Market Data

February 6, 2014

Lead Times Holding Their Own / Negotiations Not So Much

Written by John Packard

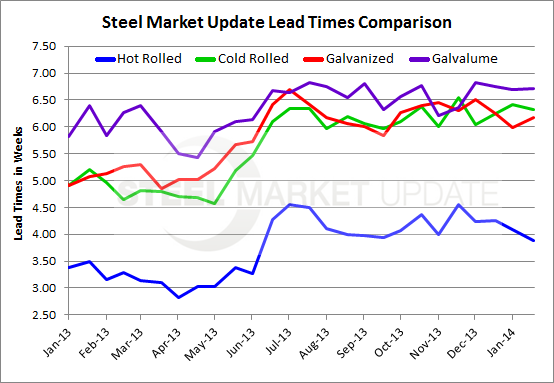

Based on the results of our steel market survey which we just completed this afternoon, lead times out of the domestic mills remained relatively constant compared to what we reported during the middle of January.

Hot rolled lead times slipped to 3.89 weeks (average) down from 4.09 weeks.

Cold rolled remained over 6 weeks at 6.32 weeks.

Galvanized also remained almost exactly the same at 6 weeks (6.18 weeks).

Galvalume also remained the same at 6.71 weeks.

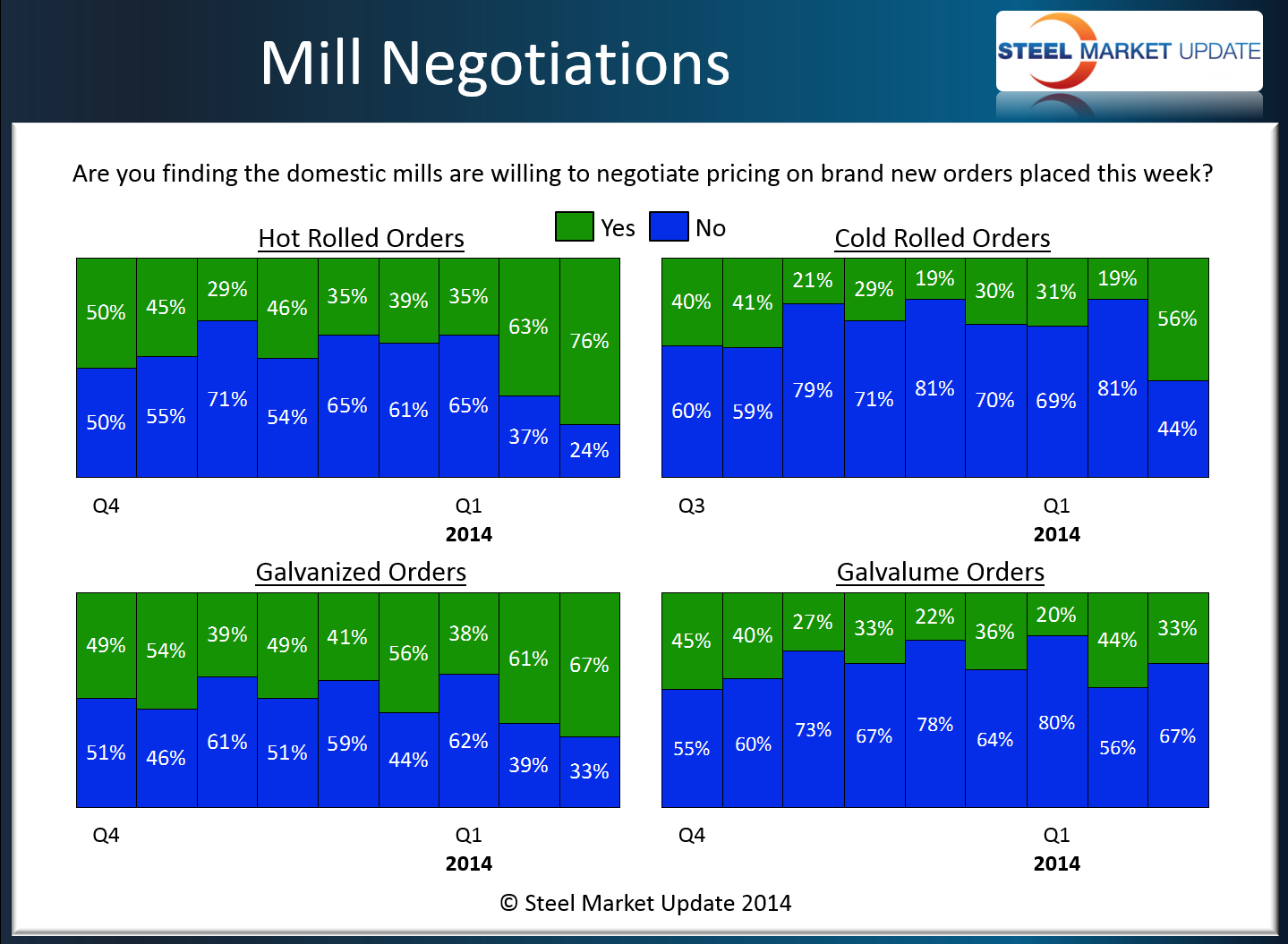

Our respondents reported three of the four flat rolled products we are currently following, the percentage of the respondents reporting the domestic mills as willing to negotiate pricing on hot rolled, cold rolled and Galvanized increased compared to two weeks ago. The only item which showed less willingness to negotiate was Galvalume which dropped from 44 percent to 33 percent.