Prices

February 16, 2014

US Scrap Exports through December

Written by Peter Wright

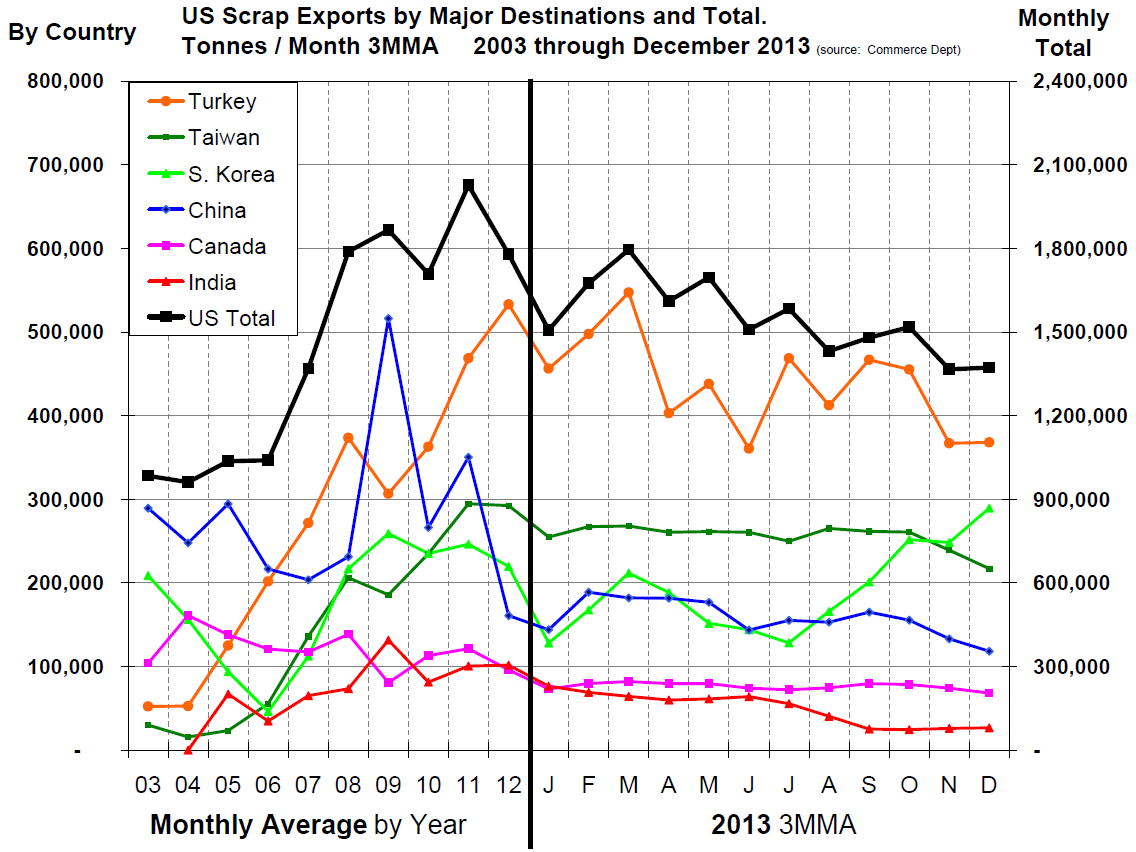

Scrap exports closed out the year of 2103 at 18,470,000 tons, down by 2,888,702 tonnes or 13.5 percent from 2012. Turkey alone was down by 1,169,000 and the Far East as a whole was down by 942,000 tonnes or 9.9 percent. Figure 1 shows the three month moving average of total exports and of the receipts of individual nations.

Exports to the Far East dropped in both 2012 and 2013 as the depreciated Japanese Yen made scrap from that source cheaper when priced in US dollars. South Korea bucked the general declining trend by continuously increasing its purchases from the US for the last five months of 2013. The major change on the upside in 2013 was Egypt who increased their purchases from the US by 134.7 percent to 872,000 tonnes. Egypt is not shown in Figure 1 as we have insufficient history to show the long term trend.

The big variable for East coast export demand is Turkey which is facing internal political dissent that must be affecting business confidence and a decline in its traditional export market of the Middle East and North Africa. According to the AMM scrap price indexes, a mix of 80:20 #1 and #2 heavy melt bulk cargo has declined by $34/tonne since January 13th. Turkey produced 34.7 million tonnes of steel last year, 70 percent of which was in electric arc furnaces and imported 18 million tonnes of scrap. Turkish steel production grew steadily in 2009 through 2011, plateaued in 2012 then declined by 3.4 percent in 2013. The collapse of the Lira against the US dollar began exactly a year ago and is now down by 19 percent. Against the Russian Ruble the Lira is only down by 7.4 percent making Russian scrap more competitive. In addition, Turkey has increased its purchases of billets for re-rolling from Russia and Ukraine in the last two years, replacing domestic Turkish crude production rather than complementing it, and so was a direct subtraction from scrap purchases. At this time it is unclear how Russia will respond to increased scrap demand from Turkey. Russia instituted an export tax combined with strict administrative policies in 2007 that resulted in a sharp decline in international scrap trade. However, upon joining the World Trade Organization, Russia agreed to substantially reduce tariffs on exported steel scrap. This occurred to some extent but Russian exports only recovered to one third of their previous level. Then in February 2012, Russia adopted a customs regulation that excluded Vladivostok, Nakhodka and St Petersburg from the list of permissible shipping points, representing a clear effort by Russia to erect yet more administrative barriers to exports of steel scrap.

On February 14th AMM reported that bulk scrap purchase by Turkey in the US declined again this week but some Turkish buyers, reporting that inventories are very low, believe the bottom is near.