Prices

November 14, 2013

Hot Rolled Futures: Strong Finish

Written by John Packard

Financial Markets

When I last wrote I commented that it was likely we would head back up solidly into the 1775-1800 zone on S+P 500 before attempting any retracement. Well, today we closed 1790. We should meet some pretty good resistance here which we will likely test for a couple of weeks. With yearend approaching, I am expecting a strong finish here and we could therefore very well bump up against resistance or even break it into yearend. A retracement in the near term will probably be modest if it materializes. Everyone is getting comfortable, even me, watch out, probably a good warning sign.

All the commodities except the ferrous suite are falling. Crude, as a I mentioned two weeks back, is now testing that support we talked about. We closed $93.92/bbl, right above the weekly support which is at $93.65/bbl. Crude looks like it wants to test the lower end of its range on the monthly, having failed to set a higher high in August. That lower target looks like $85/bbl, test of the higher low back in April 2013, and if that is broken then back to $80/bbl zone. It sounds really low unless of course you look at January 2009 price which hit $32.70/bbl. On Copper, we failed this week. We looked like we were headed to test higher resistance levels, however, the bull flag pattern that was forming got crushed this week by the 8 plus cent drop since Monday. Basis the weekly chart, it looks to me like Copper wants to test $3.00/lb again, but it may take it a while to shed those 16 cts/lb. And Gold, what to say, depressed right?! Well, with horns coming out of everyone’s head on stocks, who needs Gold? Might be a great time to buy for that reason alone. So commodities all pretty ugly, but not ferrous, hmm, leading or lagging?

Steel

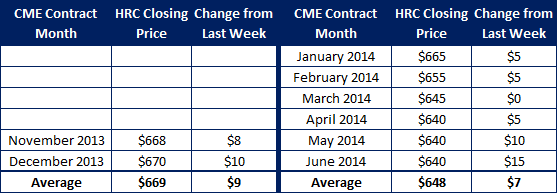

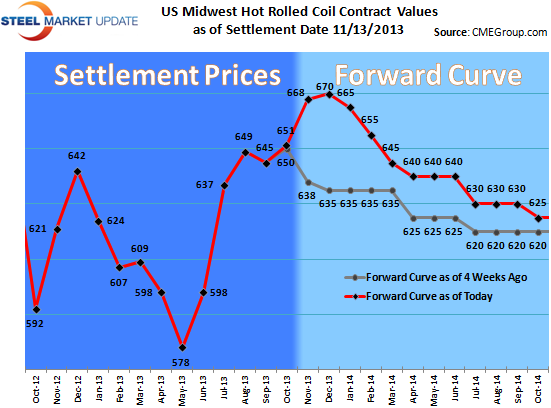

We had a decent week in futures with 950 lots or 19000 ST trading. A bit of a seesaw as the market is pushed to higher prices when someone has to come in and buy forward, and the next day is pushed to lower prices when someone has to come in and sell, etc. I don’t think the market has really changed a whole lot in the period except for the front two months. We are backwardated still with December either side of $665/ST, same as spot, coming off down to $630/ST area by the 4th quarter of 2014. We’ve seen a smattering of trades all the way down the curve this week with some Cal ’14 going through today.