Analysis

December 23, 2013

Housing Starts and Permits in November

Written by Peter Wright

Finally the first data on housing starts since August! Total starts in November shot up to 1,091,000, (annualized), the highest since February 2008. Both single and multi family starts were the strongest since H1 2008.

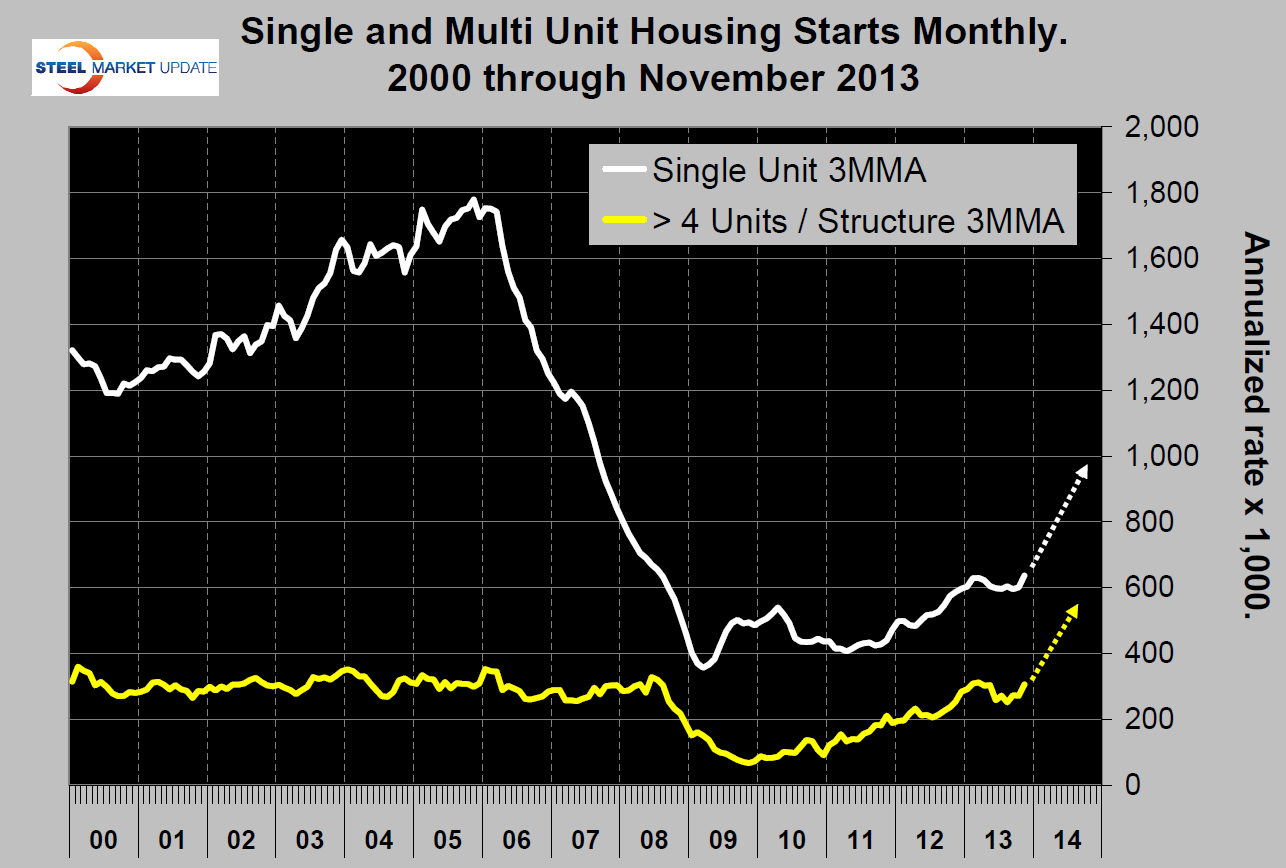

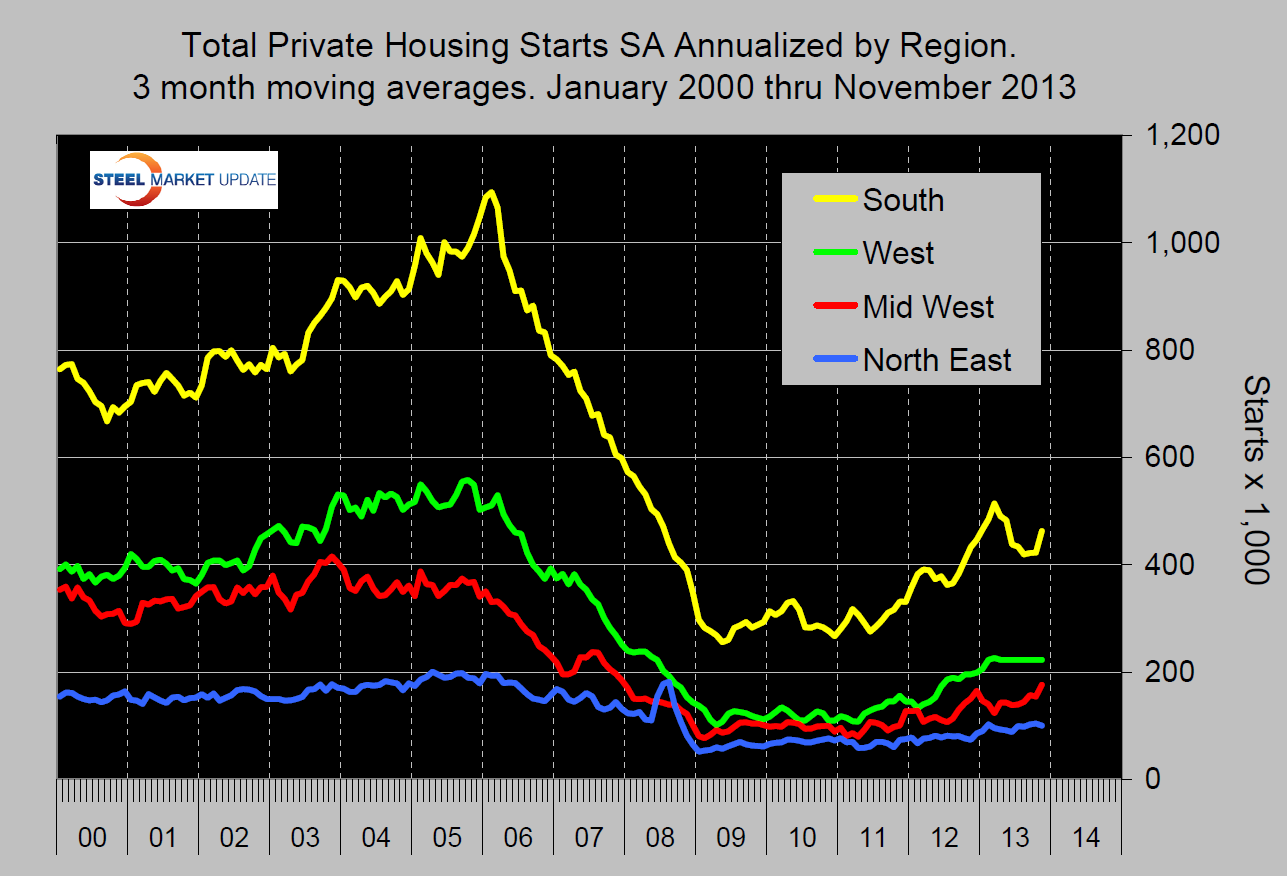

The three month moving average of starts was also very encouraging. At the present rate of increase, single family could reach the one million rate by the end of next year (Figure 1). Multi family have already fully recovered from the recession so the recent result was surprising for this sector. It may be that we are witnessing a long term shift in the mix of housing away from single towards apartments. Prior to the recession the ratio of single to multifamily units was six to one. Today the ratio is only two to one. The recent surge in starts was driven primarily by the South region and to a lesser extent by the Mid West. The North East and the West have been more or less flat for the last ten months (Figure 2).

The three month moving average of starts was also very encouraging. At the present rate of increase, single family could reach the one million rate by the end of next year (Figure 1). Multi family have already fully recovered from the recession so the recent result was surprising for this sector. It may be that we are witnessing a long term shift in the mix of housing away from single towards apartments. Prior to the recession the ratio of single to multifamily units was six to one. Today the ratio is only two to one. The recent surge in starts was driven primarily by the South region and to a lesser extent by the Mid West. The North East and the West have been more or less flat for the last ten months (Figure 2).

