Market Segment

February 18, 2014

Service Center Flat Rolled Shipments Improve Despite the Weather

Written by John Packard

The Metal Service Center Institute (MSCI) reported today that January 2014 carbon steel shipments were essentially flat (same) as one year ago. However, flat rolled shipments improved compared to one year ago. You can view the MSCI press release on shipments and inventories on their website.

Service centers shipped 3,648,200 tons of steel products during the month of January 2014 which had 22 shipping days the same as last year. The shipment rate was 165,800 tons per day which is almost exactly the same as one year ago when service centers shipped 165,600 tons per day during the month of January. Inventories stood at 8,554,700 tons, up slightly from the 8,367,700 tons reported at the end of December. Months on hand stood at 2.3 months on a non seasonally adjusted basis down from 2.8 months at the end of December and 2.5 months on a seasonally adjusted basis up from 2.3 months the prior month.

Carbon Flat Rolled

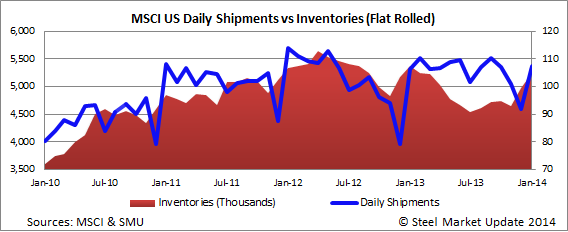

U.S. service centers shipped 107,600 tons per day of carbon flat rolled steels during the month of January 2014. This is better than the 106,200 tons per day shipped during January 2013. Our assumption is shipments could have been slightly higher if not for the weather related closures suffered in many areas of the country. Total tons shipped were 2,368,100 tons up 1.4 percent over last year.

Flat rolled inventories stood at 5,251,900 tons at the end of January. This is up 270,500 tons over December but 2.4 percent below the total flat rolled tons being held at the end of January 2013.

Months on hand stood at 2.2 months on a non adjusted basis (2.6 months at the end of December) or 2.3 months on a seasonally adjusted basis (2.1 months).

Steel Market Update will have a more detailed analysis including our proprietary Apparent Excess/Deficit report and forecast for our Premium members on Wednesday, February 19th.