Distributors/Service Centers

December 8, 2013

Service Centers Pushing Spot Prices Higher

Written by John Packard

The U.S. service centers are believers and, according to their customers as well as the distributors themselves, they are raising spot prices on flat rolled steel. It has been Steel Market Update’s opinion for quite some time that for domestic mill price increases to continue to rise the service centers need to support the increases and push spot prices higher.

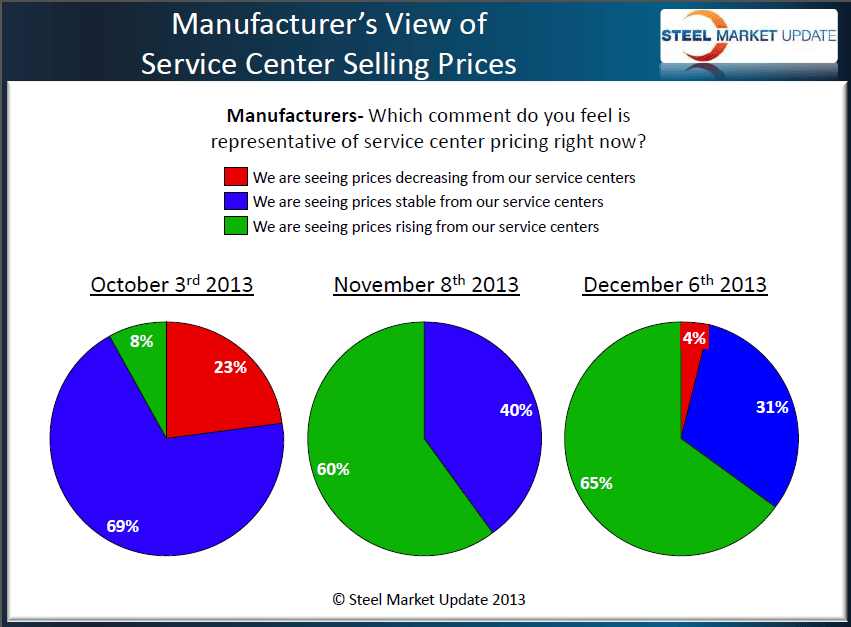

Of the manufacturing companies responding to our most recent steel market analysis 65 percent reported service centers as raising spot flat rolled steel prices. Another 31 percent of the respondents reported prices as stable while a small fraction (4 percent) reported they were seeing lower prices out of the distributors.

Those reporting prices as rising increased by 5 percent compared to the beginning of November and by 57 percent when going back to the beginning of October.

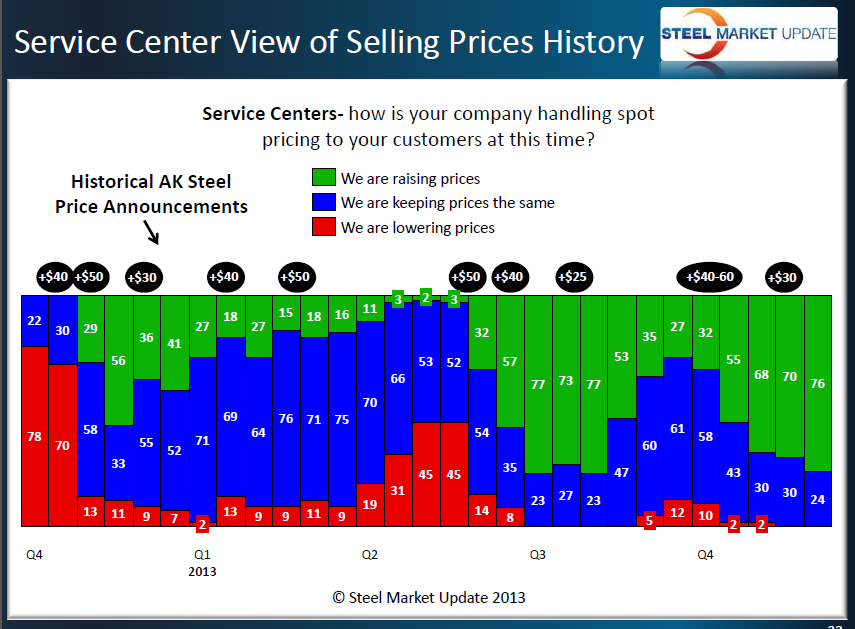

Seventy six service centers responded that their company was increasing spot prices to their customers. This is up 6 percentage points from the middle of November and 8 points higher than early November. During the first week of October only 32 percent of distributors were raising spot prices at that point in time.

Below is a graphic we have shared with our readers on a number of occasions. Above the bar chart are the price increase announcements made by AK Steel. It has been our theory based on the data we have collected over time, that when the service centers capitulate (over 70 percent are lowering prices), as they were during the 4th Quarter 2012, it opens an opportunity for the domestic mills to raise prices. For prices to continue to rise the service centers need to support the increases (in other words they recognize their inventory costs are rising) and they push their spot prices higher. We continue to see continued strength for rising flat rolled steel prices and prices will most likely remain firm to moving higher until the distributors begin to grow inventories.