Market Segment

December 17, 2013

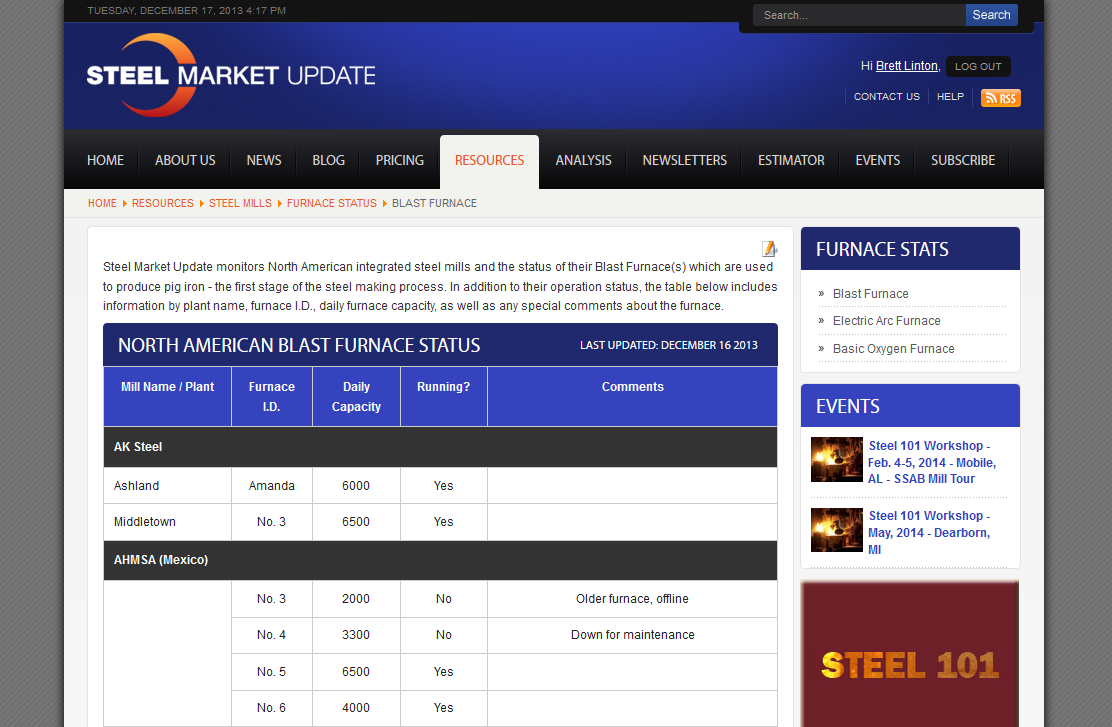

North American Blast Furnace Status

Written by John Packard

We want to take a moment to remind our Executive Members (as well as our trial members) that we have a section under the Resources tab for steel mills. Once there you can navigate to the Furnace Status sub-menu tab and then over to the Blast Furnace tab where you can access the most up-to-date status as to what blast furnaces are running in North America. We attempt to update this information on a weekly basis or when we find furnaces which may have been pulled offline suddenly (such as the USS Great Lakes furnaces on Sunday).

Once you are on the page (which looks like the image below) you can hover over each mill and line item. The information will become highlighted in yellow in order to keep your focus on each specific furnace. The mills are listed in alphabetical order (only two mills shown below).

If you have information regarding the status of any North American blast furnace please let us know as we are constantly probing the marketplace as we attempt to stay on top of this kind of information.