Prices

January 5, 2014

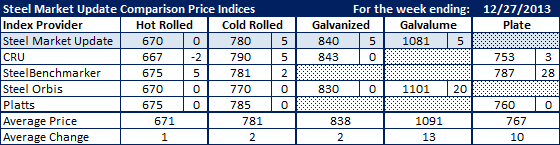

SMU Comparison Price Indices: One Moves Higher, Others Wait

Written by John Packard

Platts took all of their flat rolled sheet indices higher this past week and they now reference benchmark hot rolled at $685 per ton – $15 per ton higher than Steel Market Update and $17 per ton higher than CRU. With the New Year Holiday sandwiched in the middle of this past week SMU did not capture enough transactions to justify raising steel prices – even though the domestic mills have announced increases just prior to Christmas which call for $700 per ton hot rolled and $810 per ton cold rolled and coated base pricing.

Steel Orbis did not provide new numbers this past week and SteelBenchmarker was not scheduled to release new numbers.

Steel Market Update will conduct our next flat rolled steel market survey beginning on Monday of this week. If you receive an invitation please take a moment to click on the link and respond to our questionnaire.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Within 200-300 mile radius of Northern Indiana Domestic Mill.