Market Data

December 22, 2013

Service Center Spot Prices Peaking?

Written by John Packard

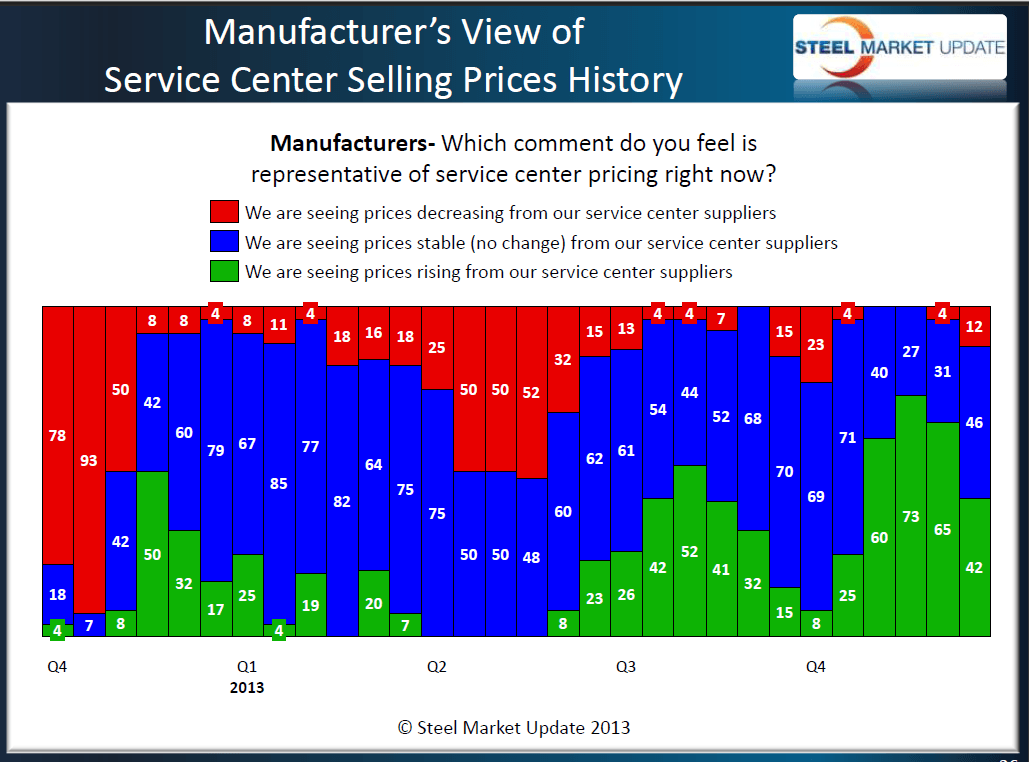

Manufacturing companies are beginning to report a fracture within the service center ranks. In our latest steel market analysis conducted last week, 12 percent of the manufacturers reported decreasing spot flat rolled prices from their service center suppliers. This is up from 4 percent measured at the beginning of December which was up from zero percent in early November.

The percentage of service centers reported to be raising prices shrunk from 65 percent at the beginning of the month to 42 percent now.

In the graphic below, we see the history of service center spot sales as reported by the manufacturing companies. We will have to carefully watch spot pricing results as we move into January to see if indeed the bloom is off the rose.

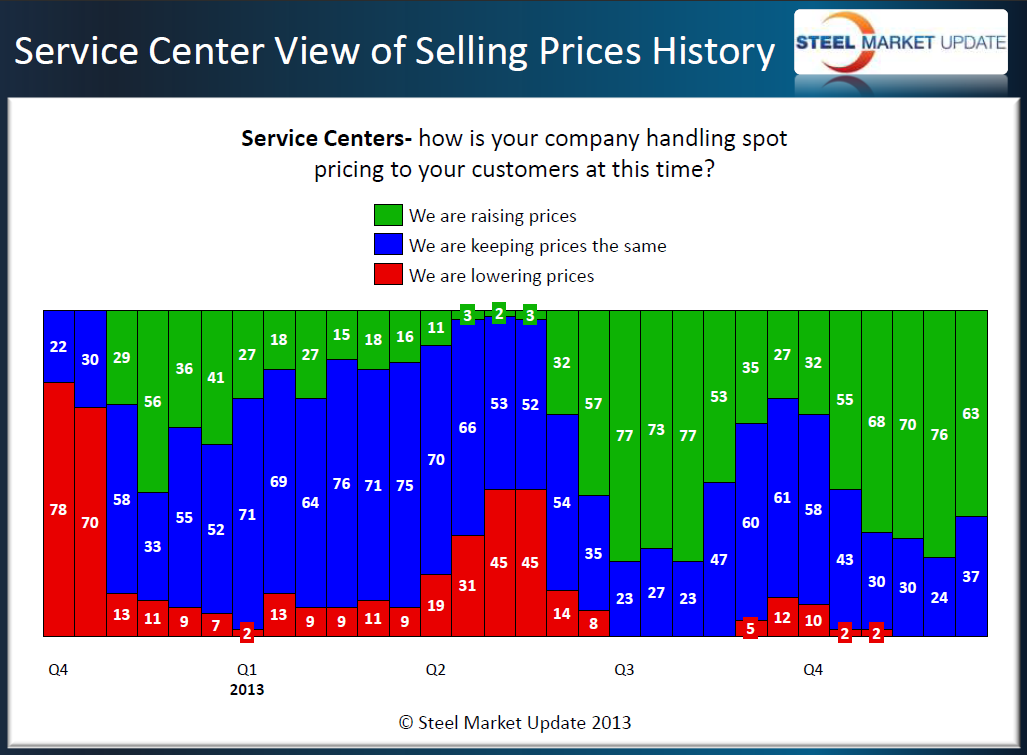

From the service center perspective, spot prices are continuing to rise as 63 percent of the distributors reported their company as raising prices. This is down 13 percentage points from early December results when 76 percent of the service centers were reporting prices as going higher. None of the service centers reported their company as lowering prices.

The continued push toward firmer spot prices represented by 63 percent of the service centers is a net positive for the domestic steel mills as they attempt to keep prices stable and moving higher over the next 30 days. For this reason, amongst others, Steel Market Update Price Momentum Indicator continues to point toward stable to higher pricing over the near term (30 to 60 days).