Market Data

January 23, 2014

Mill Lead Times & Negotiations

Written by John Packard

Mill lead times, according to those taking our SMU steel market survey this week, continue to be extended compared to where they were one year ago. However, we found (based on our survey results) that the mills have become more willing to negotiate on hot rolled, galvanized and Galvalume but not on cold rolled.

Hot rolled averaged 4.09 weeks, down from 4.25 weeks at the beginning of January but well above the 3.38 weeks reported during the middle of January 2013.

Cold rolled lead times moved out (extended) to 6.41 weeks from the 6.25 weeks reported at the beginning of the New Year and are much longer than the 4.91 weeks we saw at this same point in time last year.

Galvanized lead times averaged 5.98 weeks, down from 6.25 weeks from the first week of January but well above the 4.91 weeks reported during mid-January 2013.

Galvalume continues to have the longest lead times at 6.70 weeks (average), down slightly from the 6.75 weeks reported in our last survey but well above the 5.82 weeks measured during the middle of January 2013.

Below is an interactive graphic (and table) which is visible to our readers when viewing the newsletter through the website. You can do that by clicking on the “Read Full Text” link at the top of this newsletter or you can go directly to www.SteelMarketUpdate.com and either read the newsletter article by article by clicking on the rolling banners in the “Latest Newsletter” or by clicking on the “News” tab in the toolbar. You can also view the full newsletter by going to the “Newsletter” tab and the first item in the sub-menu will be the Executive (or Premium for Premium Level members) Archives. You will need to log in to view these items. If you forgot your user name and password please contact our office and we will re-set it for you and assist you in logging into the website. You can reach us at: info@SteelMarketUpdate.com or by phone: 800-432-3475.

{amchart id=”112″ SMU Lead Times by Product}

Mill Negotiations

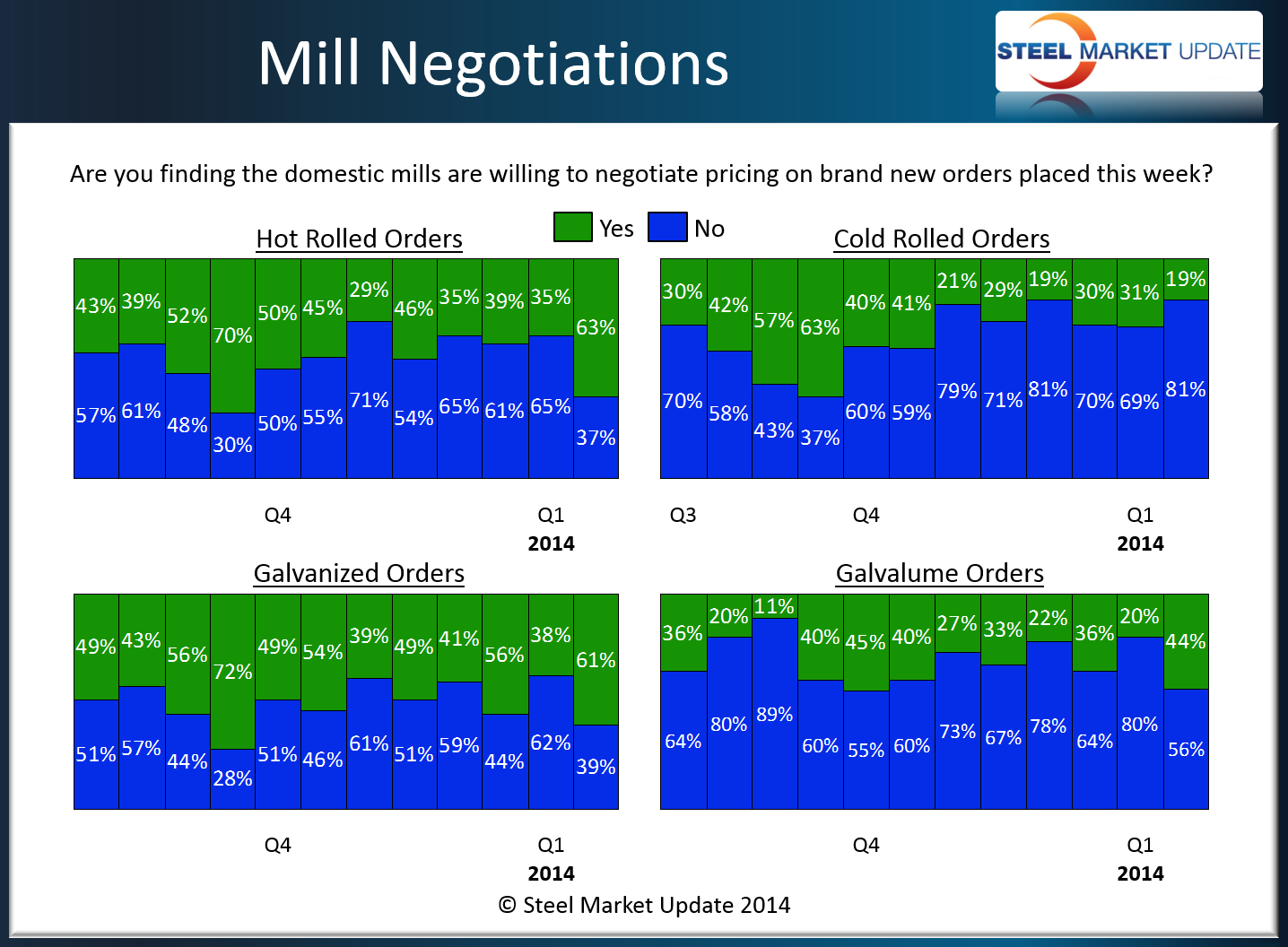

The percentage of those in the flat rolled steel community reporting the domestic mills as more willing to negotiate pricing on hot rolled, galvanized and Galvalume were much higher in this week’s survey than that of any time over the past few months. You would have to go back to late 3rd Quarter to get higher percentages on hot rolled and Galvalume. Cold rolled, however, continues to be an item with minimal variations from the requested pricing.

The percentage reporting hot rolled prices as negotiable rose from 35 percent in early January to 63 percent this week. This is an increase of 28 percent over a two week period.

The percentage reporting cold rolled prices as negotiable declined from 31 percent to 19 percent.

The percentage reporting galvanized prices as negotiable rose from 38 percent to 61 percent (+23 percent).

The percentage reporting Galvalume prices as negotiable rose from 20 percent to 44 percent (+24 percent).