Market Data

November 19, 2013

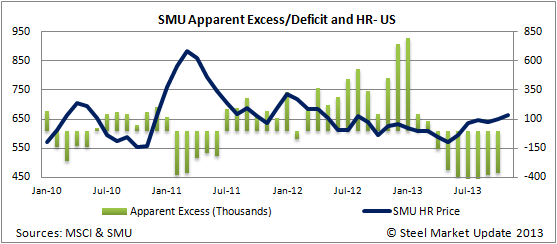

Flat Rolled Apparent Deficit Now Stands at 361,000 Tons

Written by John Packard

Based on Steel Market Update proprietary analysis of the recently released MSCI shipment and inventory data, we have determined that the Apparent Deficit of flat rolled steel for October now totals 361,000 tons. This is a reduction of 21,000 tons compared to the end of September. At the end of October 2012, service centers had a 142,000 ton excess.

Our opinion is the greater the Apparent Deficit the more material service centers will be required to buy in the coming months in order to get their inventories back into equilibrium. The tighter inventories affect the domestic mills’ ability to raise and collect price increases. As you can see by the graphic below benchmark hot rolled prices began to improve right about the same time service centers dropped from a large Apparent Excess into a Deficit.