Market Data

March 16, 2014

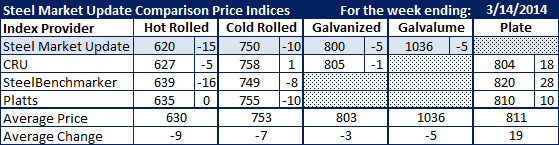

SMU Comparison Price Indices: Another Notch Lower

Written by John Packard

The indexes are beginning to spread out, especially on benchmark hot rolled coil pricing. Steel Market Update saw HRC prices down $15 per ton this past week, SteelBenchmarker was $16 per ton lower (but they only produce prices twice per month), CRU down $5 and Platts held the line even with the previous week.

The spread on cold rolled is might tighter than hot rolled with the four indexes averaging $753 per ton.

Galvanized was quite tight between SMU and CRU and Galvalume we stand unopposed having dropped Steel Orbis the week prior to this week.

Plate prices moved in the opposite direction with all three indexes posting double digit gains for plate over the previous week. The plate average is now $811 per ton (up $19 per ton).