Market Data

January 19, 2014

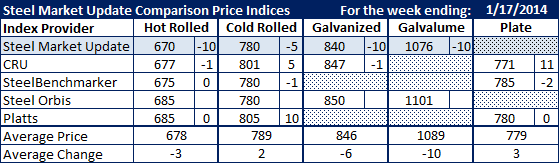

Comparison Price Indices: Cracks Appear

Written by John Packard

Two of the indexes followed by Steel Market Update (three including our own indices) saw prices as beginning to drop for the first time in many weeks. The average hot rolled number dropped $3 per ton to $678. The cold rolled results were mixed with SMU and SteelBenchmarker (which is only published twice per month) taking their average lower while CRU and Platts both moved higher.

Galvanized moved lower by $6 per ton on average compared to the previous week and SMU noted Galvalume prices as falling this past week as well.

Plate price rose an average of $3 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Northern Indiana Domestic Mill.