Market Data

November 10, 2013

SMU Survey: Service Center Support for Price Increases Grows

Written by John Packard

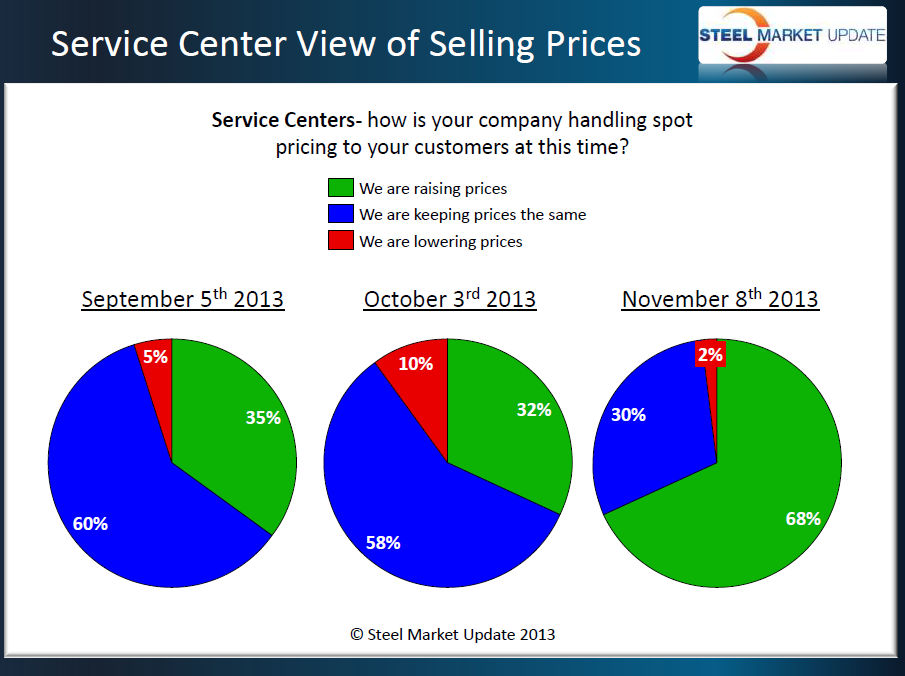

Service centers are attempting to collect higher flat rolled spot steel prices from their end user customers and each other. Steel Market Update has seen a dramatic rise in the percentage of service centers raising spot prices to their customers during the last 30 days.

Based on responses from service centers the percentage of distributors reporting their company as raising prices as of the first week of November more than doubled since the first week of October (68 percent vs. 32 percent).

Based on responses from service centers the percentage of distributors reporting their company as raising prices as of the first week of November more than doubled since the first week of October (68 percent vs. 32 percent).

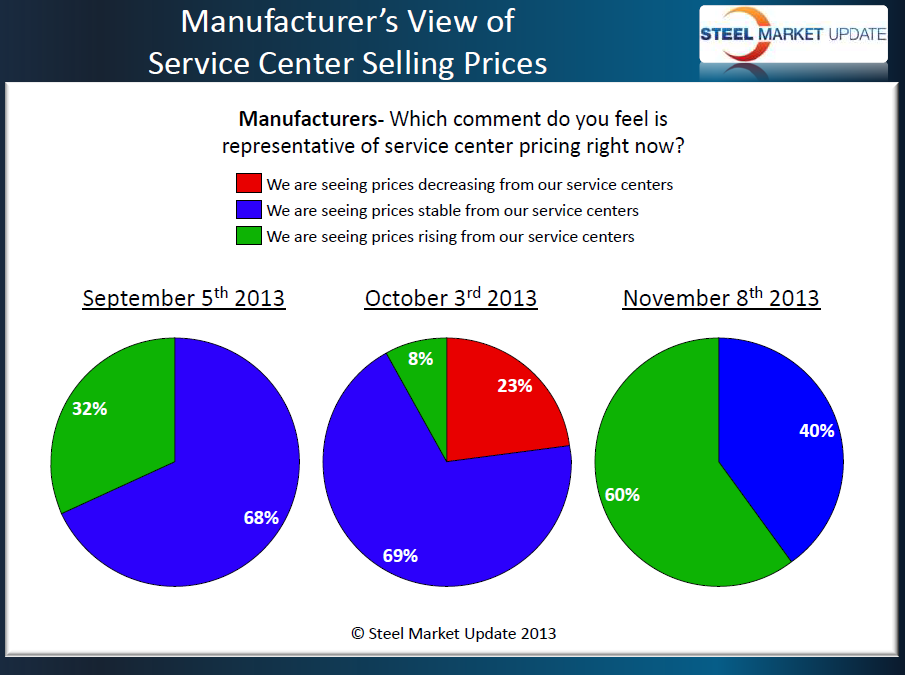

What we found very interesting is that when we reviewed the end user/manufacturing company responses, we found an even more dramatic turn-around during the same time period. End users reported to SMU during the first week of October that only 8 percent of the service centers were attempting to collect higher spot prices at that time. During the first week of October 23 percent of the manufacturing respondents reported distributors as actually offering lower prices – something they were not reporting during the first week of September. When looking at the most recent data completed as of Thursday, November 7th, 60 percent of the end users reporting rising spot prices out of their distributors and the balance reported prices as stable. No one reported any lower spot price offers out of the distributors.

In Steel Market Update’s opinion, domestic mill price increases on flat rolled products can’t be successful without support from the distributors. Service centers tend to not discount their inventories if they know replacement costs are going to be higher. It appears that there were some questions regarding the support of higher prices by the distributors going back to August, September and the first week of October. At that point in time, a number of service centers were convinced they would be able to buy steel cheaper once lead times hit late November and into December. As time progressed, the distributors seem to understand that the end of the year special deals may have already come and gone and their replacement costs are rising.

In Steel Market Update’s opinion, domestic mill price increases on flat rolled products can’t be successful without support from the distributors. Service centers tend to not discount their inventories if they know replacement costs are going to be higher. It appears that there were some questions regarding the support of higher prices by the distributors going back to August, September and the first week of October. At that point in time, a number of service centers were convinced they would be able to buy steel cheaper once lead times hit late November and into December. As time progressed, the distributors seem to understand that the end of the year special deals may have already come and gone and their replacement costs are rising.

Service center support levels for higher spot market pricing is good news for the domestic mills that have just begun to announce a new round of price increases ($20 to $30 per ton on east coast and $40-$60 per ton on the west coast).

SMU Note: our new Premium Level membership will have access to a portion of our survey data and historical analysis. This will include data related to the article above as well as other data which we collect but do not necessarily publish on a regular basis. You can contact our office (800-432-3475) for more details and pricing options if you wish to upgrade your account (or a portion of your corporate account).