Market Data

March 11, 2014

Key Banc Update on Key End Markets

Written by Sandy Williams

Key Banc recently published its report entitled “The Industrial Cycle: Monthly Update on Key End Markets.” The following is a summary of findings from report that SMU readers may find interesting.

Key Banc says the outlook for industrial activity remains positive for 2014. After a dismal performance in January affected by weather conditions, activity rebounded in February with a number of macro indicators showing improvement. The U.S. Manufacturing ISM index was above 50 for nine consecutive months in February, rising to 53.2 after a low reading of 51.3 in January attributed to severe winter conditions in most of the country. North America, in general, is in a positive trend with nonresidential construction continuing to show improvement for 2014. In China, the PMI dropped for the second month to a reading of 50.1 in February as both demand and production slowed. The Eurozone is showing promise with an accelerated rate in new orders, production and manufacturing job creation.

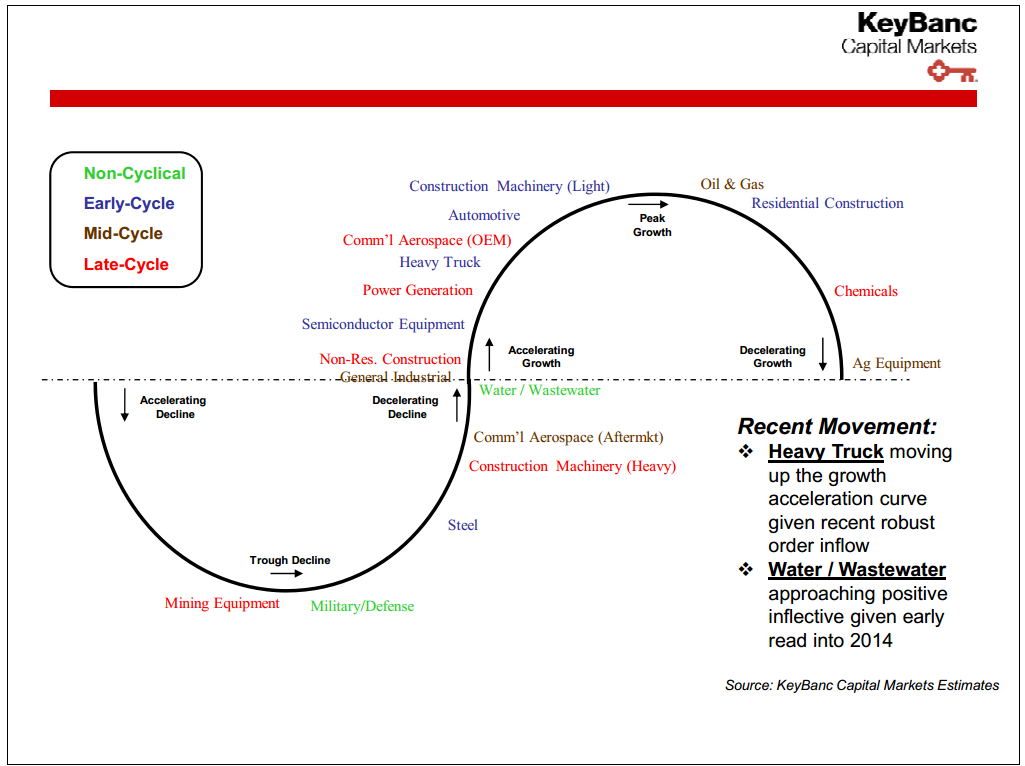

The following chart from Key Banc gives a good visual perspective on where key markets are in the current business cycle. The steel industry is shown in the early cycle of decelerating decline moving toward renewed growth.

End Markets

Aerospace: Boeing and Airbus both reported increases in orders and deliveries for February as compared to January. Defense spending for FY 2014 is down with some defense platforms cut or eliminated. The FY 15 defense budget request was $496 million, down about $45 billion from earlier projections and roughly equal to FY 14 spending.

Agriculture: Agricultural equipment spending was up 5.6 percent in 2013 compared to 2012 but Key Banc does not expect significant improvement in farm machinery sales for 2014. Agriculture sales are expected to decline 5-10 percent in the US and Canada.

Automotive: The automotive industry looks healthy despite weather related slow start to 2014. The industry is expected to sell a seasonally adjusted annual rate of 16.1 million light vehicles in 2014 and is showing a 4.4 percent growth rate year-over-year.

