Market Segment

January 16, 2014

Service Centers Ship 26 Million Tons of Flat Rolled During 2013

Written by John Packard

The Metal Service Center Institute (MSCI) released steel shipment and inventory data for the month of December and for the full year 2013. Total steel inventories rose and ended the month of December at 8,367,700 tons which is an increase of 387,800 tons from the previous month. The daily shipment rate dropped from 153,400 tons per day in November to 140,400 tons per day during the month of December (all products). Total shipments for the month were 2,948,500 tons which was 16.5 percent better than during December 2012.

There were 21 shipping days in December 2013 vs. 20 shipping days in November and 20 days in December 2012.

The months of material on hand increased from 2.6 to 2.8 months on a non-adjusted basis and remained at 2.3 months on a seasonally adjusted basis.

Service centers shipped a total of 41,359,900 tons of all products during calendar year 2013. This was a 0.3 percent improvement over the tonnage shipped by distributors during 2012.

Flat Rolled

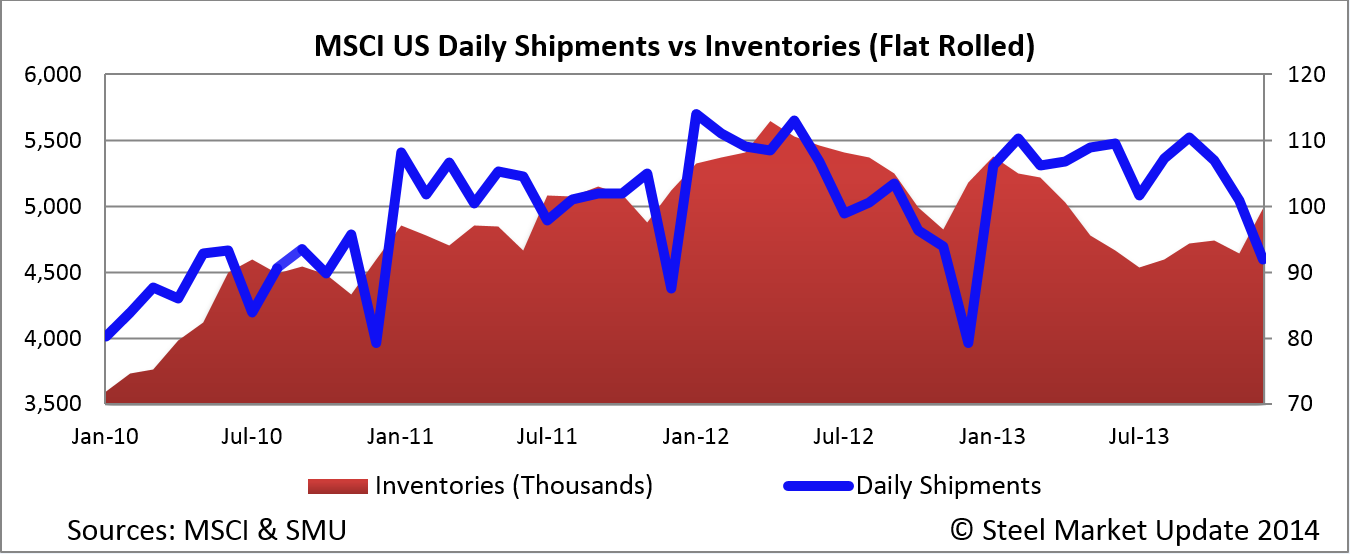

Carbon flat rolled shipments totaled 1,929,300 tons which was 21.7 percent better than December 2012. The daily shipment rate was 91,900 tons per day – down from November’s 100,900 tons per day but well above the 79,300 tons per day shipped in December 2012.

Flat rolled inventories grew to 4,981,400 tons at the end of December which is 3.9 percent lower than one year ago. Based on the end of December inventories distributors held 2.6 months supply on a non-seasonally adjusted basis and 2.1 months when seasonally adjusted.

Total flat rolled shipments for 2013 were 26,918,300 tons or 2.5 percent higher than 2012 annual shipments.

U.S. service centers received 2,266,600 tons of new flat rolled steel inventories during the month. This was higher than both November (1,920,700 tons) and December 2012 (1,940,400 tons).

Carbon Plate

Plate shipments remained relatively stable when compared to November. The December daily shipment rate was 14,500 tons per day while November’s rate was 14,600 tons per day. Compared to December 2012 plate shipments were up 15 percent.

Plate inventories stood at 1,037,100 tons as of the end of December. Inventories were down 0.6 percent compared to December 2012.

Months on hand totaled 3.4 on a non-seasonally adjusted basis (same as November) and when adjusted stood at 3.0 months up slightly from November’s 2.9 months.

Total plate shipments during 2013 totaled 4,109,300 tons which is 4 percent lower than 2012 tonnage.

Pipe & Tube

Carbon pipe and tube shipments totaled 186,500 tons as the daily shipment rate was 8,900 tons per month. This is the lowest daily shipment level since December 2012 when it was also 8,900 tons per day.

Pipe and tube inventories stood at 717,300 tons at the end of December. The number of months on hand was 3.8 months on a non-seasonally adjusted basis, up from 3.4 months at the end of November and 3.3 months on a SAAR up from 3.1 months.

Total pipe and tube shipments for the year were 2,727,600 tons which is down 1.3 percent from the prior year.