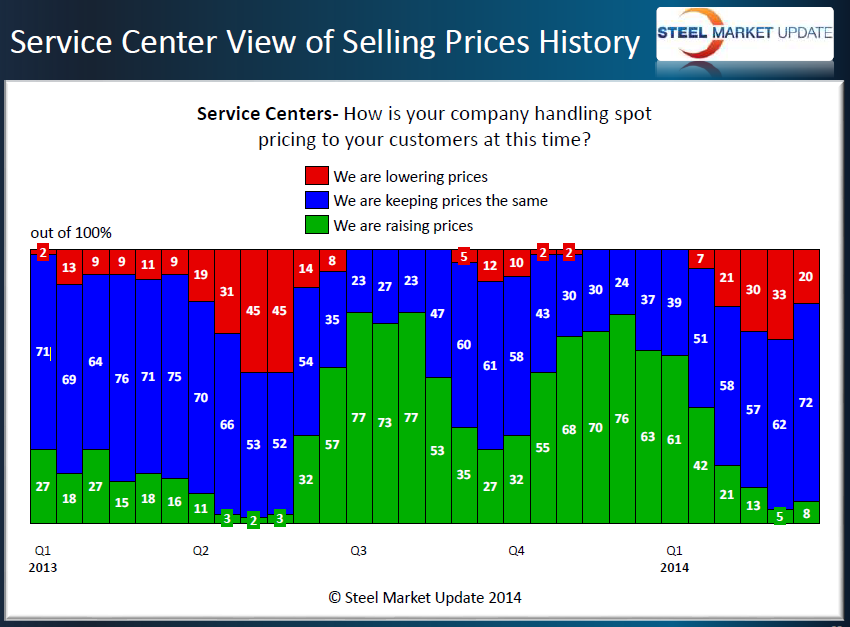

The vast majority of service centers (72 percent) reported prices as remaining the same as two weeks before. Those reporting spot prices as dropping moved lower, from 33 percent to 20 percent. Eight percent of the distributors advised that their company was increasing spot pricing.

Here is a longer time view of the service center responses.

Our early opinion is that the service centers appear to be responding to the announcements. We will watch the next survey result which will begin on Monday of next week. At that point in time we should have a better read of whether the change was short term or the beginning of support for the mill price increases.