Market Data

November 21, 2013

SMU Survey: Mill Lead Times & Mill Negotiations

Written by John Packard

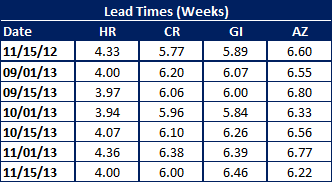

Lead times shrunk on three of the four flat rolled products followed by Steel Market Update. We saw hot rolled lead times fall back to 4.0 weeks from 4.36 weeks reported at the beginning of November.

We also saw cold rolled lead times retreat to 6.0 weeks from 6.39 weeks and Galvalume shrunk to 6.22 weeks from 6.77 weeks. Galvanized lead times move out slightly to 6.46 weeks from 6.39 weeks.

Lead times are based on the responses gathered during our flat rolled steel market analysis which we conduct twice per month.

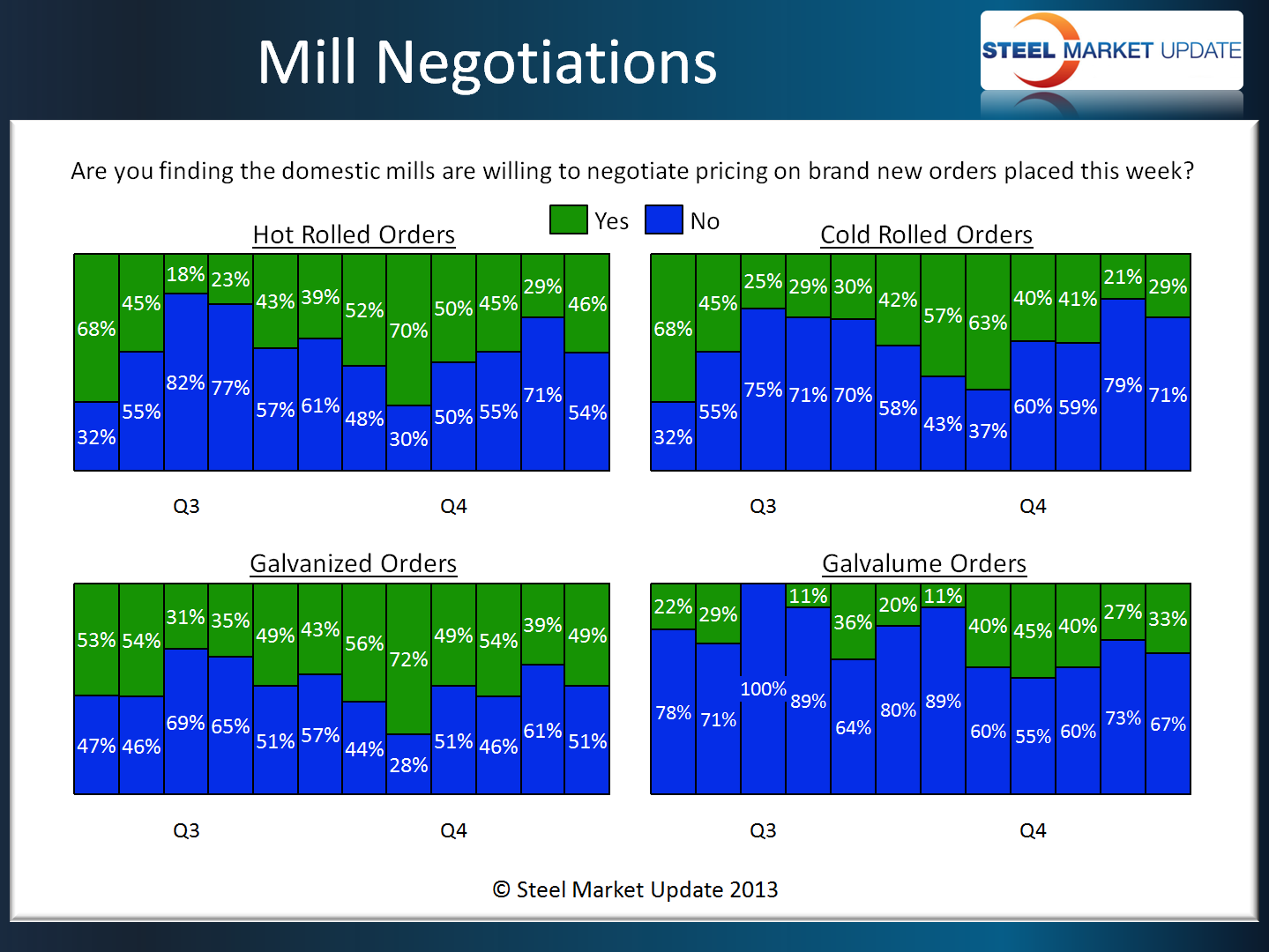

As lead times pulled back we saw a slight increase in the percentages of our respondents reporting the domestic mills as willing to negotiate pricing. Even with the increase the mills appear to be only mildly interested in negotiations with cold rolled and Galvalume being the two tightest products (least willing to negotiate) and hot rolled and galvanized being the most aggressive (most willing to negotiate).