Market Data

January 23, 2014

Global Steel Production in December 2013

Written by Peter Wright

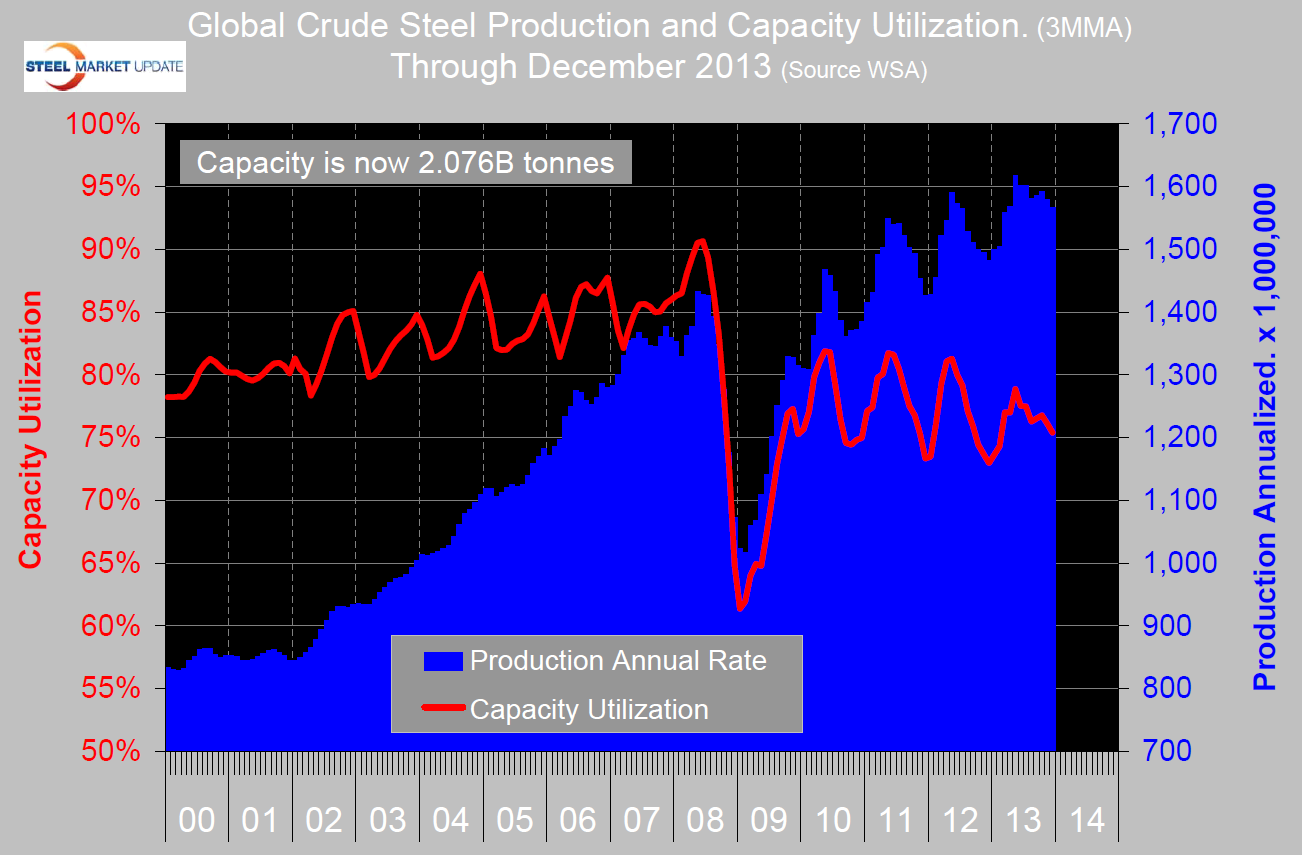

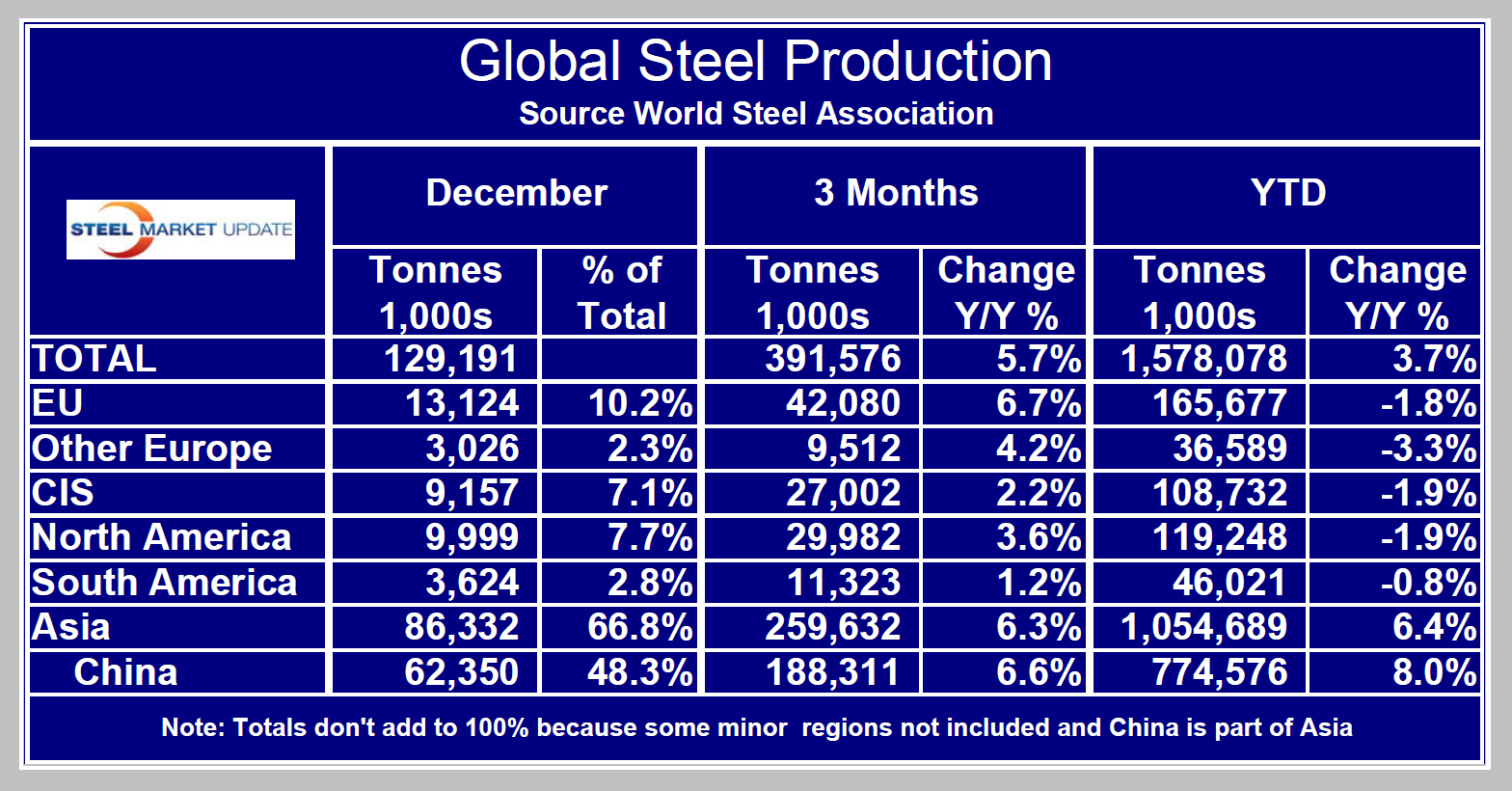

Global steel production in December was 129.2 million tonnes, an increase of 0.8 percent from November and of 6.3 percent from December 2102 according to the World Steel Association. The decline in the 2nd half of 2013 was much less than occurred in the previous three years. Capacity utilization in December was 74.7 percent. The annualized three month moving average of production was 1.566 billion tonnes in December (Figure 1).

Capacity is now 2.076 billion tonnes. In the 4th quarter global production grew by 5.7 percent year over year and in the 12 months of 2013, production was up by 3.7 percent compared to 2012. The fact that the last three months growth rate was stronger than the YTD result means that momentum is positive and production is accelerating. All regions had positive y/y growth in the 4th quarter but all regions except Asia had negative growth in 12 months y/y. In other words, China with its 8.0 percent growth rate in 2013 pulled the whole world into positive territory. Excluding China, the change from negative growth in the year as a whole to positive y/y growth in the 4th quarter is a very encouraging sign that the global steel market is strengthening. North America and China produced 7.7 percent and 48.3 percent of the global total respectively. Much has been written about China’s intent to reduce pollution, to close antiquated plants and to reduce the investment in new steel capacity. Up to November this year there was no sign that this was happening but China’s 4th quarter production was down by 4.5 percent from both the 2nd and 3rd quarters so maybe this is the first sign that political pressure is beginning to bite.

SMU Comment: Recent global steel production results are very encouraging especially in the face of recent commentary about a global economic slowdown. The data from the World Steel Association shows North America to have the strongest momentum of all regions and to have had a 7.7 percent y/y growth rate in the 4th quarter. This result is in accordance with the service center shipment report that was issued by the MSCI last week. (Source World Steel Association)