Market Data

January 7, 2014

Steel Market Update 2013 Proprietary Data Review

Written by John Packard

Steel Market Update (SMU) would like to share some of the data we collected during the past 12 months. Below is a review of flat rolled steel pricing for 2013, scrap pricing during the year, SMU Steel Buyers Sentiment Index and more…

Benchmark Hot Rolled Pricing in Review

Benchmark hot rolled ended 2012 at $635 per ton ($31.75/cwt base) and prices eroded from there flattening out around $600 per ton ($30.00/cwt) at the end of February and into March before continuing their downward slide reaching bottom at the end of May at $565 per ton ($28.25/cwt). By the end of August, prices had rebounded to $650 per ton ($32.50/cwt) where they flattened out for most of September and into October. By late October, prices reached $660 per ton ($33.00/cwt) and have remained relatively firm – but range bound at $660-$670 per ton through the end of the year. The year ended up $35 per ton ($1.75/cwt) at $670 per ton ($33.50/cwt).

We had a $105 per ton swing from the lowest point at the end of May ($565) to the highest point which was $675 recorded on December 10th.

We are providing our members a look at the past two years utilizing one of our interactive graphics which can only be seen when viewing the newsletter (or this article) on the website. The graph will allow you to expand our shrink the amount of historical pricing data you want to review (interactive). You can also add other products to the graph (CR, GI, AZ) when on the website.

{amchart id=”110″ Weekly Pricing Article Graph- Use for NEWSLETTER}

Busheling Scrap Pricing in Review

Prime grades of scrap such as #1 Busheling also saw an upward trend for the year and traded with a similar spread as what we saw in hot rolled coil. Busheling began the year at $385 per gross ton average (per SMU indices) and then dropped by $5 per ton to $380 before moving up to $440 per gross ton by the end of the calendar year.

We do not yet have enough new data for January to be able to determine a new average but, we are being told to expect Busheling to be up approximately $20 per ton to $460 per gross ton in the Midwest. We have heard reports from sideways to up $20 for January as of this past weekend.

You can use the same graph we shared with you above in the hot rolled article to look at #1 Busheling as well as shredded and #1 Heavy Melt Scrap (HMS).

SMU Steel Buyers Sentiment in Review

Steel Market Update (SMU) Steel Buyers Sentiment Index began the year at +21, which is within the lower quadrant of the optimistic range of our index. Sentiment remained modestly optimistic until the middle of June when it broke out to +35. Since then, Sentiment has continued to be moderately optimistic floating between +33 to +42, which was the high for the year achieved in the middle of August.

If you would like to see an extended historical graph and our table of historical data you can do so by clicking on the Sentiment graphic on the right hand side of the Home Page once you are logged into the website (the graphic is not displayed until you are logged in). This will take you to the Sentiment historical data and interactive graph.

