Market Data

November 30, 2013

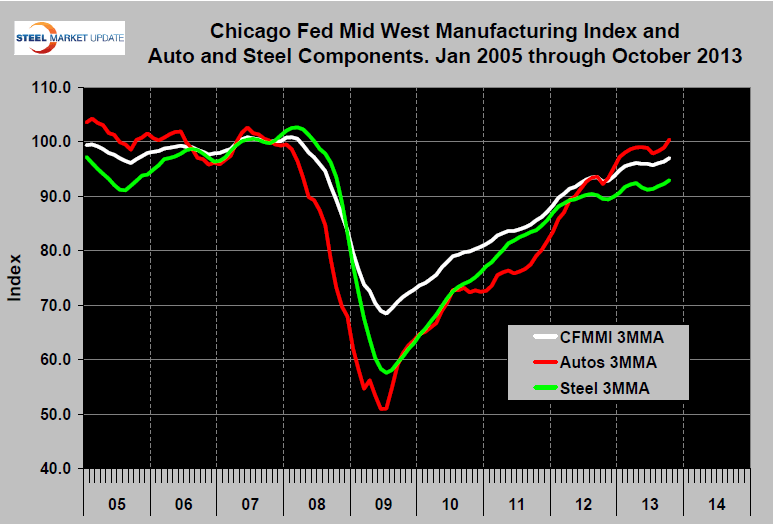

Midwest Manufacturing Index (CFMMI) Improved to 97.4

Written by Peter Wright

The Chicago Fed Midwest Manufacturing Index (CFMMI) is a monthly estimate by major industry of manufacturing output in the Seventh Federal Reserve District states of Illinois, Indiana, Iowa, Michigan and Wisconsin. It is a composite index of 15 manufacturing industries that uses hours worked data to measure monthly changes in regional activity.

The three month moving average, (3MMA) of the composite index increased for the third straight month in October to 97.0, (2007 =100). The automotive component was up for the third month and steel for the fourth month (Figure 1 below).

The official news release reads as follows: The Chicago Fed Midwest Manufacturing Index (CFMMI) increased 0.4 percent in October, to a seasonally adjusted level of 97.4 (2007 = 100). Revised data show the index was up 0.3 percent in September. The Federal Reserve Board’s industrial production index for manufacturing (IPMFG) moved up 0.3 percent in October. Regional output rose 5.7 percent in October from a year earlier, and national output increased 3.6 percent.

Production in two of the four regional sectors increased in October:

• Regional steel sector output increased 2.2 percent;

• Regional resource sector output moved up 0.3 percent;

• Regional auto sector production moved down 0.2 percent; and

• Regional machinery sector production decreased 0.4 percent.

The region’s steel sector output increased 2.2 percent in October, following a decrease of 0.4 percent in September. The nation’s steel output increased 1.0 percent in October. Regional steel output was up 5.9 percent from its October 2012 level, and national steel output was up 4.6 percent. The Midwest resource sector’s output moved up 0.3 percent in October after decreasing 1.3 percent in September. The national resource sector’s output moved up 0.3 percent in October. Production in the regional resource sector’s food, wood, paper, and chemical subsectors increased from September to October, while production in its nonmetallic mineral subsector decreased. Compared with a year ago, regional resource output was up 1.7 percent in October and national resource output was up 1.2 percent.

The region’s auto sector production moved down 0.2 percent in October after increasing 1.2 percent in September. The nation’s auto production moved down 0.3 percent in October. Midwest automotive output was up 8.7 percent in October relative to its year-ago level, and national automotive output was up 5.5 percent.

The Midwest’s machinery sector production decreased 0.4 percent in October after increasing 1.6 percent in September. The nation’s machinery production increased 0.3 percent in October. Regional machinery output was up 4.5 percent in October from its year-ago level, and national machinery output was up 4.8 percent.

SMU Comment: this Chicago Fed commentary is based on monthly changes. At SMU we always track the 3MMA to smooth out the short term data but in this instance both tell the same story. Manufacturing in the Mid West has been strengthening since July. Autos are now at pre-recessionary levels but steel lags by ten points. This confirms other data which shows that the steel market has not kept up with its major demand sectors.