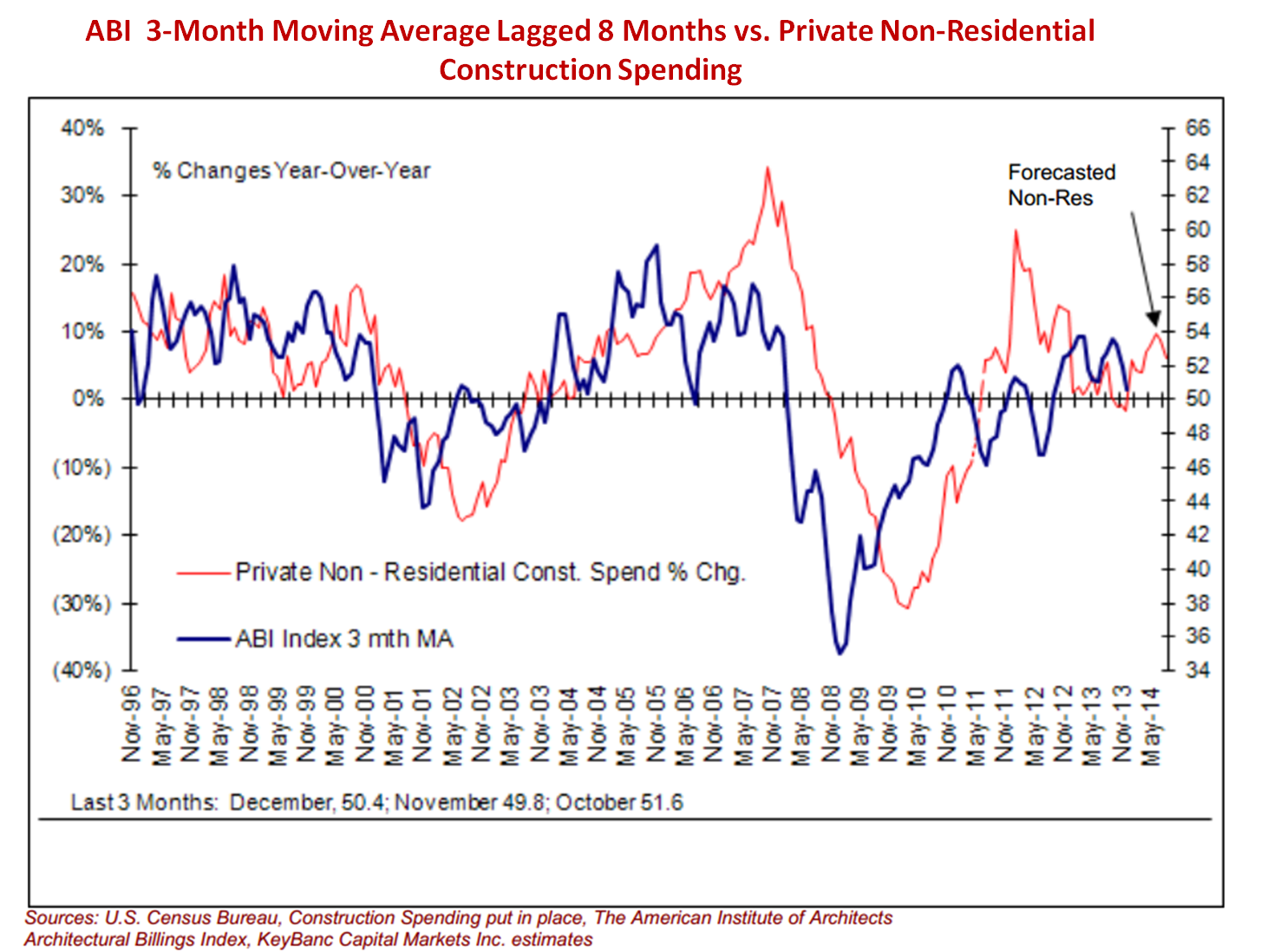

Non residential construction: Indicators by the US Census Bureau and American Institute of Architects show improvement in non residential construction activity. Spending was up 6.4 percent year-over-year in January according to the US Census Bureau. The ABI improved in January to 50.4 from 48.5 in December, with the index for inquiries for new projects at 58.5 for the month. The following chart from the Key Banc report shows the 3-month moving average for the ABI vs. private non-residential construction spending.

Residential Construction: Residential construction momentum may be beginning to fade, says Key Banc, primarily due to the prolonged period of adverse weather in the US. Three consecutive months of building permit declines suggest a gradual easing in housing expansion. Existing home sales decreased 5.1 percent month-over-month to a SAAR of 4.62 million units in January. Key Banc expects spring sales to return to normal with the yearly trend similar to 2013.

Construction equipment: Key Banc says positive ABI readings and improving monthly sales by Caterpillar led to a forecast for increased spending in both the residential and commercial construction equipment.

General industrial: The ISM Purchasing Manufactures Index (PMI) rose in February to 53.2 from 51.3 indicating general expansion in activity for the overall economy. Capacity utilization rates improved in 2013 after erratic changes in 2012 but have been decreasing in 2014. The seasonally-adjusted capacity utilization rate reported by the Federal Reserve in January dropped to 78.5 percent from 78.9 percent in December. Manufacturing companies comprise 77 percent of the index and decreased to 76.0 percent from 76.7 percent in December. Industrial output was also down by 0.3 percent sequentially in January according to the Federal Reserve.

Oil & Gas: Baker Hughes reported North American and international rig counts have been in a generally upward trend so far in 2014.