Market Data

February 2, 2014

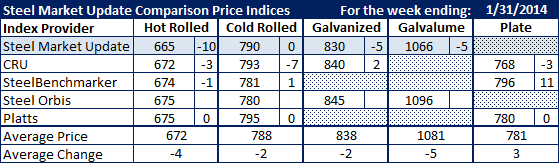

Comparison Price Indices: Small Changes

Written by John Packard

Steel Market Update follows a number of indexes and their average price points on hot rolled, cold rolled, galvanized, Galvalume as well as plate.

Steel Market Update (SMU) found prices slipping on three of the four products we currently index – hot rolled, galvanized and Galvalume. CRU also picked up some modestly weaker numbers as well. Platts maintained the same prices as measured the prior week. SteelBenchmarker, which only produces pricing twice per month, was essentially unchanged on HR and CR and up $11 per ton on plate. We did not receive new numbers from Steel Orbis prior to our publishing deadline.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Northern Indiana Domestic Mill.