Analysis

February 20, 2014

Automotive Inventory Highest in 9 Years

Written by Sandy Williams

It’s hard to sell cars when they are covered by snow and customers are being warned to stay safe and snug at home. As a result, auto dealers watched sales freeze and inventory pile up in January.

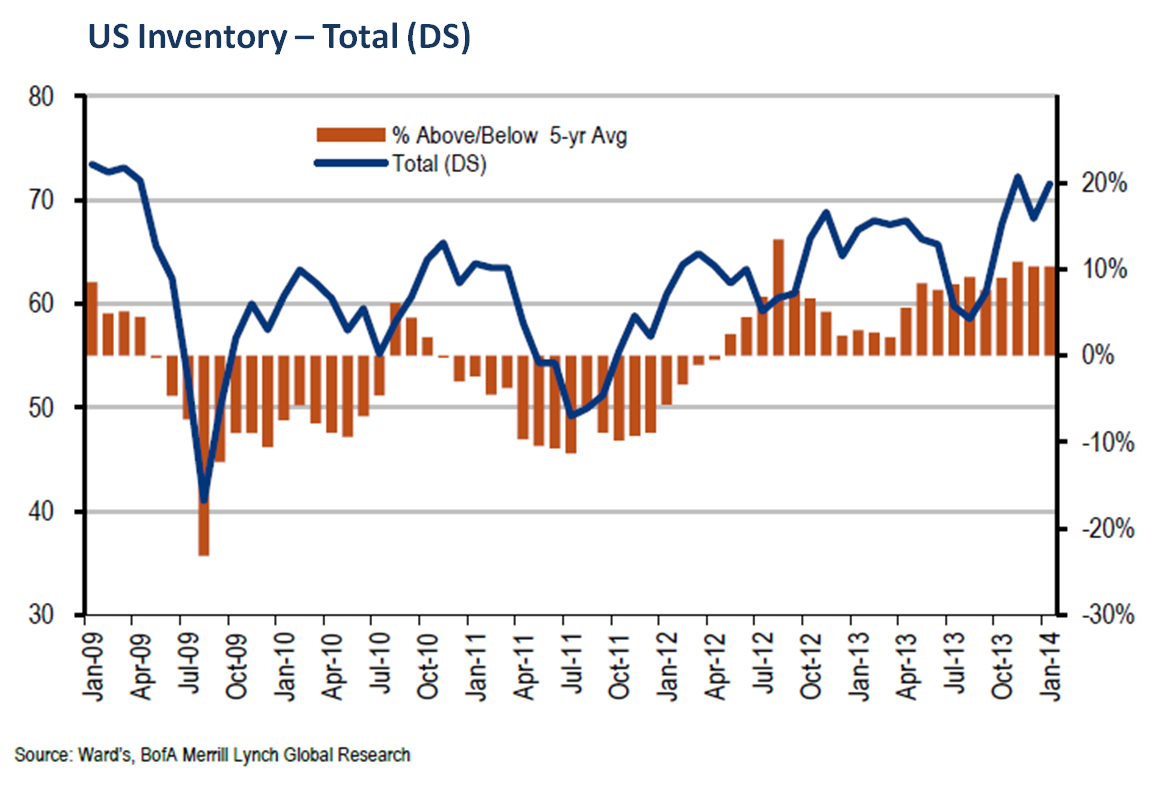

Total auto inventory increased to 3.61 million units at the end of January, the highest it’s been in nine years. The days’ supply jumped to 89 on Jan. 31 from 64 in December—well above the five-year average supply of 65 days.

The Big Three Detroit manufacturers all reported inventory higher by double digits in January but shrugged off concerns saying the weather hampered sales during the month and added to normal seasonal increases of inventory. Ford reported inventory on hand to cover a 111 day supply, up from 73 days in December. Japanese and European brands were approximately 3 percent above the average daily supply. Korean brands languished in dealer lots with inventories 23 percent above the five year average. Overall inventory levels are about 300,000 to 400,000 units more than needed for current market demand, says WardsAuto.

Bank of America Merrill Lynch looked at the figures from a different perspective. “While the current inventory appears relatively high on a trailing 12-month sales basis, when compared to our forward estimate of 16.5mm units for 2014, the current inventory of 3.6mm units equates to 67 days’ supply, just 4% above the 5-year average.”

Although the increase in inventory has analysts concerned, automakers say the build-up in inventory is normal this time of year and will return to usual levels as warmer weather takes hold. US auto sales are expected to top 16 million this year, and automakers have said they don’t want to be caught short during the peak summer selling months.

“It was an interesting month,” said John Felice, Ford Vice President, U.S. Marketing, Sales and Service. “On the inventory, we feel very well positioned with the inventory levels. Again, day supply is always a function of sales pace as well as the inventory on the ground. As we see every year, typically in January, elevated day supply in terms of the calculation. As we get into the spring market, we feel we are well-positioned with inventory levels and what we see getting back to more trend type sales pace.”

High auto inventory generally can be resolved in two ways: by providing consumer incentives to drive sales and/or by reducing production. The latter, would be a concern for the steel industry since about 23 percent of U.S. steel production is shipped to the automotive industry.

At the present time, no reductions are planned as automakers prepare for the spring sale surge. Maintaining sales prices, however, may become a challenge as dealers vie for customers in a slower growing economy.