Market Data

January 7, 2014

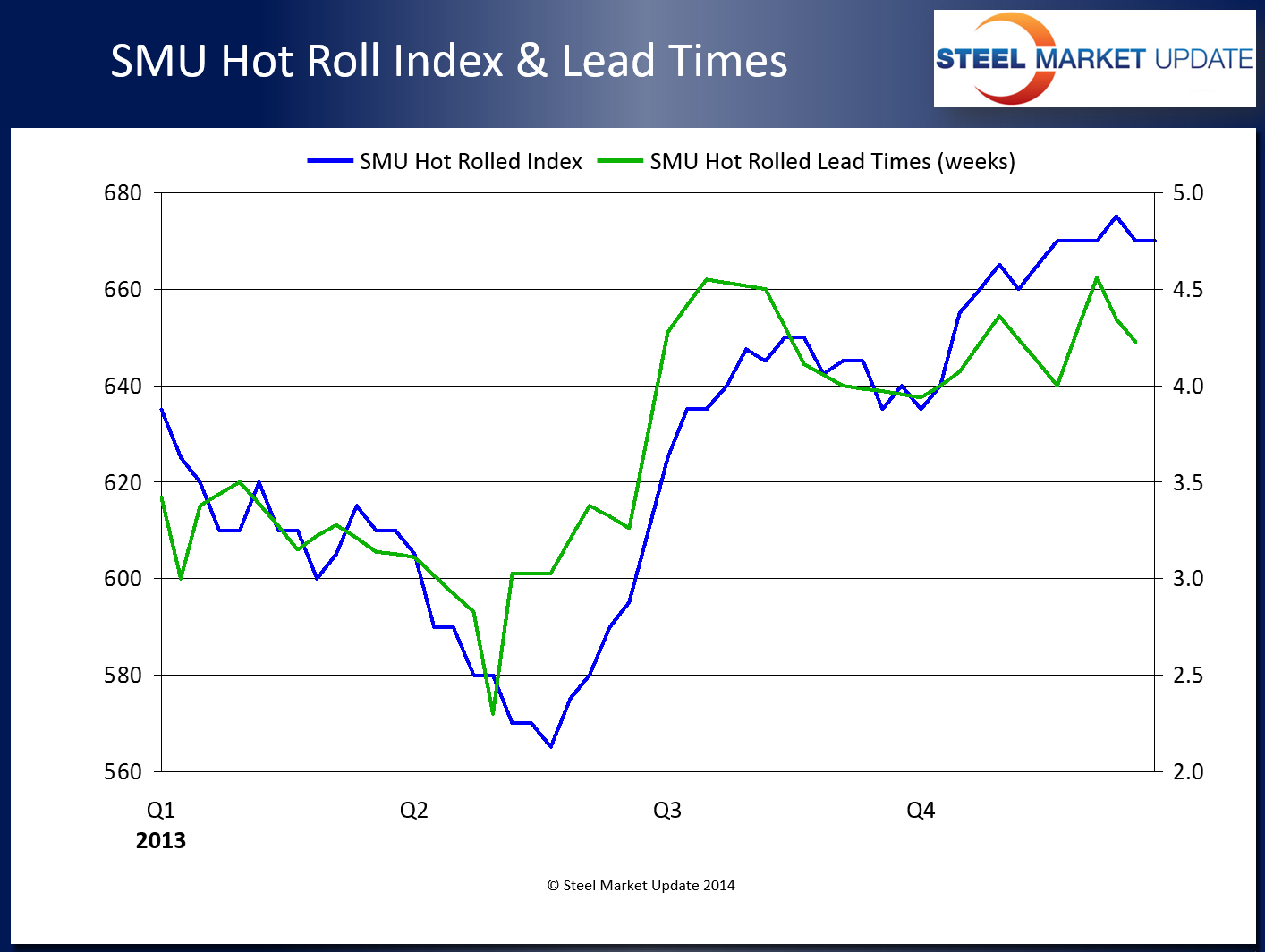

Lead Times and Flat Rolled Steel Pricing (2013)

Written by John Packard

One of our readers asked us last week if we had ever done an analysis of steel prices and lead times. The answer (now) is yes, we have…

So the question we posed to ourselves – is there are relationship between mill lead times (as captured in our SMU steel market survey) and flat rolled steel prices. We used our benchmark hot rolled average pricing for calendar year 2013 (blue line) and lead times in weeks (green line) as reported in our twice monthly steel survey.

When looking at the data you need to remember that lead times are for orders being entered for future production (we do not segregate spot from contract) and hot rolled pricing is based on spot orders being placed for future production. We will let you decide if there is a correlation….