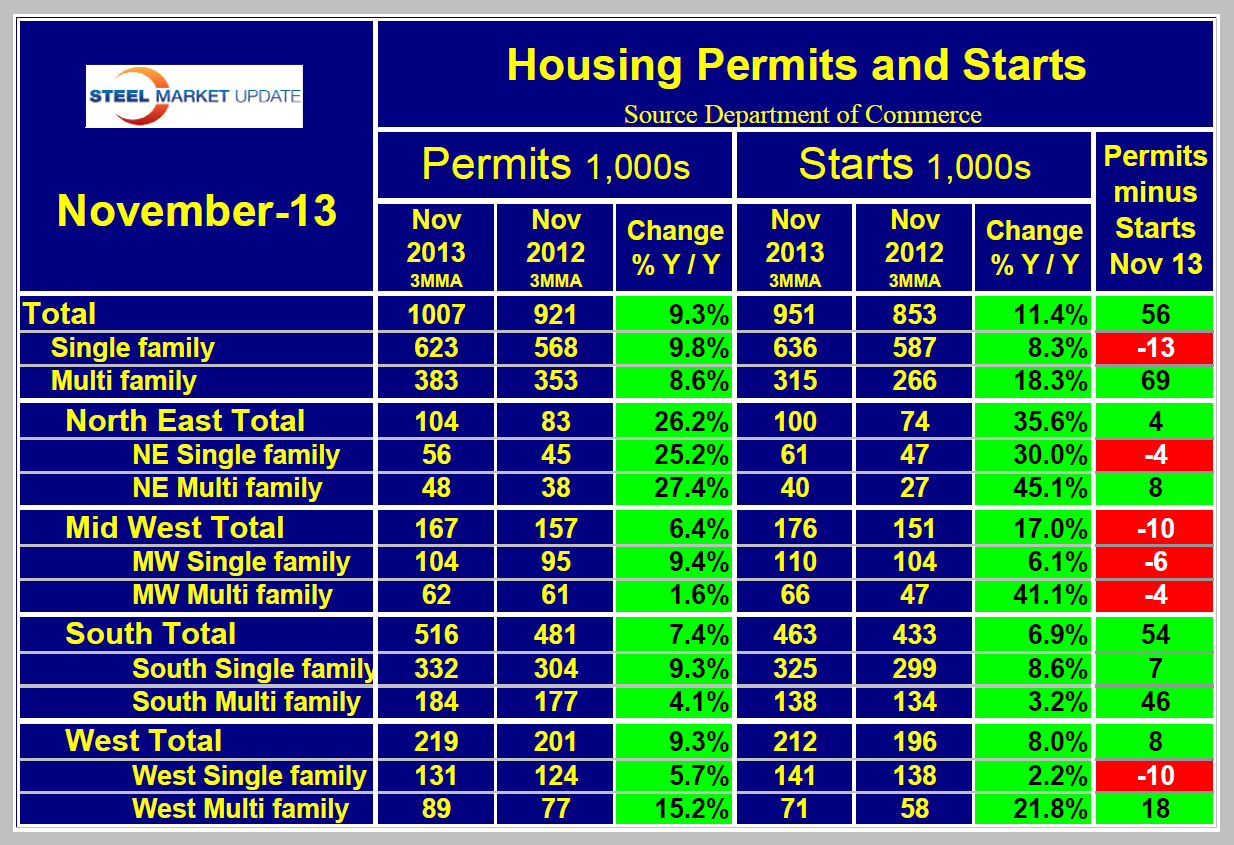

Total permits have exceeded total starts in each of the last six months which bodes well for future construction. However that result is driven heavily by apartments for which permits exceeded starts by 69,000 in November on a three month moving average basis. Single family permits were 13,000 less than starts. Another indication that we may be at the beginning of a long term change in the mix of housing (Table 1). In all regions except the South, single family permits lagged starts. In all regions bar none, apartment permits exceeded starts.

Total permits have exceeded total starts in each of the last six months which bodes well for future construction. However that result is driven heavily by apartments for which permits exceeded starts by 69,000 in November on a three month moving average basis. Single family permits were 13,000 less than starts. Another indication that we may be at the beginning of a long term change in the mix of housing (Table 1). In all regions except the South, single family permits lagged starts. In all regions bar none, apartment permits exceeded starts.

The NAHB composite index of homebuilder’s sentiment surged higher by 4 points in November to 58; it’s highest since November 2005. All three sub-components advanced, with the present sales index increasing the most. Regionally, homebuilder confidence improved in three of the four regions, with the Northeast being the exception. This release indicates that builders believe the modest slowdown in sales and construction in the second half of 2013 to be temporary.