Market Data

March 18, 2014

Industrial Production and Manufacturing Capacity Utilization in February 2013

Written by Peter Wright

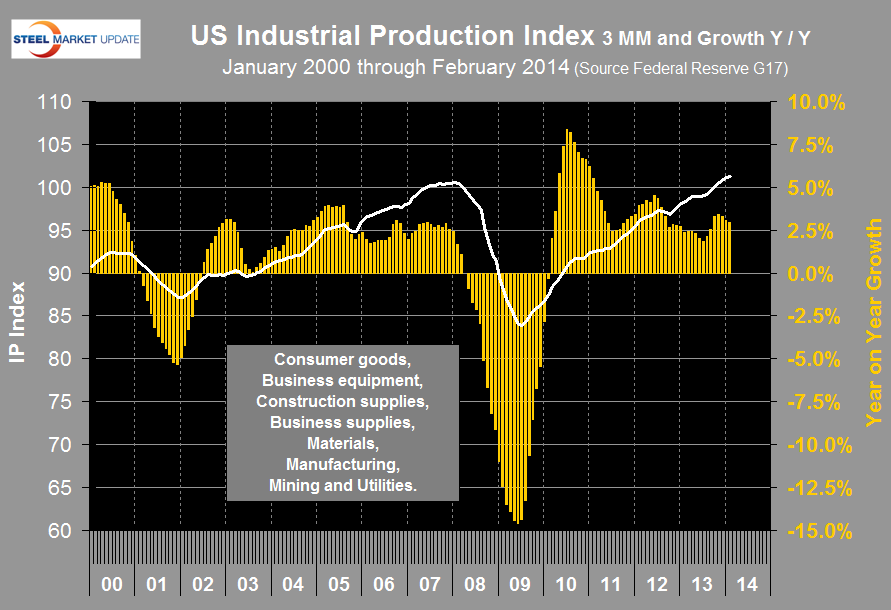

Both these data points are reported in the Federal Reserve G17 data base. The Industrial Production (IP) index was reported as 101.63 for February, this was the fourth consecutive month for the index to exceed the pre-recession peak of September 2007. The three month moving average, (3MMA) of the index expanded by 0.62 month on month and by 2.9 year on year. Data is seasonally adjusted. The three month moving average (3MMA) at 101.27 was the highest since January 2008 which was also the pre-recessionary peak. This index is based on the July 2007 level being defined as 100 (Figure 1).

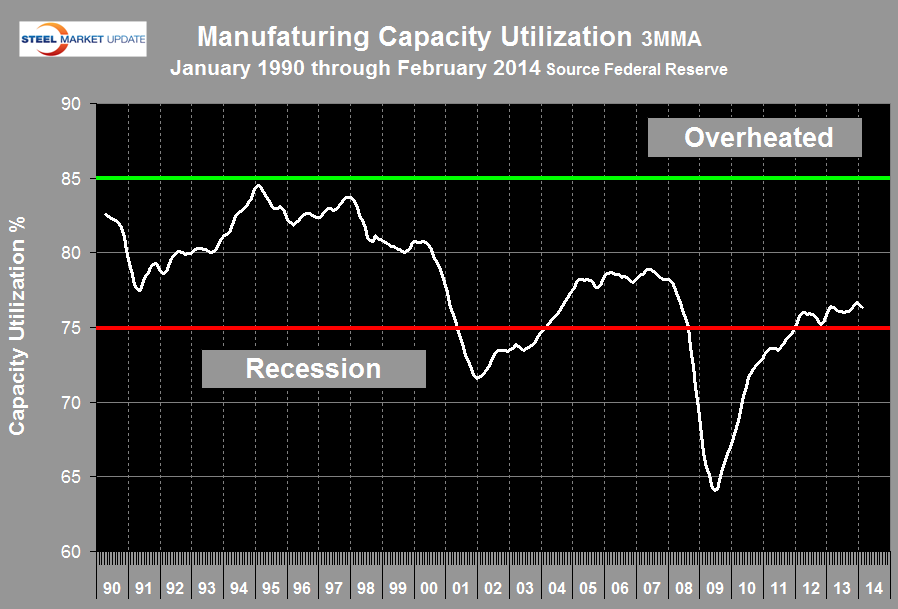

Manufacturing capacity utilization was 76.43 percent in February, up from 75.93 in January. The 3MMA declined by 0.09 percent to 76.36 percent and was up by 0.42 percent year over year (Figure 2).

