Market Data

January 9, 2014

Mill Lead Times & Negotiations Continue to Reflect Mill Strength

Written by John Packard

Based on the results of our first steel market survey of the New Year, lead times at the domestic steel mills remained at moderately higher than normal.

Benchmark hot rolled lead times remained above 4.0 weeks (average). Based on the average of the responses received during the survey process HRC lead times were measured at 4.25 weeks. Essentially unchanged from the 4.23 weeks reported during the middle of December and well above the 3.42 weeks measured during the first week of January 2013.

Cold rolled lead times expanded from 6.04 weeks in mid-December to 6.25 weeks this week. Last year CRC lead times were measured at 5.25 weeks during the first week of January.

One product where we have seen a regression in lead times was galvanized, which shrunk from 6.51 weeks to 6.25 weeks. Even so, the current lead times are almost one full week extended compared to the 5.33 weeks reported at the beginning of January 2013.

Galvalume lead times continue to be the most extended at 6.75 weeks. Galvalume is essentially unchanged from the 6.83 weeks captured in mid-December and well above the 6.17 weeks lead time reported during January 2013.

{amchart id=”112″ SMU Lead Times by Product}

Below is an interactive graph of the lead times. What is interesting about this graphic is the ability to look at data from an historical perspective. The interactive graph also includes the individual data points which can be seen by hovering your cursor over the lines in the graph or by clicking on the “table” tab which will provide the data in a table format. If you are seeing a blank space it is because you need to be logged into the website in order to see and interact with the graphics/table. If you need assistance with your login or would like help navigating the website please contact us and we will work with you on a one-on-one basis: info@SteelMarketUpdate.com

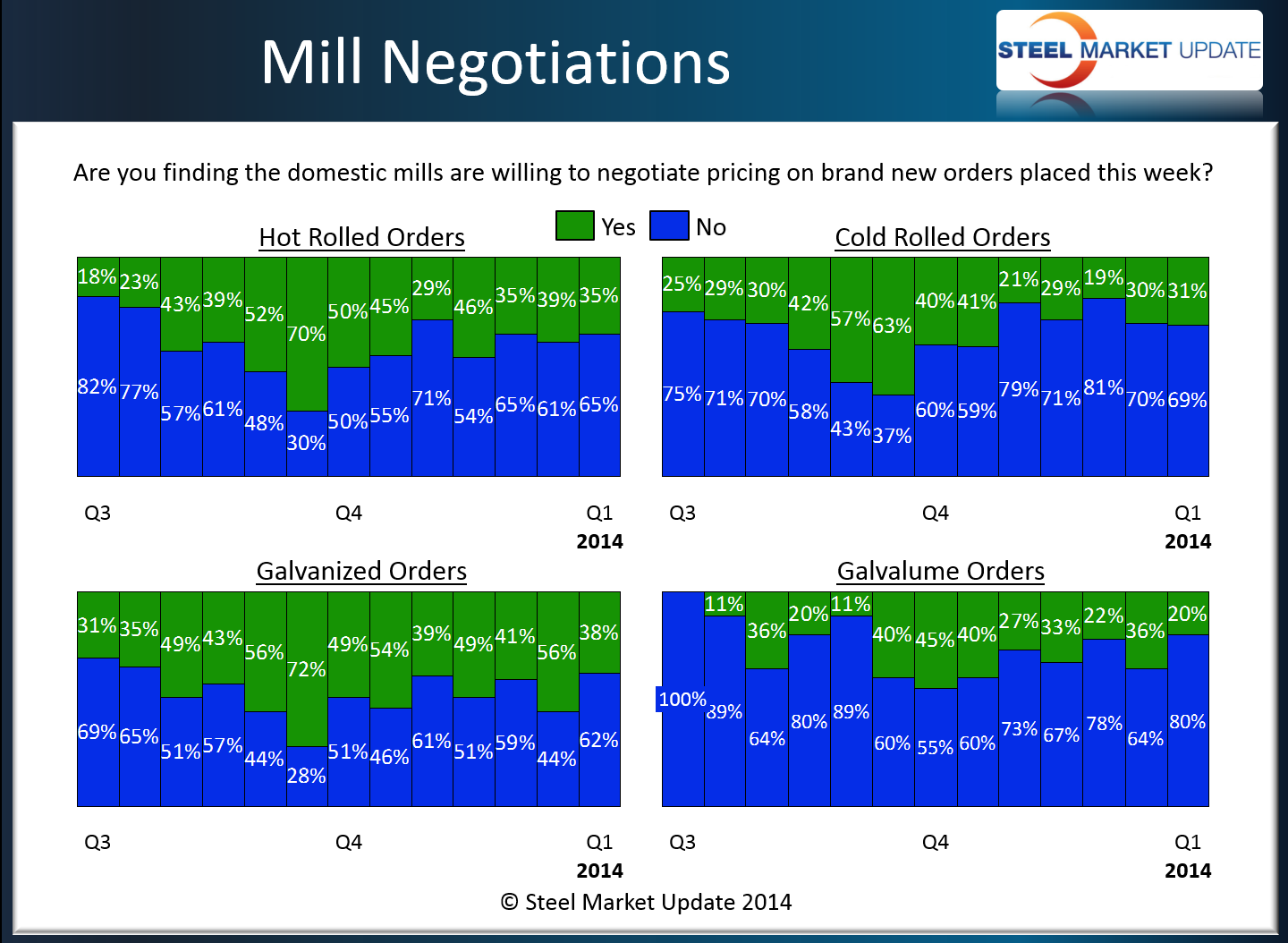

Mill Negotiations

With the continuation of modestly extended lead times, we are seeing negotiations between buyers and the domestic mills as being fairly restricted. In our questionnaire we asked buyers if they were finding the domestic mills as willing to negotiate pricing on new orders (by product). Each product’s pricing was reported to be firm with fewer buyers reporting the mills as willing to negotiate.

Hot rolled fell from 39 percent during the middle of December to 35 percent. The percentage of respondents reporting cold rolled as a product that mills were willing to negotiate remained fairly stable at 31 percent. Galvanized continues to have the highest percentage, 38 percent, but is well below the 56 percent reported in mid-December. The least negotiable item was the one with the longest lead time: Galvalume, which only had 20 percent of our respondents reporting the mills as willing to negotiate.