Market Data

December 19, 2013

Mill Lead Times & Mill Negotiations: Still Tight (signs of loosening?)

Written by John Packard

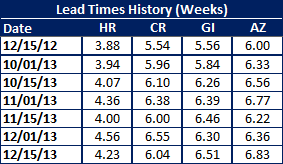

Lead times continue to be longer than normal with hot rolled averaging more than 4 weeks (4.23 weeks), cold rolled exceeding 6 weeks (6.04 weeks), galvanized at 6.51 weeks and Galvalume averaging 6.83 weeks. All of the flat rolled steel lead times measured this week are extended compared to last year during the middle of December. Our survey respondents are reporting galvanized as having the biggest change compared to last year having added a full week to its average.

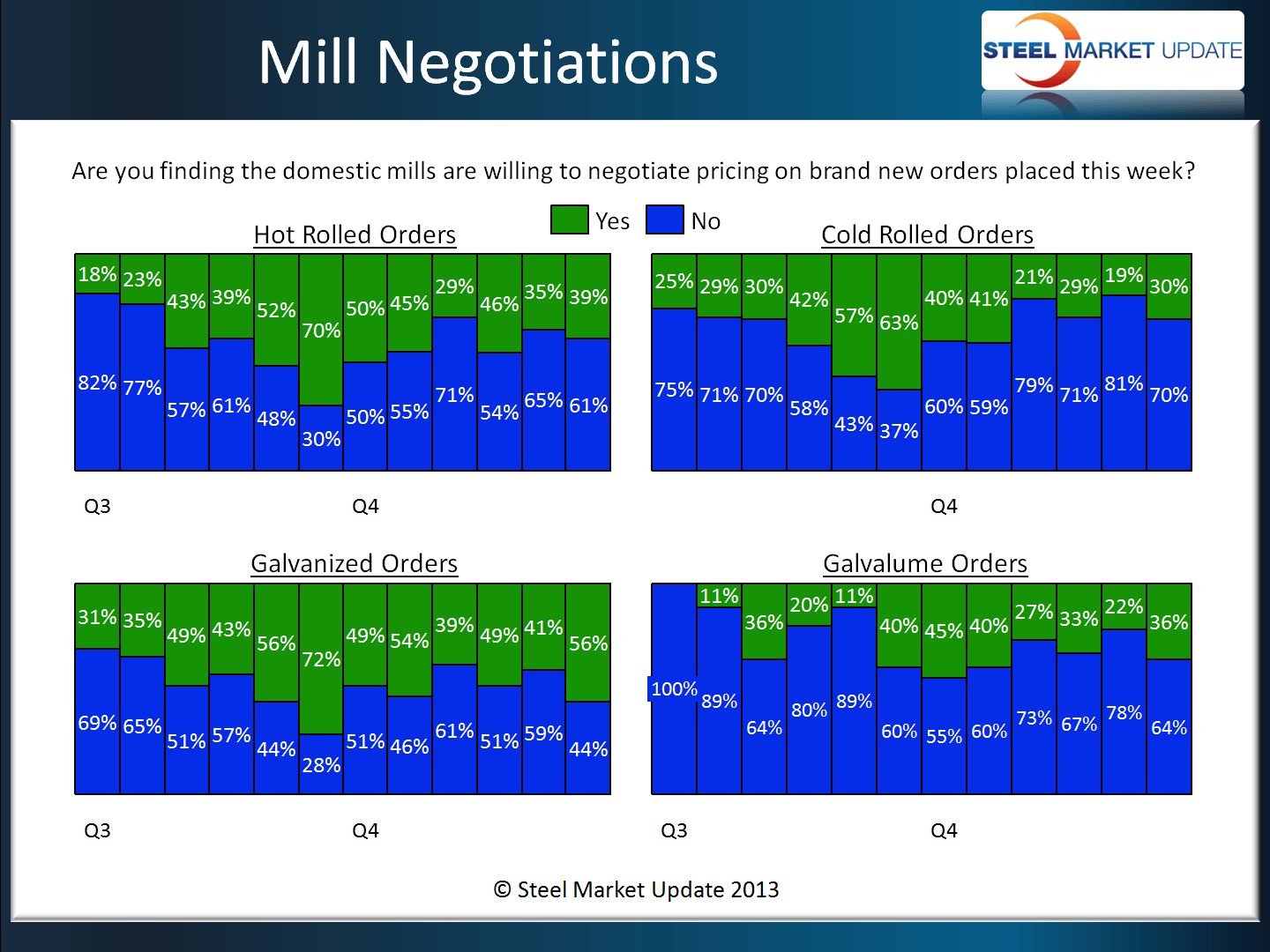

As we approach the end of the year we are capturing some movement in hot rolled as our survey respondents reported the domestic mills as being more willing to negotiate HRC than they were just two weeks ago (56 percent vs. 41 percent). All of the other items had increases in negotiations but the continued to be relatively modest adjustments.