Market Segment

December 5, 2013

ThyssenKrupp Prompts Comments During SMU Market Analysis

Written by John Packard

Steel Market Update (SMU) conducted the first of our two monthly surveys for the month of December. We invited approximately 600 companies to participate in this week’s market analysis. Of the companies responding 47 percent were manufacturers, 42 per cent were service centers/wholesalers and the balance consisted of steel mills, trading companies, toll processors and suppliers to the industry (such as paint or chemical companies).

With the sale of ThyssenKrupp Steel USA being announced late last week and over the weekend, we wanted to gather the opinions of those taking our survey as to the potential impact of the sale.

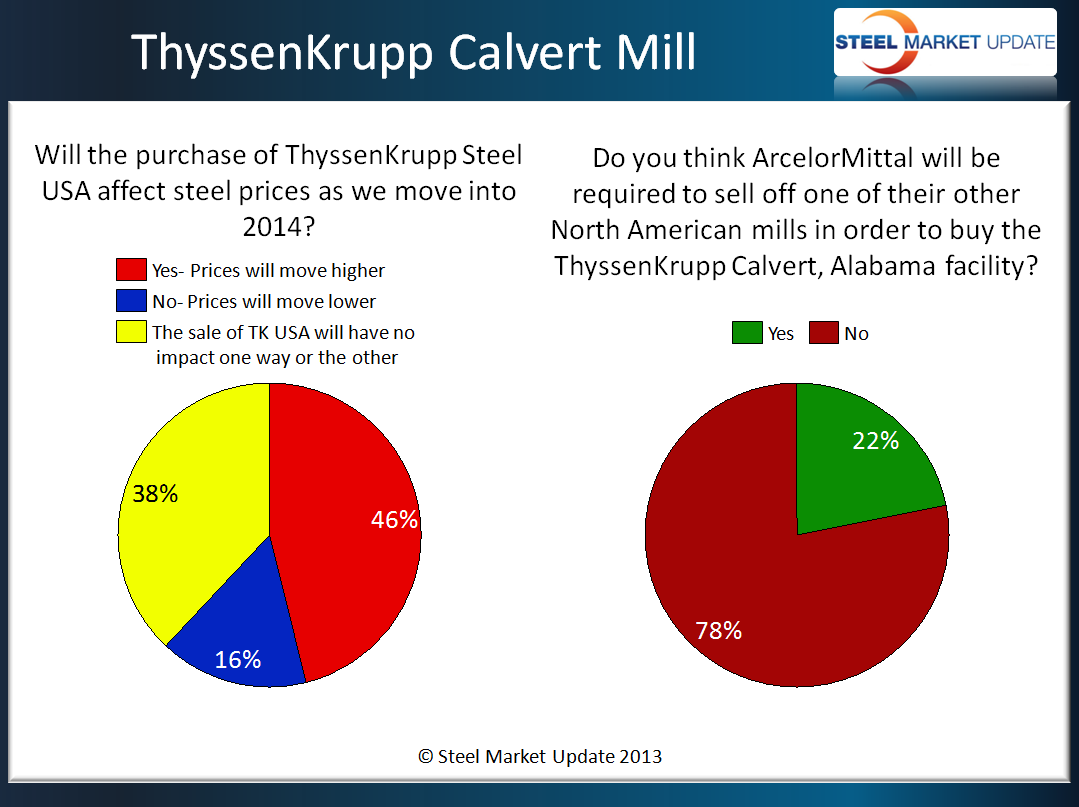

We asked our respondents if the sale would affect steel prices as we move into 2014. The largest percentage of respondents, with 46 percent of the tally, responded that prices would move higher. Another 39 percent believe the sale will have no impact on prices one way or the other and the balance, with 15 percent of the total, believe the sale will cause prices to move lower.

Here are some of the comments left behind by those responding to this question:

“Demand is softening and import coming in, should push prices down.”

“Prices will change if there is a change in supply. Based on what I’ve read thus far, that will not happen in 2014.”

“Not yet, but it will late 1st Quarter and into 2nd Quarter.”

“Prices will only improve if AM will be required to shut down some capacity of coated products in the Midwest.”

“It shouldn’t until the deal closes in mid year.”

“Prices will be higher than they would otherwise be, not necessarily higher than they are now.”

“We believe this move will help the mills continue to maintain higher pricing levels.”

“I would qualify that by stating that prices may not move sharply higher, but there should be more pricing ‘firmness’ in the market in 2014.”

“Macro pricing changes are due to supply and demand changes. The mill continues to produce so supply does not significantly change.”

The sale of the Calvert, Alabama facility must first be approved by the U.S. Department of Justice and Federal Trade Commission. We asked those taking our survey if they thought ArcelorMittal would be required to sell off one of the other North American assets in order to complete the purchase. The vast majority with 76 percent do not think AM will have to sell any existing assets.

A number of the comments received during the process found that ArcelorMittal needs to cut back on some of their production – whether the government requires it or not. Here are a couple comments on this subject:

“Even if the government does not require it, I think it would only make sense for them to shutter an older facility.”

“Do believe that they will be proactive and idle some finishing at Indiana Harbor West.”

“Hopefully the Federal Government won’t make the same mistake that it made at Sparrows Point and put more people out of work.”