Market Data

March 20, 2014

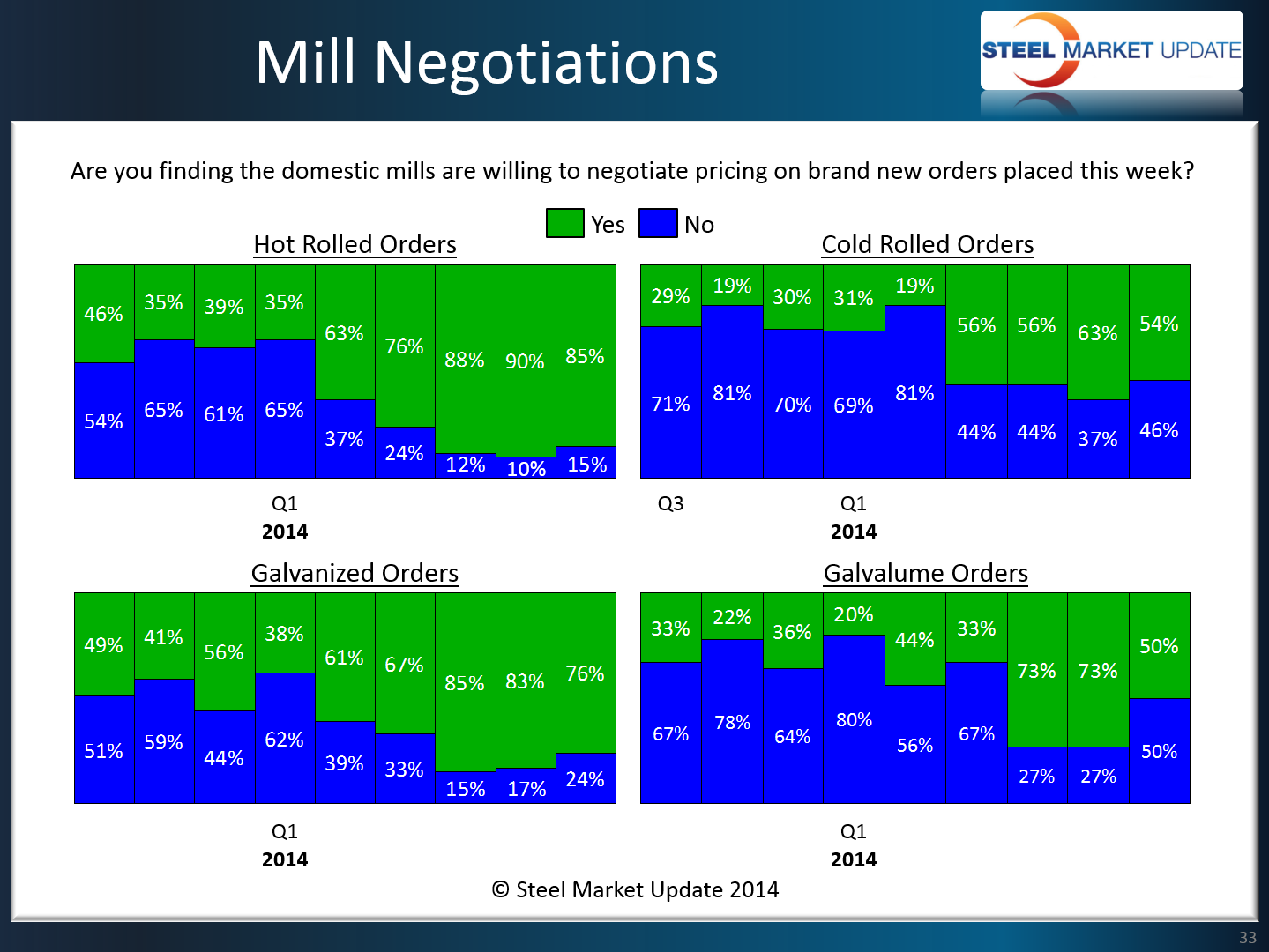

Mill Negotiations Starting to Show Early Affects from Announcements

Written by John Packard

As mentioned in the Lead Times article, SMU began the process of analyzing the flat rolled steel market early on Monday morning – prior to any flat rolled price increase announcements being made. More than likely the survey results regarding mill negotiations represented by the graphic below are going to have about half the respondents reporting their situation prior to the announcements and the rest after the announcement.

Either way, it is typical for the domestic steel mills to hold existing quotes for a day or two (or through the end of the week) before changing their negotiation position. Then it takes a couple of weeks to determine if anything has truly changed. So, the next market analysis will be important to review to see if the mills follow through on their move to higher pricing.

As you can see by our graphic, hot rolled and galvanized have been the two most “flexible” items to negotiate between the domestic mills and their customers. We are seeing less enthusiasm by the mills to negotiate cold rolled and Galvalume pricing.

Here is how we measured the results from this week’s market analysis: