Market Data

March 4, 2014

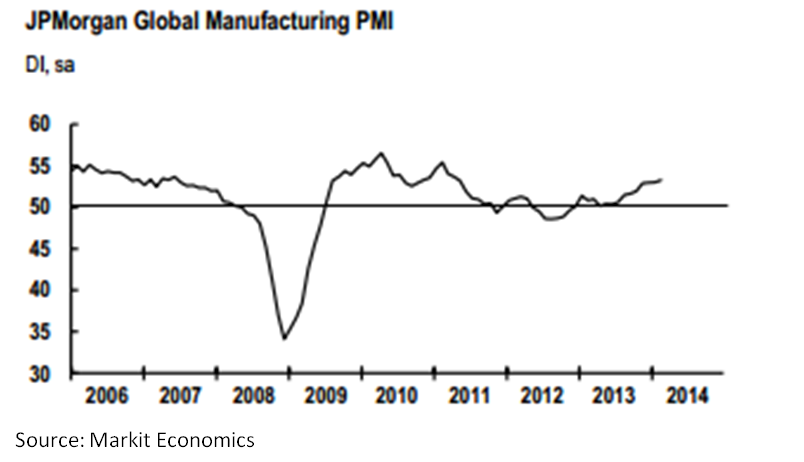

Global Manufacturing PMI Reaches 34-month High in February

Written by Sandy Williams

Global manufacturing activity showed steady improvement during February. The JP Morgan Global Manufacturing PMI rose to 53.3 in February, inching up from 53.0 in January. Manufacturing output remained steady in February while new orders grew at a faster rate. Employment levels were higher in much of the world with staffing cuts reported in China, Russia and Indonesia.

The US PMI was at its highest level since May 2010; Japan and the UK growth is considered robust. The Eurozone continues to make progress while China, South Korea and Russian are in contraction. India, Brazil, Vietnam and Indonesia were all below the global average.

The US PMI was at its highest level since May 2010; Japan and the UK growth is considered robust. The Eurozone continues to make progress while China, South Korea and Russian are in contraction. India, Brazil, Vietnam and Indonesia were all below the global average.

Price inflation relaxed somewhat in February with input costs growing at a slower pace and selling prices only slightly higher.

“The manufacturing sector is downshifting from very rapid growth late last year. The global PMI has not quite registered the shift due to weather-related distortions in the US survey, which bounced in February,” said David Hensley, Director of Global Economics Coordination at JPMorgan. “However, excluding the US, the global PMI is trending lower. The March reading should give a clearer signal of underlying momentum.”

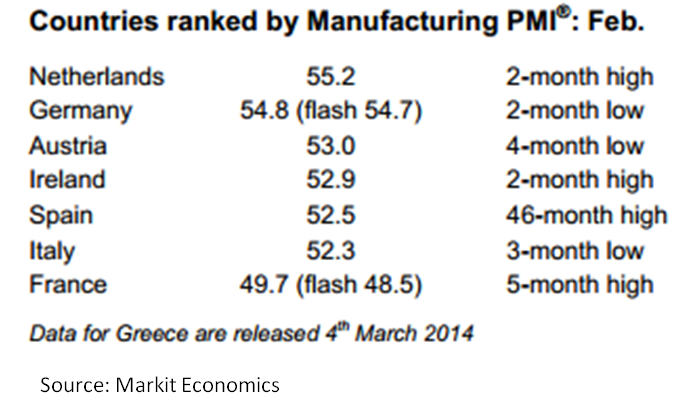

Eurozone

The Eurozone Manufacturing PMI dropped slightly in February, registering 53.2 from 54.0 in January, indicating a slowdown in the rate of expansion for the region. The reading is still the second strongest in three years, said Chris Williamson, Chief Economist at Markit.

Markit expects GDP to rise by 0.4-0.5 percent in the first quarter of 2014 unless the slide in momentum carries through to March. New orders and backlogs of work both rose in February and, in response, employment rose for the second consecutive month. Williamson says the Eurozone is “moving in the right direction and recovery is broadening out.”

The Netherlands led the PMI readings followed by Germany and Austria. France still trails the rest of the Eurozone nations but rose to a five month high of 49.7 in February.

China

China is showing signs of weakness in manufacturing with output and new orders both declining for the first time since July 2013. The HSBC China Manufacturing PMI registered 48.5 dropping one point from January. New business from abroad declined at a rate similar to the previous month. Input buying fell as production and demand faltered, inventories of raw materials were reduced to align with production requirements.

“The final reading of the HSBC China Manufacturing PMI confirmed the weakness of manufacturing growth. Signs become clear that the risks to GDP growth are tilting to the downside. This calls for policy fine-tuning measures to stabilise market expectations and steady the pace of growth in the coming quarters,” said Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC.

Russia

The HSBC Russia Manufacturing PMI indicated contraction for the fourth consecutive month, registering 48.5 in February, up slightly from 48.0 in January. Manufacturing indicators were grim in almost all categories. Indices for output, new orders, employment and stocks of purchases all fell in February. Export orders were down for the sixth month and falling at a faster rate than January. Input prices and selling prices both escalated during the month. Domestic demand is expected to continue to decline in the coming months.

“So far we do not observe any signs of import substitution in manufacturing on the back of the ruble weakening,” said Alexander Morozov, Chief Economist (Russia and CIS) at HSBC. “In contrast, the faster rise in prices weighs on demand and output in this sector of the economy. This is a surprising finding that contrasts the prevailing expectations about an impact of weaker currency on the economy. At the same time, this finding provides an argument for policy rate hike, in our opinion.

“It is highly likely that manufacturing will post negative output growth in 1Q, both on a quarterly and annual basis, we think. With such a weak start to the year, Russian industry risks a failure to grow this year.”

Japan

Manufacturing production increased sharply in February along with new orders mostly driven by domestic demand. The Markit/JMMA Japan Manufacturing PMI registered 55.5, almost unchanged from a high of 55.6 in January and indicating the twelfth month of successive growth. Inflation pressure increased both input and output prices. Export orders slowed for the third month in a row. Japanese manufacturers are bracing for a sales tax hike that will go in effect in April that may challenge current manufacturing expansion.

Mexico

The HSBC Mexico Manufacturing PMI lost 2 points, dropping form a 12 month high of 54 in January to 52 in February. Production and new orders slowed in February pulling down the headline PMI. Input costs inflation at a 12 month high, including higher fuel costs and raw material prices, pushed factory selling prices up at the fastest rate since September 2012.

Canada

Canada had a strong month with output, new orders and employment all rising in February. The RBC Canadian PMI registered 52.9, up from a nine-month low of 51.7 the previous month. New business volumes and export sales continued to increase but a softer pace. Input cost inflation was the highest since May 2011. Winter conditions slowed lead times from vendors, especially from the US.