The latest National Association of Manufacturers survey found that 86.1 percent of respondents were positive about their company’s outlook, up from 78.1 percent three months ago, with increased expectations for sales, exports, employment and capital spending. Still, smaller manufacturers were less positive, particularly in their investment plans. The top challenges were the business climate and rising health care and insurance costs, with respondents noting the need for comprehensive tax reform and expressing concern about ever-increasing regulatory burdens.

Government regulations were also cited as the most important problem in the latest National Federation of Independent Business (NFIB) survey of small business owners. It was one of two sentiment surveys released last week showing reduced confidence. NFIB’s Small Business Optimism Index fell sharply, down from 94.1 in January to 91.4 in February. The percentage saying it was a good time to expand declined, with weak sales and earnings expectations. Likewise, preliminary March consumer confidence numbers from the University of Michigan and Thomson Reuters were also lower, perhaps reflecting concerns about job and income growth

The Federal Reserve Beige Book released on March 5th reported as follows: “Manufacturing activity expanded at a moderate pace from January through early February in most Districts. Several Districts reported that severe winter weather had a negative effect on sales and production during this period, including Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, and Dallas. The weather was cited to have caused utility outages, disrupted supply chains and production schedules, and resulted in a slowing of sales to affected customers. Philadelphia and Richmond reported that shipments and orders declined during the first half of February. Steel producers in Cleveland indicated that they have excess capacity, and San Francisco reported low capacity utilization rates at steel mills. Boston and San Francisco indicated that semiconductor sales had been particularly strong. High-tech contacts in Dallas reported a slight improvement in orders, as demand for memory chips remained strong and demand for logic devices remained weak but stable. San Francisco also cited growth in the commercial aerospace industry due to a backlog in orders for commercial aircraft, while defense-related manufacturers reported sluggish overall conditions and expected sales to trend downward. Auto production was strong in Chicago despite weather-related slowdowns in sales, and Cleveland reported auto production to be higher than a year ago. Most Districts were optimistic about the future and expect manufacturing activity to rise in the coming months.”

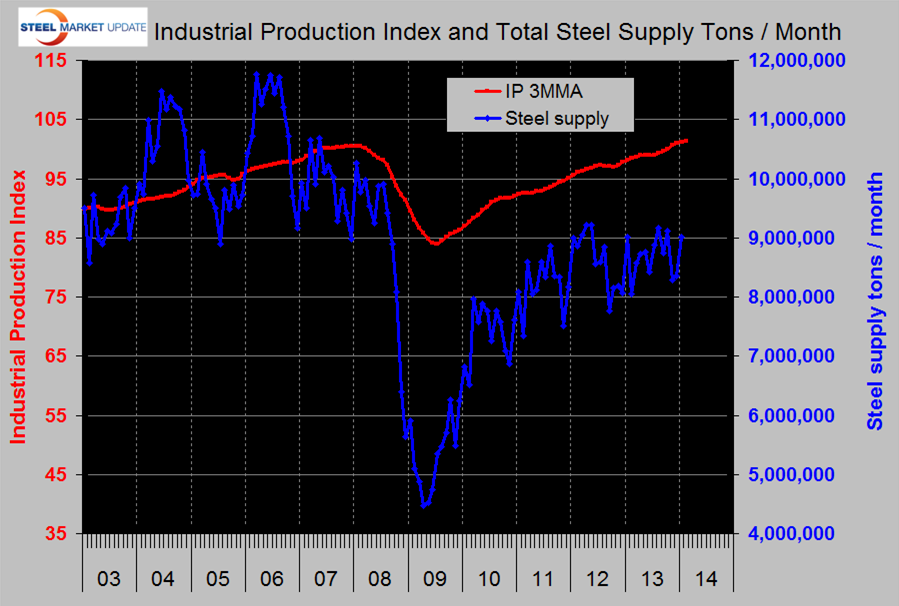

SMU Comment: prior to the recession there was a reasonable correlation between industrial production and steel supply though steel was very much more volatile in this comparison just as it is against GDP (Figure 3). We have many indicators that suggest that steel supply is much lower than it should be at this stage of a recovery and IP is one of them. We believe the main reason for the discrepancy is the continued low activity by historical standards of the major sectors of construction. This includes, housing, non-residential buildings and infrastructure.