Distributors/Service Centers

March 9, 2014

Manufactures Report Service Centers Dropping Spot Steel Prices

Written by John Packard

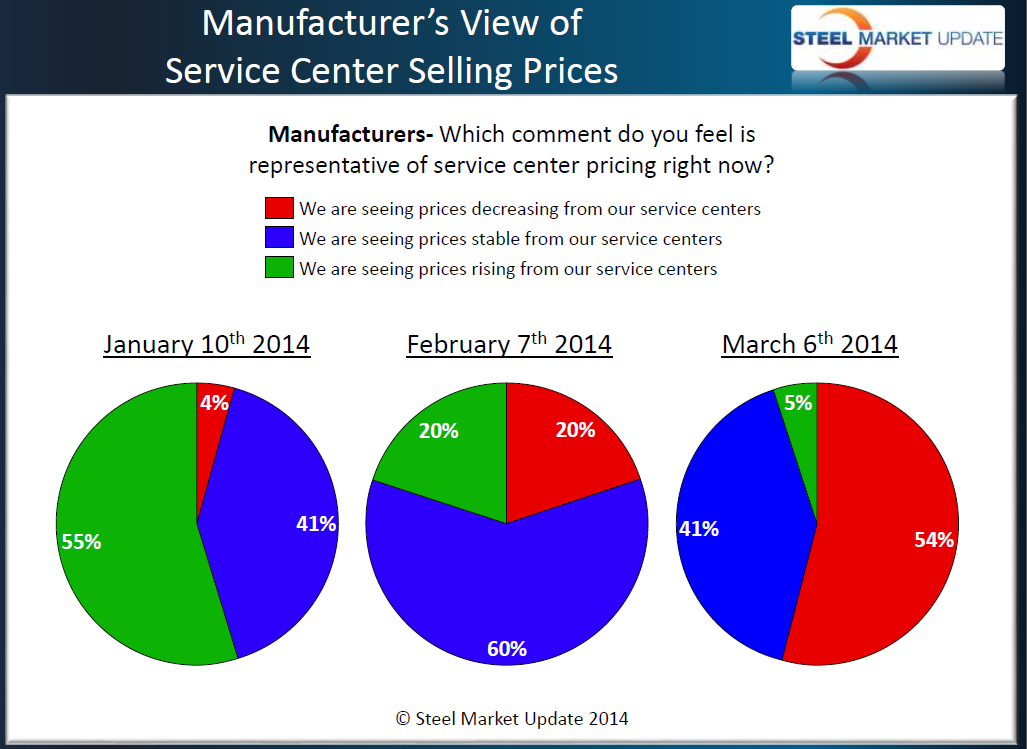

Steel Market Update saw the percentage of manufacturing companies reporting steel service center flat rolled steel spot prices as declining increase from 20 percent in early February to 54 percent at the beginning of March.

This past week Steel Market Update (SMU) conducted our early March analysis of the flat rolled steel markets. This is something we do twice per month, inviting slightly fewer than 600 companies to participate. We are able to segregate our respondents by industry and 44 percent of the respondents were associated with manufacturing companies, 40 percent with service centers/wholesalers, 6 percent were trading companies, 4 percent (each) steel mills and toll processors and 2 percent were suppliers to the steel industry.

As you can see by the graphic below manufacturing companies are reporting service center prices as dropping by ever larger percentages since we saw the early crack in pricing the first week of January 2014.

It is SMU’s opinion that distributor spot pricing is a harbinger for the direction spot mill pricing will go over the near term. However, we have found in the past that once the service centers reach a point of capitulation (which we have defined as 70+ percent of the distributors lowering pricing) the domestic mills at that point have the ability to raise prices.

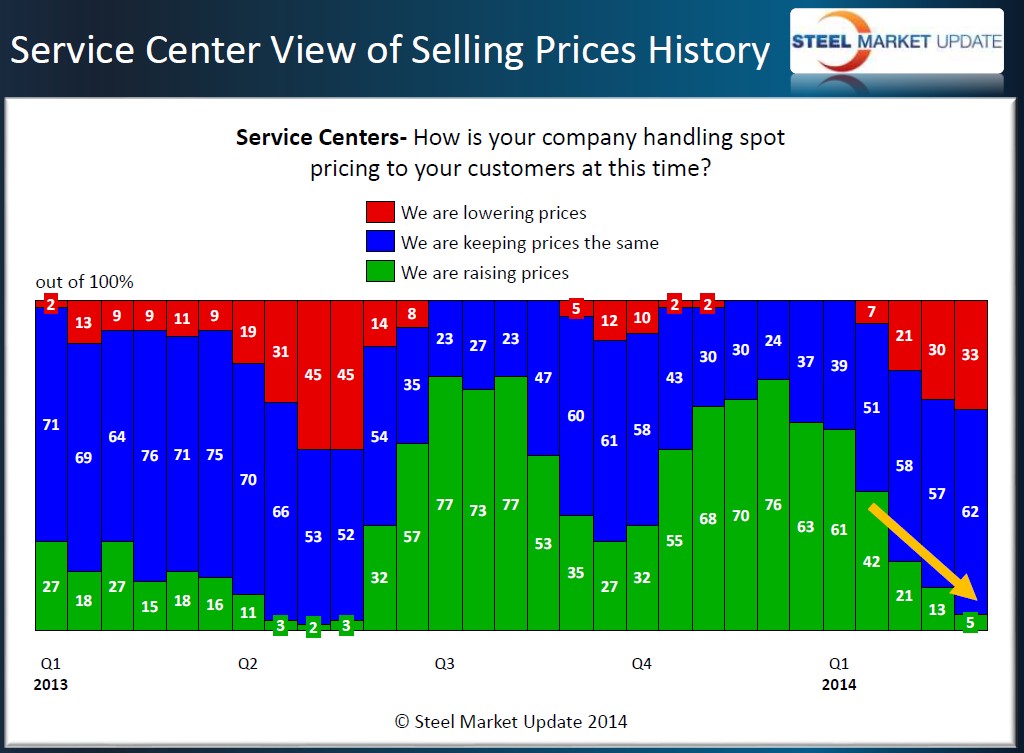

Service centers have not yet reached capitulation as 33 percent of distributors reported prices as falling while a small group (5 percent) reported prices as rising (plate?). The percentage reporting prices as dropping has increased from 21 percent in February and zero percent back at the beginning of January.

Below is a longer term view of service center spot pricing. We have to go back further in history to find points when service centers reached the capitulation level.

We capture a large amount of information through our twice monthly market analysis and we share a good portion of both the current and historical data with our Premium Level members. For information on how to become a Premium Level member go to the subscribe section of our website or contact our office: info@SteelMarketUpdate.com or 800-432-3475