Prices

March 20, 2014

Global Steel Production and Capacity Utilization in February 2014

Written by Peter Wright

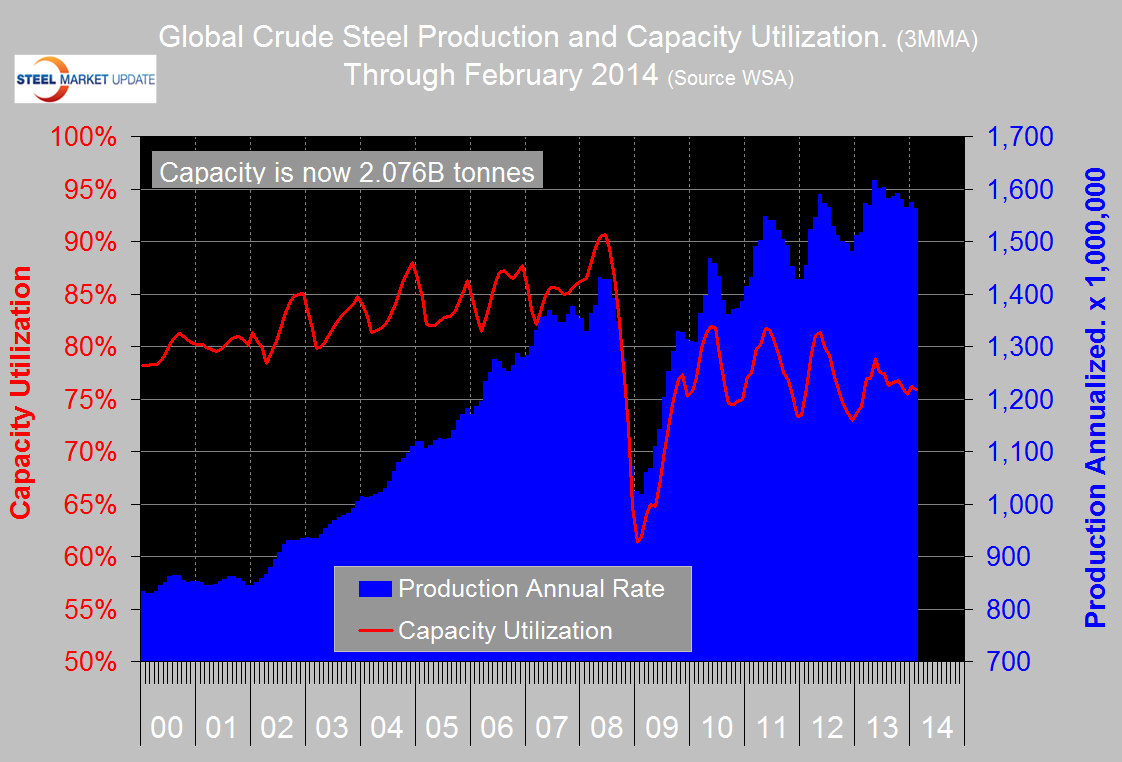

Global Steel Production in February declined by 11.7 million tonnes, normal for that month based on a reduced number of operating days. February steel production was 125 million tonnes, an increase of 0.6 percent from February last year. Capacity utilization on a rolling three month basis through February was 75.9 percent (Figure 1). The annualized three month moving average of production was 1.562 billion tonnes in the December through February time frame. Capacity is now 2.076 billion tonnes.

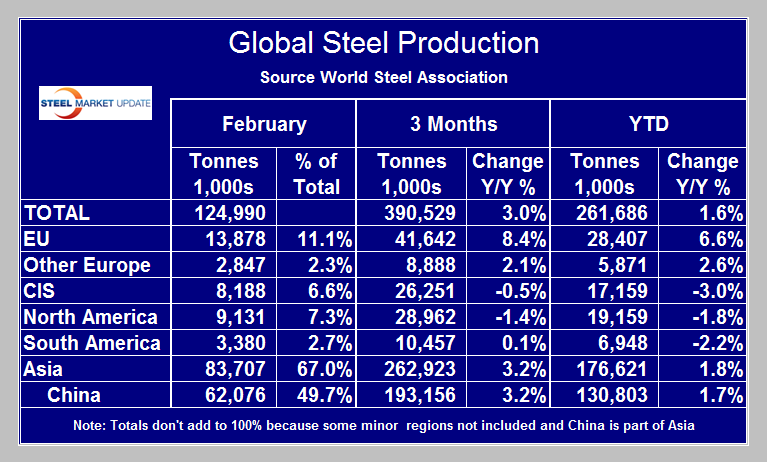

Table 1 shows regional production in February with regional share of the global total, also three months production through February and YTD production. In three months through February y / y growth was 3.0 percent. Year to date through February y / y growth was 1.6 percent. All regions except North America and the CIS had positive y / y growth in three months through February with the European Union continuing to lead the way. South America eked out a small 0.1 percent growth. The growth of China’s steel output has slowed dramatically this year with y / y growth in January and February of 2.9 percent and 0.4 percent, respectively. It is still too soon to tell if China’s production really is being reigned in but the signs are encouraging. North America and China produced 7.3 percent and 49.7 percent of the global total in February respectively.

SMU Comment: Recent global steel production results are encouraging in light of recent commentary about a global economic slowdown, however, the Internal Monetary Fund (IMF) issued a cautionary note last month. Ms. Christine Lagarde, Managing Director of the IMF, issued the following statement 0n February 20, 2014 at the conclusion of the Group of 20 (G20) Finance Ministers and Central Bank Governors Meeting in Sydney, Australia: “Though global growth has strengthened in recent months, largely driven by advanced economies, increased financial market and capital flow volatility in emerging economies and low inflation rates in advanced economies pose important challenges ahead. Further action and international cooperation are necessary to promote a more robust global recovery —one that is sustained and fosters healthy job creation—and to counteract actual and potential risks.” (Source: World Steel Association)

{amchart id=”128″ World Cude Steel Production- Total and 8 Regions}