Market Data

December 3, 2013

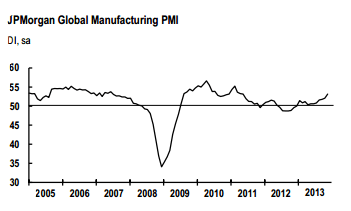

Global Manufacturing Growth Accelerating

Written by Sandy Williams

The JP Morgan Global Manufacturing PMI rose to 53.2 in November from 52.1 in October, indicating a faster improvement in overall operating conditions. Manufacturing output and new orders rose at the quickest pace since February 2011. A moderate rise in employment was reported the US, Japan, the UK, India, Taiwan, South Korea, Turkey, Vietnam, Canada and Mexico. Employment levels dropped in the Eurozone, China, Indonesia and Brazil. Input prices increased in November but at a slower rate with some success in passing increases along to customers.

“November PMI data signal a further acceleration in global manufacturing production,” said David Hensley, Director of Global Economics at JP Morgan. “It appears that output gains are receiving a temporary boost from inventory dynamics, in addition to underlying support from final demand. Near-term momentum remains positive, with the leading orders-to-inventory ratio hitting a 33-month high.”

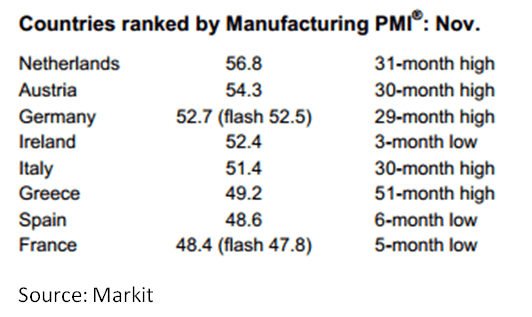

Eurozone

Manufacturing continued to recover in November with the PMI rising to 51.6 from 51.3 last month. Production output, new orders, and new exports all rose in November. Employment levels continued to slide. Chris Williamson, Chief Economist at Markit says the most promising signs of recovery are in the northern countries. Exports rose in all countries except France and Greece. Output in Greece improved for the first time in more than four years. France fell to the bottom of the Eurozone PMI rankings.

China

Manufacturing conditions improved marginally in November with the PMI almost unchanged at 50.8 from 50.9 in October. Production levels and new orders increased at their fastest rate in eight months due to domestic demand. Manufacturer inventories declined slightly last month and restocking moved at a slower pace. Exports rose only slightly. Input costs increased for the fourth month with higher raw material prices reported. Higher input prices were partially passed on through marginal growth in selling prices. Employment levels dropped slightly despite stronger business volume and were attributed to down-sizing and voluntary attrition.

Japan

November was a good month for manufacturers in Japan with the Markit/JMMA PMI posting 55.1, up from 54.2 in October and the strongest improvement in conditions since July 2006. Production and new orders rose sharply in November. Two months of stronger demand helped to quicken the pace slightly for employment growth. New export orders were at a 42 month high supported by a weak yen and economic recovery in foreign markets.

Brazil

Brazilian manufacturing conditions deteriorated in November with falling orders and easing of output. The PMI dropped to 49.7 from 50.2 recorded in October, signaling contraction for the fourth time in 2013. New orders fell and output rose only marginally. New export business stabilized after seven months of contraction. Higher import costs due to weakening currency pushed input prices higher that were passed along in higher selling prices. The 21 month inflation rise, however, slowed in momentum in November providing a bit of good news for manufacturers.

Mexico

Mexico manufacturing in November grew at the fastest pace since March 2013. The HSBC PMI jumped to 51.9 from 50.2 in October. New orders and outputs picked up and employment losses in October were restored. Demand was stronger both domestically and for new export orders. Increased raw material costs pushed input costs higher but manufacturers kept output charges unchanged. “This month’s result suggests that the manufacturing sector will maintain the recovery process started recently,” said Sergio Martin, Chief Economist at HSBC in Mexico. “This view is supported by the upward trend in non-oil exports, as well as the fading of the gas supply shortage that was a constraint for some industries in 1H13.”

Russia

Manufacturing conditions deteriorated in Russia in November. The HSBC PMI dropped from 51.8 in October to 49.4 in November. October’s fast expansion languished in November from weakened external demand. New export orders fell for the third month in a row. Input and output price inflation increased with consumer goods reporting the strongest rise in prices. Alexander Morozov, Chief Economist (Russia and CIS) suggested manufacturing conditions in November were on “a road to stagnation.”

Turkey

Manufacturing production rose sharply in November as new orders escalated from domestic and foreign markets. Companies reported increased back logs of work as they tried to meet order demand. Input costs rose, with companies reporting increased raw material and oil prices and poor exchange rates. Selling prices were adjusted higher accordingly. The PMI for November registered 55.0, up from 53.3 in October.

Canada

The RBC Canadian Manufacturing PMI registered 55.3 in November, down slightly from 55.6 in October and showing strong growth. A marked rise was seen in new orders and production. Inventories increased in November and backlogs of work rose marginally. New export orders rose for the eighth month in a row. Input prices in Canada increased in November with anecdotal reports of higher prices for steel and fuel but, on average, the rate of inflation was moderate. “A slow and steady increase in U.S. growth will play a big role in setting the stage for a continuation in the recent momentum we have seen in Canadian manufacturing activity over the past few months,” said Craig Wright, senior vice-president and chief economist, RBC.