Market Data

November 17, 2013

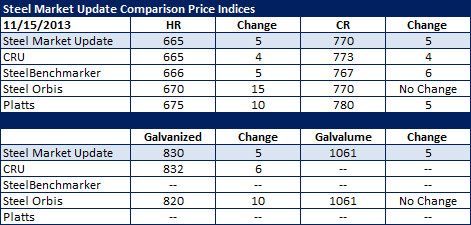

SMU Comparison Price Indices

Written by John Packard

We saw all of the indices capturing higher flat rolled steel prices this past week. Benchmark hot rolled range from $665 to a high of $675 per ton as price assessments rose from $5 to $15 per ton compared to the prior week. The SMU Price Momentum Indicator continues to point toward higher prices over the next 30 days.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

SteelOrbis: Midwest Domestic Mill.

Platts: Within 200-300 mile radius of Northern Indiana Domestic Mill.