Market Data

March 20, 2014

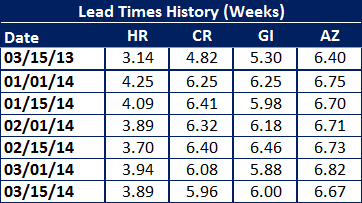

Lead Times Not Yet Impacted by Price Announcements

Written by John Packard

Steel Market Update began our latest analysis of the flat rolled steel market on Monday of this week. We found mill lead times remained very similar to those reported at the beginning of March. The ArcelorMittal flat rolled steel price announcement was not made until late Monday afternoon and by then 50 percent of the responses to our survey had already been made.

We anticipate there will be changes to lead times in our next survey which will begin on April 1st. Until then, we found lead times to have remained essentially unchanged from what was collected at the beginning of March.

Hot rolled lead times averaged 3.89 weeks down only slightly from 3.94 weeks at the beginning of the month. However, when compared to the same time last year, lead times are slightly longer compared to the 3.14 months posted during mid-March 2013.

Cold rolled lead times also remained essentially at 6 weeks. The 5.96 weeks posted this week was down only a fraction from the 6.08 weeks measured two weeks ago. As with hot rolled, cold rolled lead times are over one week longer than the 4.82 weeks posted for mid-March 2013.

As with the other products both galvanized and Galvalume (coated products) lead times remained fairly stable to the beginning of the month but longer than one year ago. Galvanized lead times averaged 6.0 weeks (5.88 weeks at the beginning of March) and Galvalume averaged 6.67 weeks versus 6.82 weeks at the beginning of the month.

Below is our table providing data since the beginning of this calendar year as well as where lead times were one year ago.