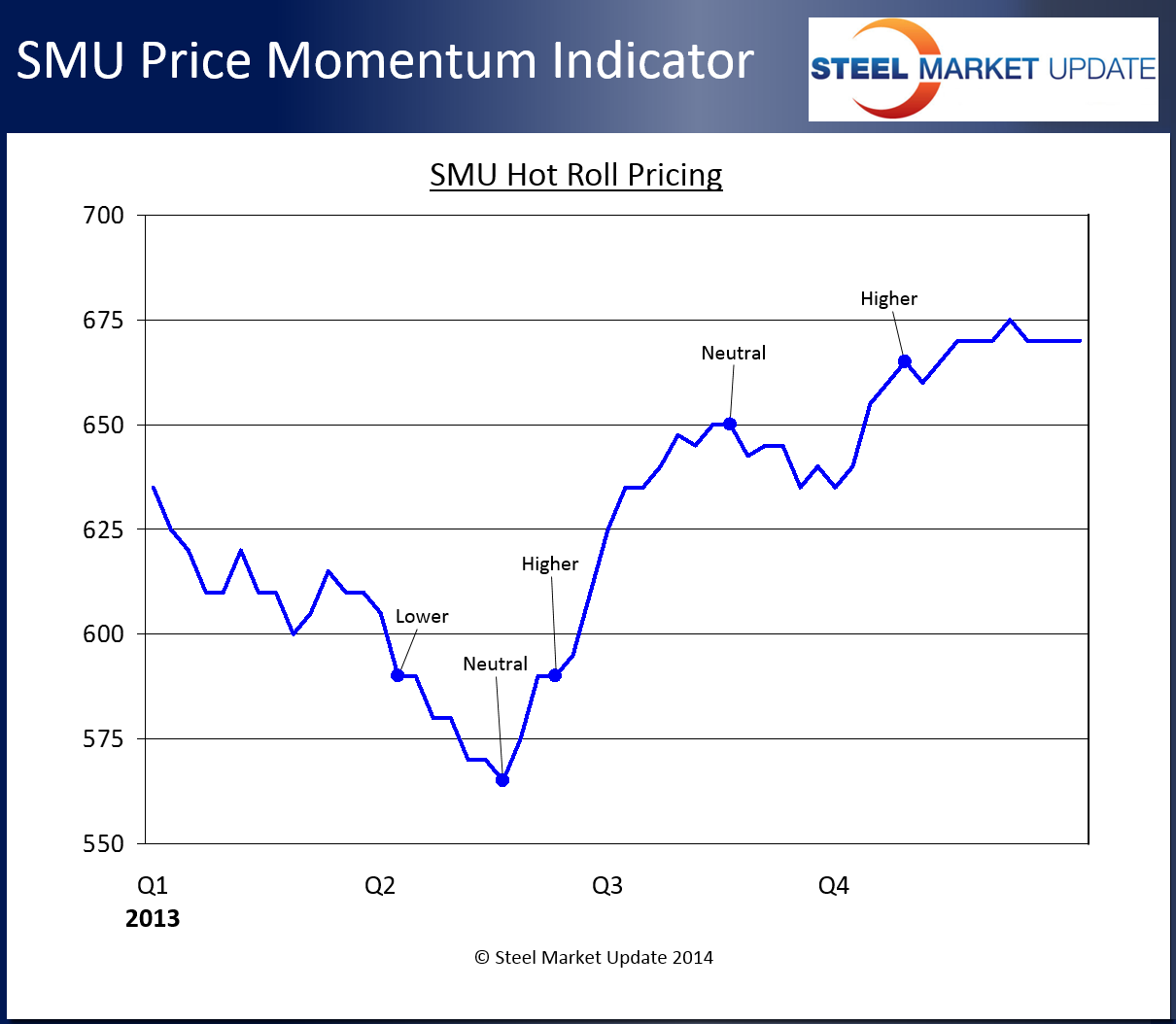

SMU Price Momentum Indicator in Review

The following displays the movements Steel Market Update had in our Price Momentum Indicator during calendar year 2013. As you can see, there were not a lot of changes throughout the year. One had one strong move lower (at a time of year when we normally don’t see lower pricing – 1st Quarter) and then it was pretty much uphill from there with one sideways move in late 3rd Quarter.

Steel Mill Price Announcements in Review

To make our review of the price increase announcements out of the domestic mills a little easier to follow, we are going to use AK Steel and their announcements (which are public record on their website). As we left 2012 AK Steel had announced a $30 per ton price increase on December 7, 2012.

On January 21, 2013 AK announced $40 per ton increase on flat rolled steel.

February 27, 2013 AK announced $50 per ton increase on flat rolled steel.

On May 23, 2013 AK announced an additional $50 per ton on flat rolled.

June 16, 2013 AK added an additional $40 per ton flat rolled price increase.

July 25, 2013 AK announced specific base prices at $675 on hot rolled, $775 on cold rolled and $785 on coated. SMU calculated at the time the increase was for approximately $25 per ton.

October 1, 2013 AK again announced base prices of $680 per ton on hot rolled, $790 on cold rolled and $810 per ton on coated. Based on previous increase announcements the new levels were +$5 on hot rolled, +$15 on cold rolled and +$25 on galvanized. SMU averages on October 1st were $635 per ton on Hot Rolled, $745 on cold rolled and $750 on coated. If you go from our averages the increase announcements were $45 on hot rolled and cold rolled while galvanized was $40 per ton.

November 7, 2013 AK went back to flat dollar per ton announcement at $30 per ton on all flat rolled products. At the time, this put AK at $700-$710 per ton on hot rolled and $810 per ton on cold rolled and coated.

For the 2013 calendar year, AK Steel announced a total of $280 per ton of price increases on hot rolled coil. As mentioned in our previous analysis on hot rolled, actual prices based on Steel Market Update averages moved within a $105 range during the calendar year.

For those of you who are not familiar with mill price increase announcements, they are based on spot pricing at the time of the increase (for that particular mill with each individual customer) and are not added together as a cumulative total due to the ups and downs associated with the spot market pricing during the year.

Not every mill followed the AK Steel pricing as mentioned above. However, most mills were moving in line during similar time periods as AK Steel. The one exception which comes to mind immediately is their November increase announcement only had one public supporter (Severstal) while the other mills waited until late December to match the AK announcement.