Distributors/Service Centers

February 9, 2014

Service Center Spot Pricing Faltering

Written by John Packard

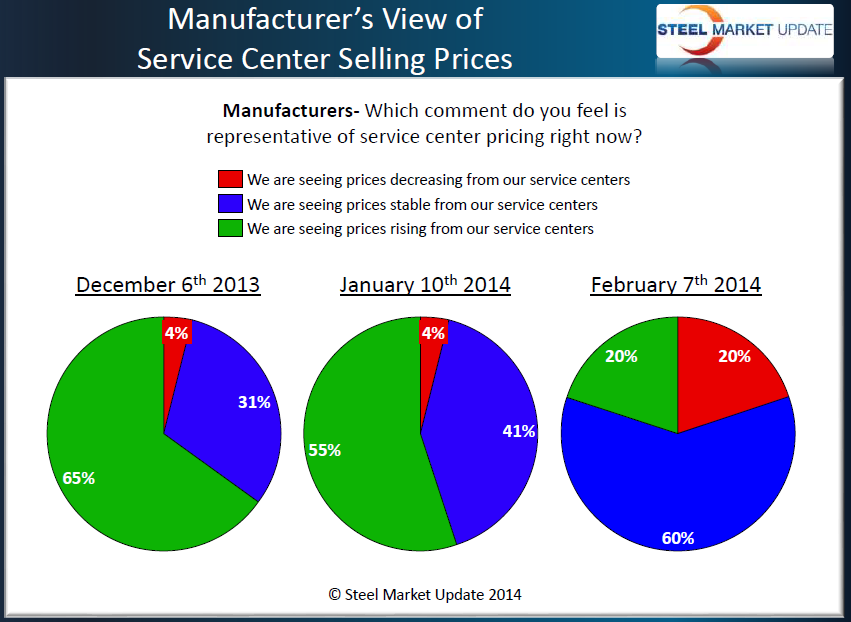

Manufacturing companies and service centers are beginning to agree on one topic: service center spot prices are faltering and spot price offers are beginning to drop. The percentage of manufacturing companies reporting lower spot prices out of the service centers rose from 4 percent in early January to 20 percent. At the same point in time, the percentage of manufacturing companies reporting distributor’s pricing as rising dropped from 55 percent down to 20 percent.

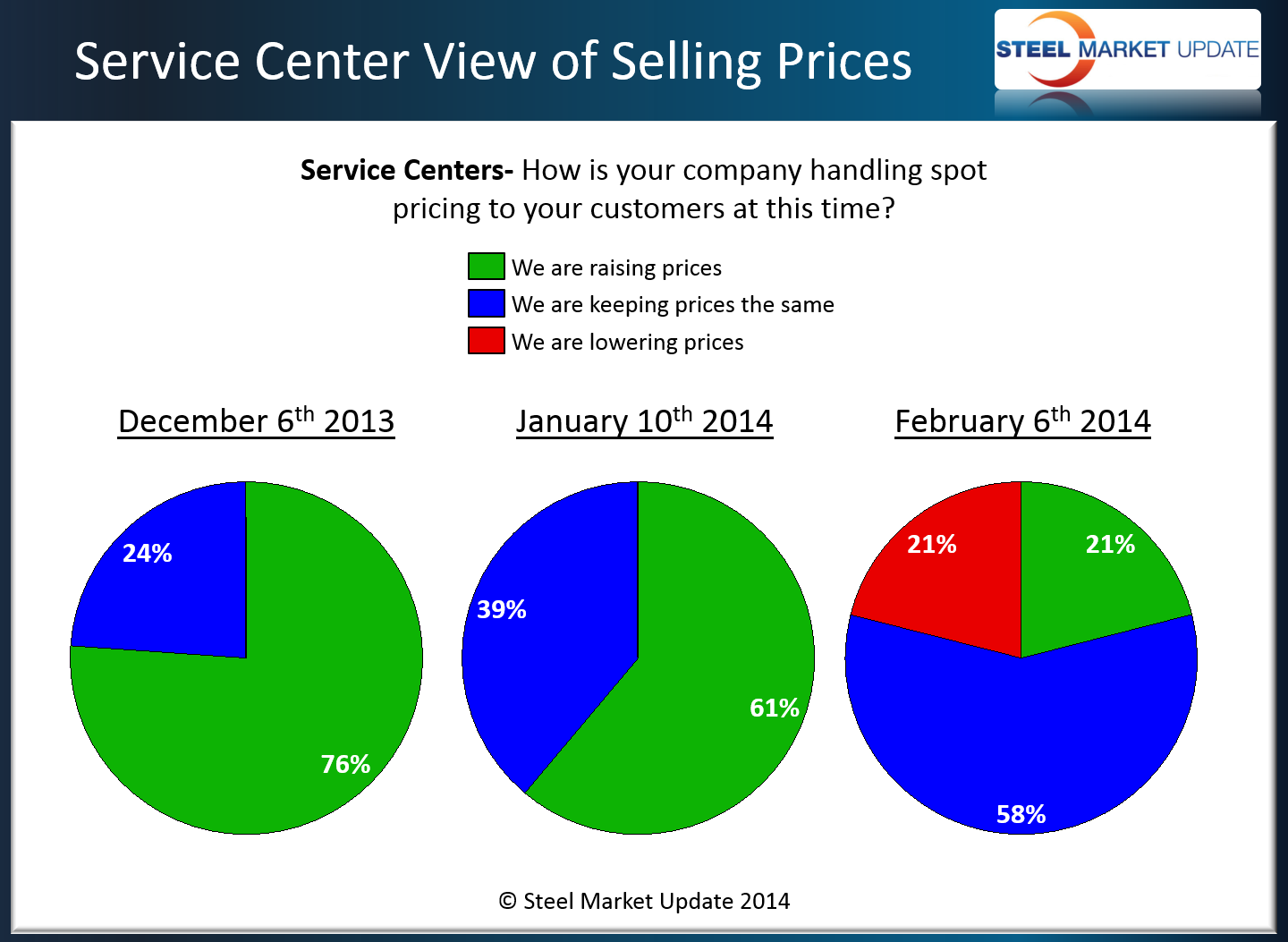

Service centers, none of which were reporting their company as lowering spot prices to their end users at the beginning of January, have moved their numbers in line with the manufacturing companies. Twenty one percent of the distributors now report spot prices as dropping while the same percentage report prices as rising. One month ago, 61 percent of the service centers reported prices as rising.

Service center spot prices is a leading indicator of rising or falling domestic mill pricing. We do not see domestic mills as being able to rise without service centers moving their spot prices higher at the same time. When service centers begin dropping spot prices we tend to see domestic mill prices reacting in a similar fashion. Mill prices have dropped approximately $15 per ton over the past 30 days.