Prices

February 18, 2014

February Import Forecast (week 2)

Written by John Packard

As we mentioned last week, Steel Market Update will provide our members weekly steel import forecasts based on license data provided by the U.S. Department of Commerce (beginning with the second week of the month). We advise our members to spend a few minutes and read David Phelps article about the import license data and why the numbers can only be used as an indicator and not a final path toward the totals for any particular month.

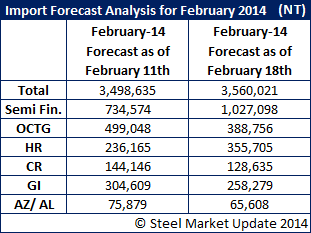

This is the second week where we are forecasting February numbers and, as you can see by the semi-finished numbers (billets & slabs but almost all slabs), there can be huge variances from week to week.

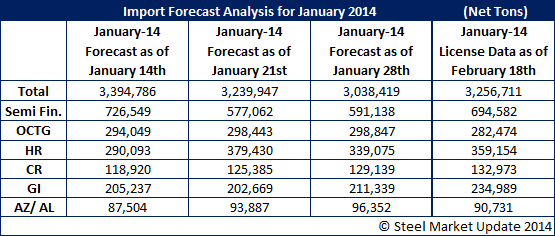

To put the numbers into perspective you can review what our forecasts called for during the month of January on a week by week basis and as of February 18th. The January numbers are still based on license data. Next week we should receive the Preliminary Census Data numbers and then we get the Final Census Numbers to close out the month.

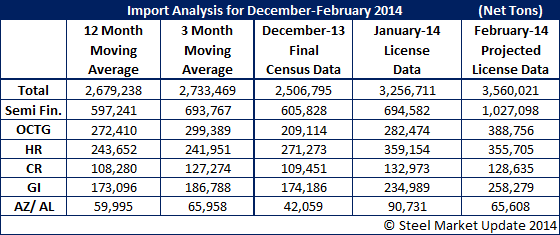

In the next table we are providing information regarding the 12 month moving average (12MMA) and 3 month moving average (3MMA) by product, the December Final Census Data, January License Data and our 2nd Forecast number for February.