Prices

March 9, 2014

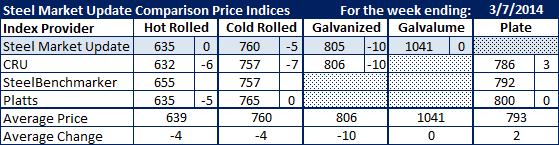

SMU Comparison Price Indices: Mild Erosion Continues

Written by John Packard

The pace of the decline slowed this past week with a number of the indexes showing mild to no erosion in flat rolled steel pricing. Benchmark hot rolled steel prices dropped into the mid $630’s. The spread between hot rolled and cold rolled steel pricing was an unusually high $121 per ton. Plate prices continue to defy gravity due to long lead times on the product.

Steel Orbis was removed from the CPI report for leaving us at the altar too many times (failing to provide updated prices prior to SMU publishing). SteelBenchmarker did not report prices this past week as they only publish pricing twice per month.