Market Data

March 6, 2014

SMU Steel Buyers Sentiment Index at +37

Written by John Packard

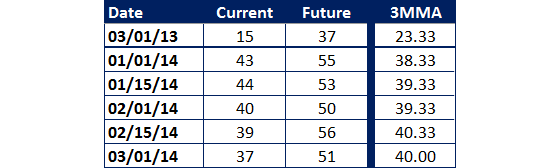

Buyers and sellers of flat rolled steel continue to be optimistic regarding business prospects both in the current market environment as well as looking out 3 to 6 months into the future. Even so, our index was 2 points lower than the +39 measured during the middle of February and at +37 is the lowest (albeit optimistic) level we have measured this year. The last time we saw +37 was during the middle of December 2013.

The three month moving average (3MMA), which had been rising since mid-December 2013, declined to +40.00. Many within the industry have been calling for 2014 to be quite similar to 2013 but what our data is suggesting is the market is much more optimistic this year than last. The 3MMA during the beginning of March 2013 was +23.33 which is much less optimistic than our current average.

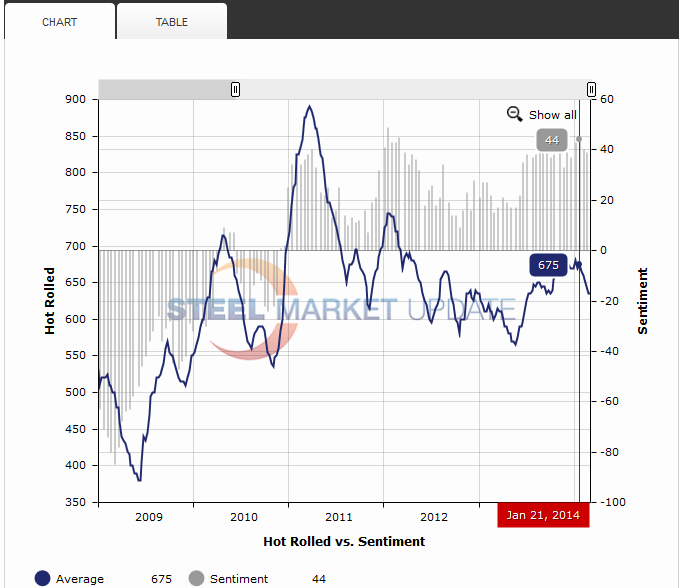

We have found through analyzing the history of our price indices and Sentiment Index that there is a correlation between the two. The graphic below is a snippet from our website (no, we didn’t force you to go to the website for this one) where in the Price History section of the website you have the ability to run this comparison interactive chart. As you can see below we scrolled to the point where Sentiment peaked and it was at the same point when HRC prices had reached their zenith as well. Since mid-January both HRC pricing and Sentiment have been in decline.

Future Sentiment at +51

SMU Steel Buyers Future Sentiment Index came in at +51 which is down 5 points from our last measurement made during the middle of February. Our Future Sentiment Index is based on how steel buyers and sellers feel about their company’s prospects three to six months into the future. The +51 continues a strong optimistic streak (in excess of +25) which goes back to October 1, 2011.

The lowest point ever measured was January 15, 2009 when Future Sentiment was -40. The highest ever measured was January 15, 2012 when we reached +63.

What Survey Respondents are Saying

Those responding to our survey explained that weather and business conditions are worse than expected during the 1st Quarter. However, those answering our questions anticipate an uptick in demand as the year progresses. A manufacturing company pointed this out in their remarks made during the survey process:

“I feel that business conditions are worse in the 1st quarter than expected. With that said, business conditions seem as good as 2013 so far. I believe that our prospects will improve throughout 2014 activity wise which means increased true demand.”

A supplier to the steel industry presented a similar case as above:

“Due to the unusual EXTREME weathers we are experiencing throughout the Southwest, it is imported to us that there are several jobs for us on hold until climate improves. Construction jobs are in submission status and potential bridge/road/highway repairs are eminent throughout the Southwest.”

While a third manufacturing company was less enthusiastic about both current and future business trends and told SMU during the survey:

“Weather really dampened demand in February.”

About the SMU Steel Buyers Sentiment Indices

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly less than 600 North American companies to participate in our survey. Our normal response rate is approximately 120-170 companies. Of those responding to this week’s survey, 44 percent were manufacturing companies (down from 49 percent in our last survey) and 40 percent were service centers/distributors (up from 37 percent in our last survey). The balance of respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.