Market Data

February 23, 2014

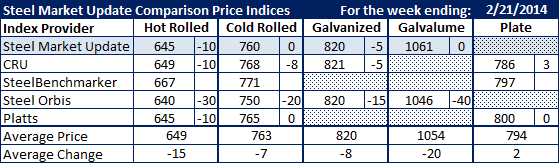

SMU Comparison Price Indices: Another Notch Lower

Written by John Packard

Steel prices continue to drop on most, if not all, of the indexes followed by Steel Market Update. Benchmark hot rolled coil was referenced at $645 per ton by both Steel Market Update and Platts. CRU had HRC pegged a few dollars higher at $649 per ton. SteelBenchmarker, which is part of World Steel Dynamics, did not report new numbers this past week. Steel Orbis reported after missing a week and their HRC number dropped to $640 per ton.

Here is how the various indexes saw price averages for hot rolled, cold rolled, galvanized, Galvalume and plate this past week:

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Northern Indiana Domestic Mill.