Market Data

December 22, 2013

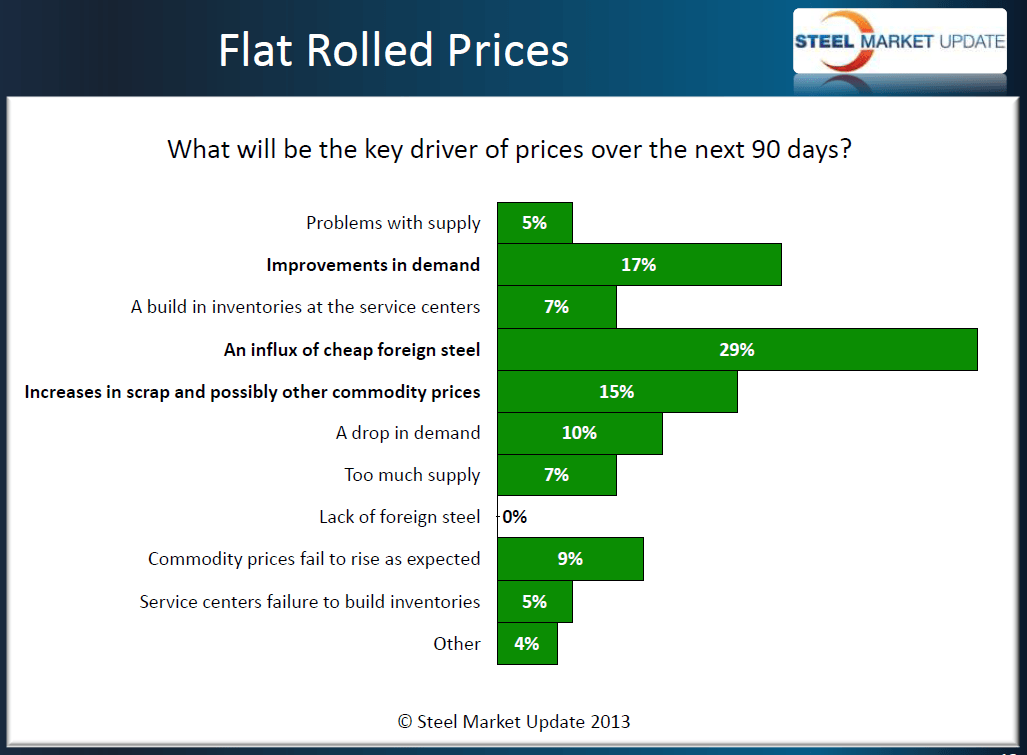

Key Price Driver Over Next 90 Days: Foreign Steel

Written by John Packard

Last week Steel Market Update invited approximately 600 companies to participate in our mid-December 2013 flat rolled steel market survey. Of the companies responding this past week, 49 percent were manufacturing companies, 39 percent were service centers/wholesalers, 4 percent trading companies, 3 percent steel mills, 3 percent toll processors and 2 percent suppliers to the industry. The survey invitation list is intentionally heavily weighted toward manufacturing companies and distributors.

The survey began prior to the U.S. Steel price announcement which was made on Monday, December 16th in the amount of $20 per ton.

We asked those taking our survey if they were surprised by the lack of price announcements so far (prior to December 16th) during the month of December. Our respondents were not surprised (59 percent) although the point became moot shortly after USS made their announcement.

Steel Market Update asked all of our respondents what direction they felt prices would move over the next 30 to 60 days; 45 percent of our respondents reported prices would move sideways, 43 percent believe prices would move higher and only 12 percent feel prices would move lower from here.

We then asked those answering our questionnaire what will be the key driver (1) of prices over the next 90 days. We limited each respondent to one answer. The largest response was reserved for “an influx of cheap foreign steel” which 29 percent of respondents chose. As you can see by the graph provided below, 17 percent believe “improvements in demand” will be a major driver, followed closely by “increases in scrap and possibly other commodity prices.”

It is interesting to note that very few people selected “problems with supply” or “service centers failure to build inventories,” both of which received 5 percent of the responses.

Steel Market Update received a number of comments to this question from our respondents:

“Service centers were caught off guard by the price increases and their inventory levels were too low. Now they are forced to pay the higher pricing from the mill.”

“Influx of foreign steel, don’t know if I would say “cheap”.

“low inventories in all sectors”

“If anyone answered lack of foreign steel that individual is on drugs.” SMU Note: Lack of foreign steel received zero percent of the vote.

“There will be multiple factors that will be key. Most of all the above will play a role. The boats are coming….”

“How about any and all of the above? We all know how fickle this market is and how mere speculation can affect pricing.”

“Inconsistent demand, different lead time at the mills.”

“I think it is a combination of low inventories at service centers, higher scrap prices, lack of foreign steel at this time and demand has improved in the country.”