Analysis

March 20, 2014

NAFTA Automotive Production and Sales in February 2014

Written by Peter Wright

Light vehicle sales in both January and February were depressed by the unusually bad weather in the North. This applied to both retail and fleet sales. The annualized sales total of autos + light trucks in February was 15.4 million units. Sales are expected to rebound to greater than a 16 million unit annual rate as pent up demand is satisfied.

Weak sales have contributed to a buildup in inventory this year. Compared to the end of February a year ago, day’s sales on the floor increased by 13 percent for the Detroit 3, by 8 percent for the Asia/Pacific manufacturers, and by 3 percent for the European brands.

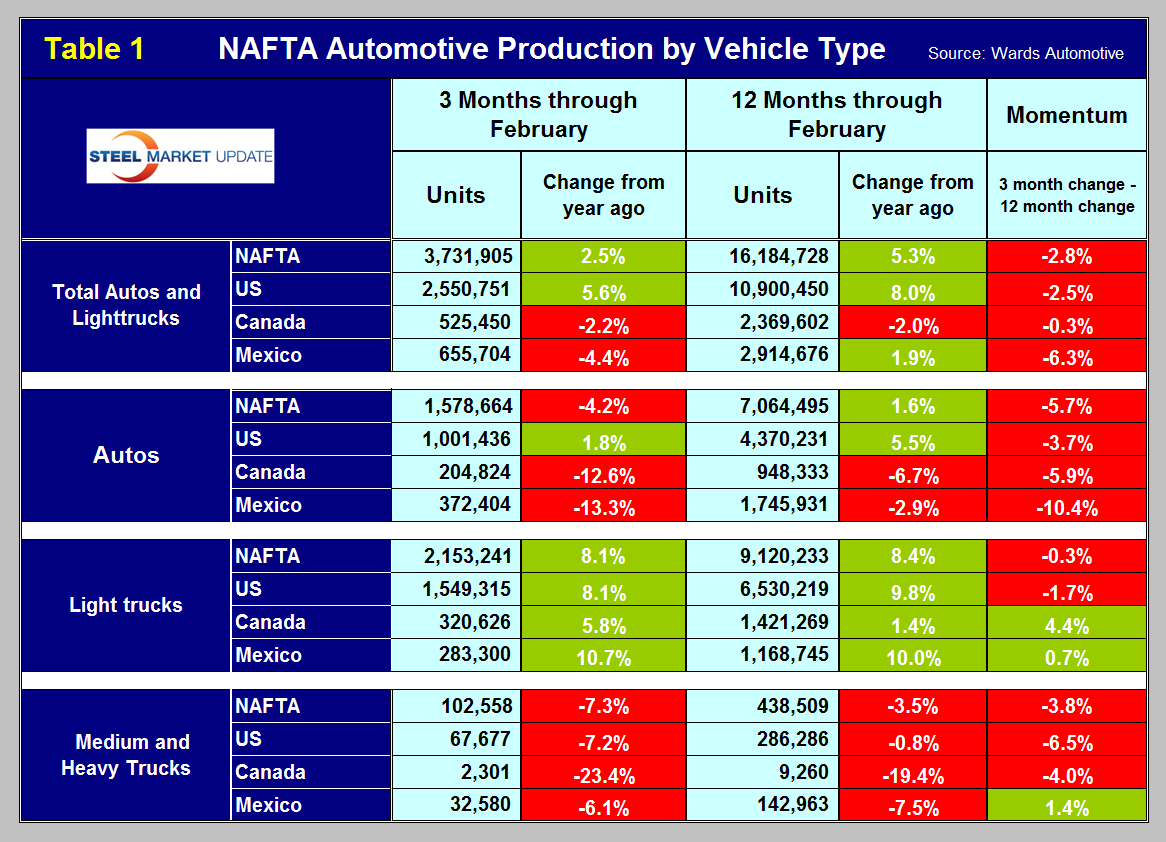

In 12 months through February 16,184,728 light vehicles and 438,509 medium and heavy trucks were assembled in the NAFTA. On a rolling 12 month basis year over year (y/y) light vehicle assemblies were up by 5.3 percent. In 3 months through January y/y the increase was 2.5 percent. Momentum is negative since the short term gain is less than the long term which means that production is slowing. On both a rolling 3 and 12 month basis y/y the US was the only country to have positive growth in auto assembly. All three nations has positive growth on both 3 and 12 month time bases for light trucks. All three nations had negative growth on both time bases for medium and heavy trucks (Table 1).

