Prices

January 6, 2014

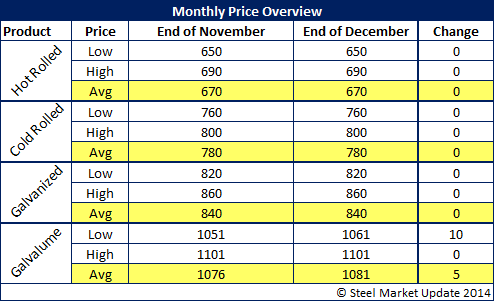

Flat Rolled Pricing Cycle Flattened Out During December

Written by John Packard

In spite of new price increase announcements being made by the domestic mills just prior to Christmas, the flat rolled pricing cycle flattened out during the month of December with essentially no movement on all four of our product groups: hot rolled, cold rolled, galvanized and Galvalume steels.

Hot rolled and cold rolled prices went essentially nowhere from the of the month of November until the end of December. Galvanized average pricing rose by $15 per ton from the beginning of the month until the end of December. Galvalume prices moved higher by $10 per ton.