Market Data

December 5, 2013

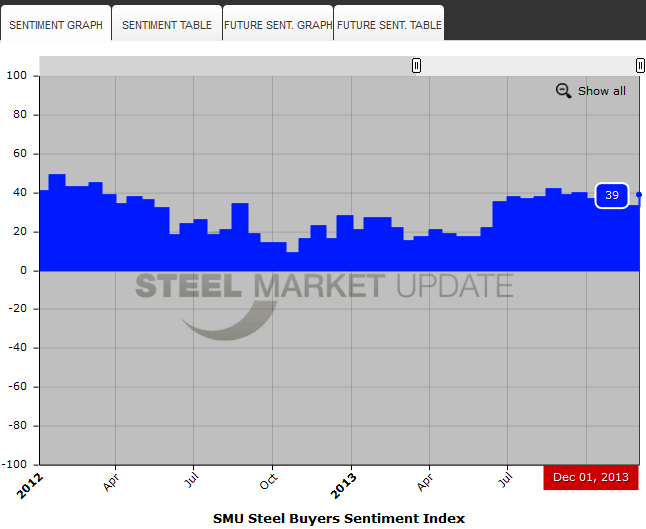

SMU Steel Buyers Sentiment Index Continues Strong Optimistic Trend

Written by John Packard

Buyers and sellers of flat rolled steel continue to be optimistic about their company’s ability to be successful in the current market conditions. Based on the results of our early December steel market analysis, SMU Steel Buyers Sentiment Index was measured at +39. This is up 6 points from our last reading and well within the optimistic range of the index. At the beginning of December 2012 Sentiment was measured at +16.

The three month moving average (3MMA) is +37.83, unchanged from 2 weeks ago and slightly below the early November reading of +39.33. One year ago the 3MMA was +15.33.

Below is a picture of the interactive graph which you will find on the website. We thought that by walking you through the process you can get a better understanding of the graphics we will be using for those who read the newsletter online. As you can see by the picture we have shared, there are tabs at the top of the graphic which allow you to see the data in either the graphic form or table format. When reading the newsletter online, you will be able to hover your cursor over the graph (or table) and the date specific data will be displayed (this graph is from the Sentiment Page which is located in a sub-menu under Analysis/Survey Results). Again, the image below is just a picture not the actual graphic. That you can find once you log into the website and when you read the article online.

If you go to our website to read this article, the same graphic as shown above will be displayed below.

{amchart id=”109″ SMU Steel Buyers Sentiment Index}

We also ask what the respondents think about their company’s ability to be successful three to six months in the future. Our SMU Future Sentiment Index was measured to be +57 which is up 12 points compared to two weeks ago. The +57 is the most optimistic measurement we have seen since May 2012.

For those of you who go online to read our articles there will be an interactive graphic with the Future Sentiment data below:

{amchart id=”108″ SMU Steel Buyers Future Sentiment Index}

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We currently display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly more than 600 North American companies to participate in our survey. Our normal response rate is approximately 125-175 companies. Of those responding to this week’s survey 49 percent were manufacturing companies 41 percent were service centers/distributors and the balance was made up of steel mills, trading companies, toll processors and suppliers to the industry (such as paint companies).

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.