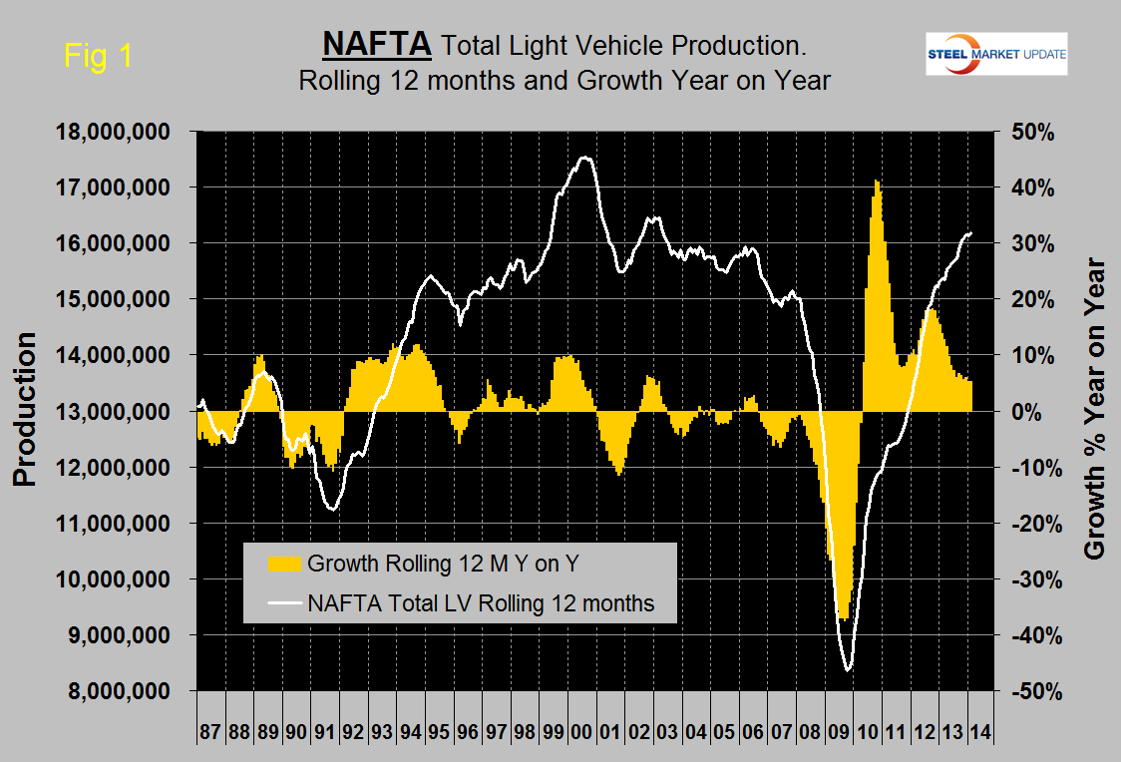

On a rolling 12 month basis, light vehicle assemblies in NAFTA are now at the highest rate in over 10 years (Figure 1).

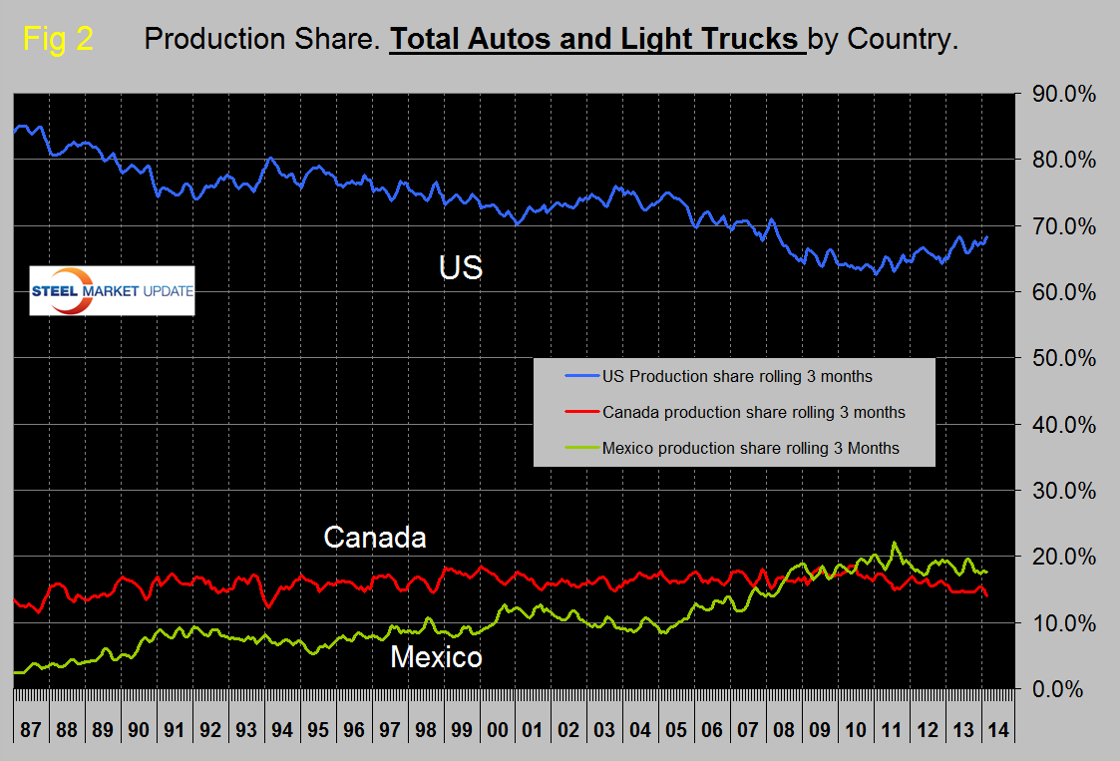

The trend which has been going on for over three years in which the US is taking light vehicle assembly share from both Mexico and Canada is continuing (Figure 2). In three months through February the US share was 68.3 percent, the highest since April 2008. Canada’s share was 14.1 percent. Mexico’s share was 17.6 percent. (Source: Ward’s Automotive and Economy.com)