Distributors/Service Centers

January 26, 2014

Spot Flat Rolled Sheet Prices: Distributors Changing Direction?

Written by John Packard

We are beginning to capture signs of a fracture in the resolve of the service centers to push higher steel prices into their end user accounts. With flat rolled steel spot prices trading within a fairly narrow and stable range for the past 10 weeks according to our SMU price indices, it should not come as a surprise that distributors have potentially reached the end of their abilities to move spot carbon sheet prices higher.

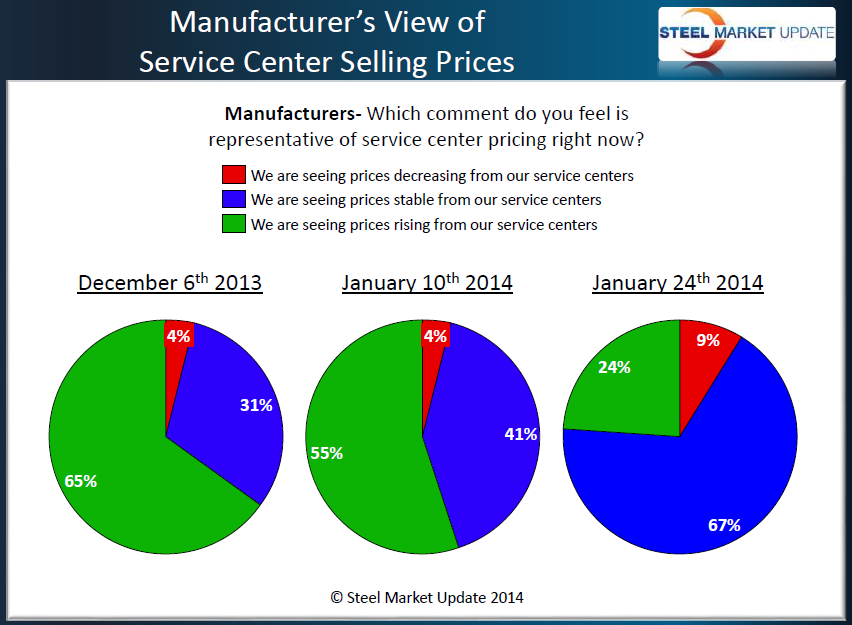

According to our most recent steel market analysis, manufacturing companies reported service centers in ever growing numbers moving away from higher spot pricing (55 percent during the first week of January vs. 24 percent this past week) toward either stable (67 percent) or declining prices (9 percent up from 4 percent ).

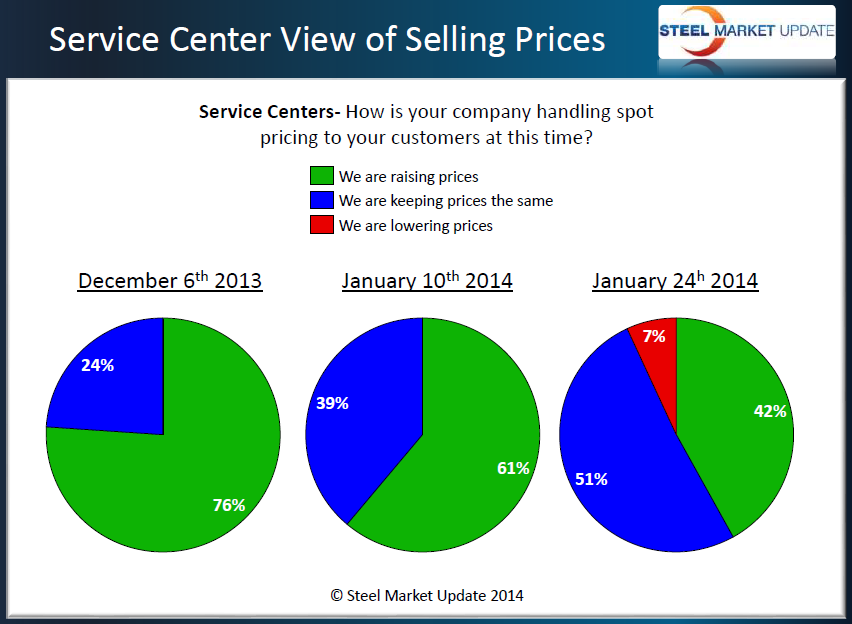

Distributors also reported for the first time in a number of months that there was a small minority of service centers beginning to lower spot pricing (7 percent). This is the first time we have seen service centers reporting declining spot prices since early in the 4th Quarter 2013. As you can see from the graphic provided, the percentage of our distributor respondents reporting spot sheet prices as rising dropped from 76 percent in early December to 42 percent this past week.

Steel Market Update expects this trend toward growth in declining spot prices out of the distributors to continue – especially if inventories start to build at the service centers, if foreign steel starts hitting the distributors floors in ever increasing amounts and if domestic mill prices either move sideways or begin to slip in the following weeks.