Market Data

December 1, 2013

November – End of Month Data

Written by John Packard

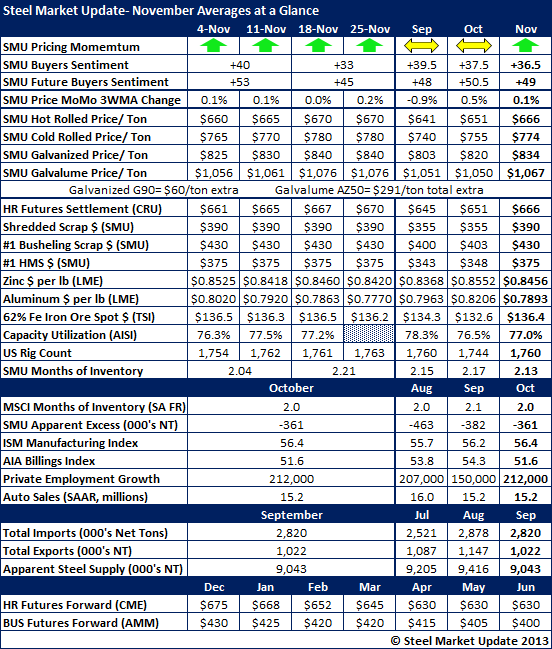

After two months of sideways movement, November saw our SMU Pricing Momentum Indicator shift to reflect higher steel prices as the trend over the next 30 days. Our proprietary SMU Steel Buyers Sentiment Index remained within optimistic range of the index at +36.5. Sentiment was down one point from the prior month and three points compared to September.

SMU Flat rolled pricing saw our benchmark hot rolled coil end the month at $666 per ton as did the CRU.

Below is a look back at the month with many of our proprietary products and items of importance for the flat rolled steel market in North America.