Distributors/Service Centers

November 10, 2013

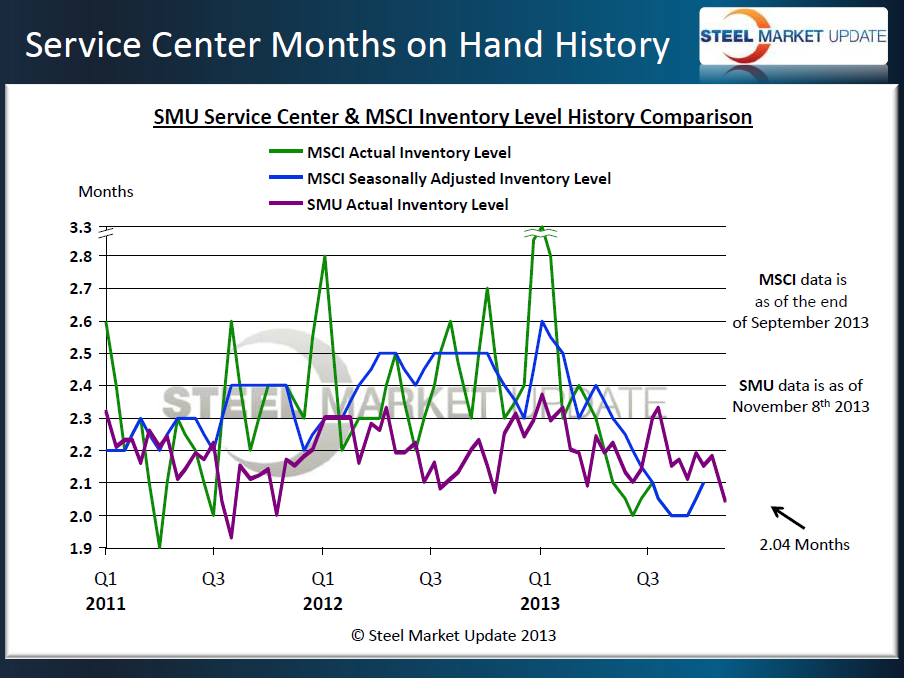

SMU Service Center Inventories at Lowest Level of the Year

Written by John Packard

Steel Market Update (SMU) asked those distributors participating in our twice monthly steel market survey to advise us how many months of flat rolled steel they have on hand. We do not pretend to possess the data base of the MSCI and we defer to their data base – especially in the case of the larger service centers.

Steel Market Update does not weigh the data based on the size of the company. Each company is treated equally and the data compiled provides a snap-shot which we believe is valuable when considering if flat rolled inventories are perceived to be short tons, balanced or in excess.

In our most recent survey results we found the service centers inventories as averaging 2.04 months which is the lowest level we have found since 4th Quarter 2011.

In the graphic below we have provided MSCI seasonally adjusted (blue line) and not adjusted (green) for you to analyze along with our results. The MSCI data is as of the end of September as they have not yet published October results.