Prices

January 14, 2014

November US Scrap Exports Down

Written by Peter Wright

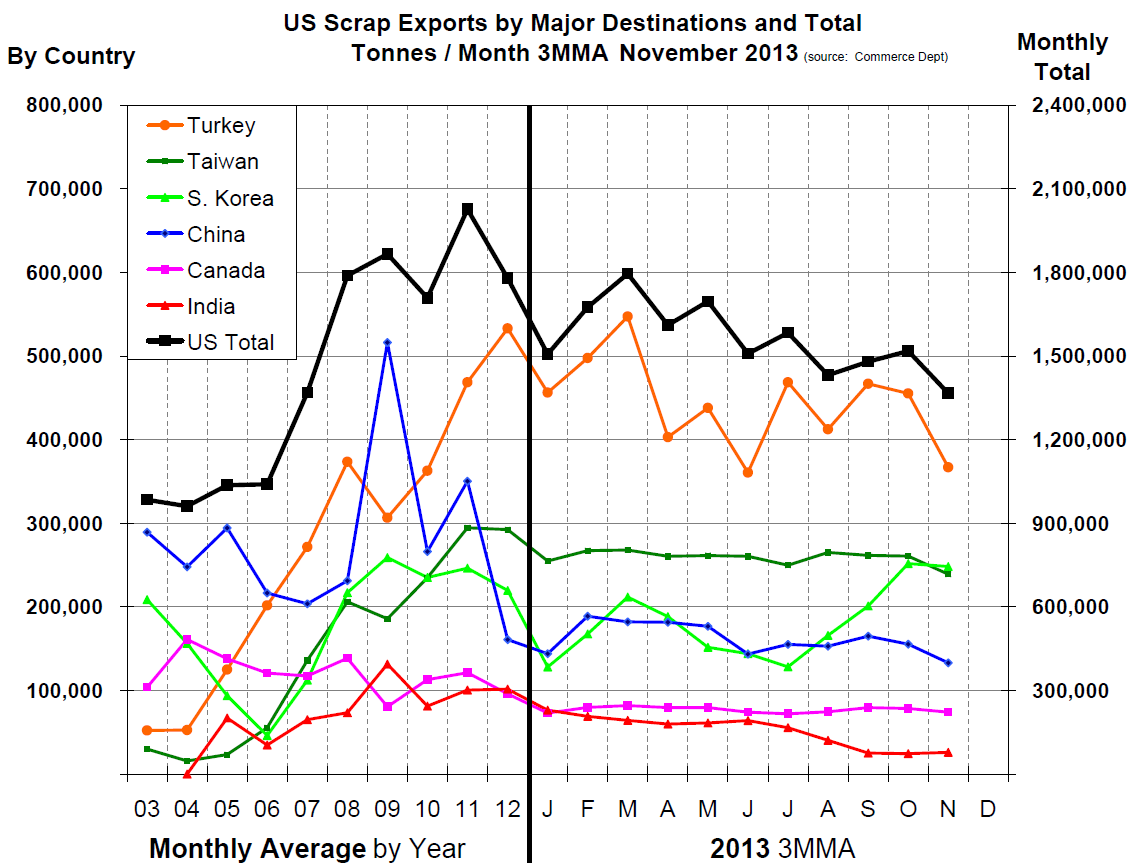

Scrap exports continued their lack luster performance in November declining for the third straight month to 1,236,000 tonnes. Total exports YTD through November 16,904,000 tonnes down from 19,753,000 tonnes in the first 11 months of last year, a decline of 14.4 percent. The largest decline in November was shipments to Turkey, down by 72,000 tonnes from October.

Global trade data shows that Turkey has been importing less scrap from all sources during the last year partly because they are importing more semi finished from Russia. Malaysia, Mexico and Egypt were all down by around 40,000 tonnes in November. Shipments to the Far East in total were up by 14,000 tonnes, mainly driven by exports to China that rose from 136,000 tonnes to 149,000 tonnes. Figure 1 shows the three month moving average of exports in total and by the major countries of destination.

Global trade data shows that Turkey has been importing less scrap from all sources during the last year partly because they are importing more semi finished from Russia. Malaysia, Mexico and Egypt were all down by around 40,000 tonnes in November. Shipments to the Far East in total were up by 14,000 tonnes, mainly driven by exports to China that rose from 136,000 tonnes to 149,000 tonnes. Figure 1 shows the three month moving average of exports in total and by the major countries of destination.