Market Data

January 12, 2014

Steel Buyers Survey: Prices Will Move Sideways by February

Written by John Packard

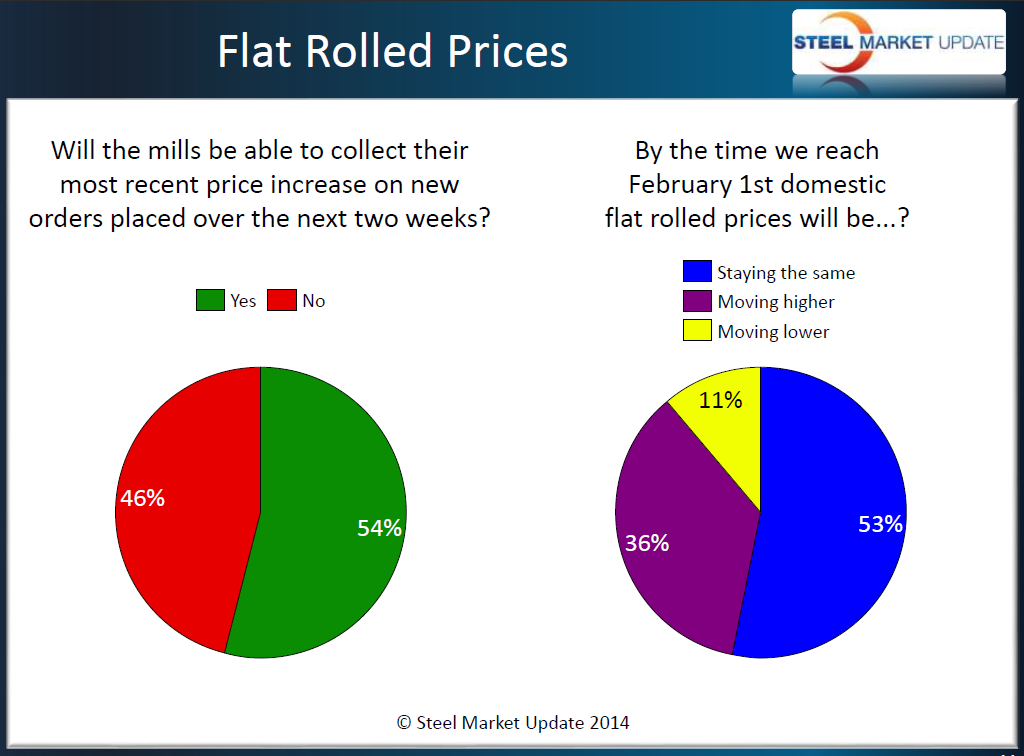

The majority of flat rolled steel buyers and sellers taking our most recent Steel Market Update (SMU) survey are reporting that they expect that domestic steel mills will be able to collect their most recent price increase within the first two full weeks of January.

According to our survey results, 54 percent of those responding to last week’s survey believe the domestic steel mills will be able to collect the most recent $20 per ton ($700 per ton hot rolled and $40.50/cwt minimum base prices on cold rolled and coated plus extras).

Those responding to the survey were not quite as optimistic that prices would move higher by the time we reach the beginning of February. The majority of the respondents (53 percent) believe prices will remain the same while 36 percent are of the opinion there is room for prices to move higher. Only 11 percent believe prices will move lower by the time we reach the beginning of February.